NEW YORK, February 17, 2026 — Parliament News — Crude oil prices 2026 remain at the forefront of global financial discussions as traders on the New York Mercantile Exchange respond to shifting supply signals, geopolitical developments, and evolving demand patterns. Energy markets opened the week with heightened volatility, and crude oil prices 2026 have become a central indicator of economic momentum across the United States and beyond.

From Wall Street trading floors to energy desks in Midtown Manhattan, investors are tracking every fluctuation. Analysts say crude oil prices 2026 reflect more than commodity fundamentals; they signal confidence levels in global growth, inflation management, and geopolitical stability.

Market Opening Volatility Across NYMEX

The trading session in New York began with sharp intraday swings in oil futures contracts. Early gains were followed by brief pullbacks as traders interpreted inventory data and overseas production updates. The fluctuations underscore how sensitive crude oil prices 2026 are to both domestic and international signals.

Energy traders point to tight global supply balances and steady demand as underlying drivers. Futures volumes have increased compared to earlier quarters, indicating rising participation from institutional investors seeking hedging strategies.

Wall Street analysts note that movements in crude oil prices 2026 often influence broader equity indexes, particularly energy heavy portfolios and industrial sectors closely tied to fuel costs.

Supply Strategy and Production Discipline

Production strategies among major exporters continue shaping the direction of energy markets. Coordinated output management by key producers has limited excess supply, creating an environment where small disruptions have outsized effects.

US shale operators are cautiously expanding drilling activity, yet capital discipline remains a priority. Industry executives emphasize profitability over rapid production growth. This measured approach contributes to sustained strength in crude oil prices 2026.

Pipeline capacity and refining throughput also play critical roles. Infrastructure maintenance schedules can tighten supply temporarily, amplifying price reactions.

Demand Recovery Supports Energy Benchmarks

Demand resilience across transportation, aviation, and industrial manufacturing is providing ongoing support. American consumers continue to travel at steady rates, and commercial freight volumes remain stable.

International demand, particularly from Asia and Europe, further reinforces pricing trends. Economists observe that unless global economic growth slows unexpectedly, demand conditions will likely continue supporting crude oil prices 2026 into the second half of the year.

Seasonal consumption cycles, including summer driving and winter heating demand, add additional layers of market complexity.

Inflationary Pressure and Monetary Policy Signals

Energy prices carry direct implications for inflation metrics. Rising fuel costs contribute to transportation expenses and broader consumer pricing.

Federal Reserve policymakers closely monitor crude oil prices 2026 as part of inflation assessments. Elevated energy costs can complicate rate decisions, particularly if consumer price indexes accelerate.

Bond markets have responded accordingly. Yields fluctuate as investors weigh the inflationary implications of sustained energy strength.

One senior economist stated,

“Energy volatility remains a decisive variable in shaping monetary policy expectations.”

Corporate Earnings and Sector Rotation

Corporate earnings across energy companies have reflected favorable pricing conditions. Integrated oil majors and independent producers posted improved revenue guidance, bolstered by stable margins.

At the same time, airlines and shipping firms evaluate hedging strategies to manage exposure. Portfolio managers are rotating between sectors depending on the direction of crude oil prices 2026.

Financial strategists emphasize diversification amid continued volatility.

Geopolitical Risk Premium in Focus

Global geopolitical developments remain central to pricing expectations. Strategic maritime routes, regional conflicts, and diplomatic negotiations can shift market sentiment within hours.

New York based traders monitor overseas developments closely, incorporating risk premiums into contract pricing. This geopolitical sensitivity contributes to the dynamic nature of crude oil prices 2026.

Energy security discussions in Washington and international capitals reflect the strategic importance of maintaining steady supply channels.

Historical Context of Oil Market Cycles

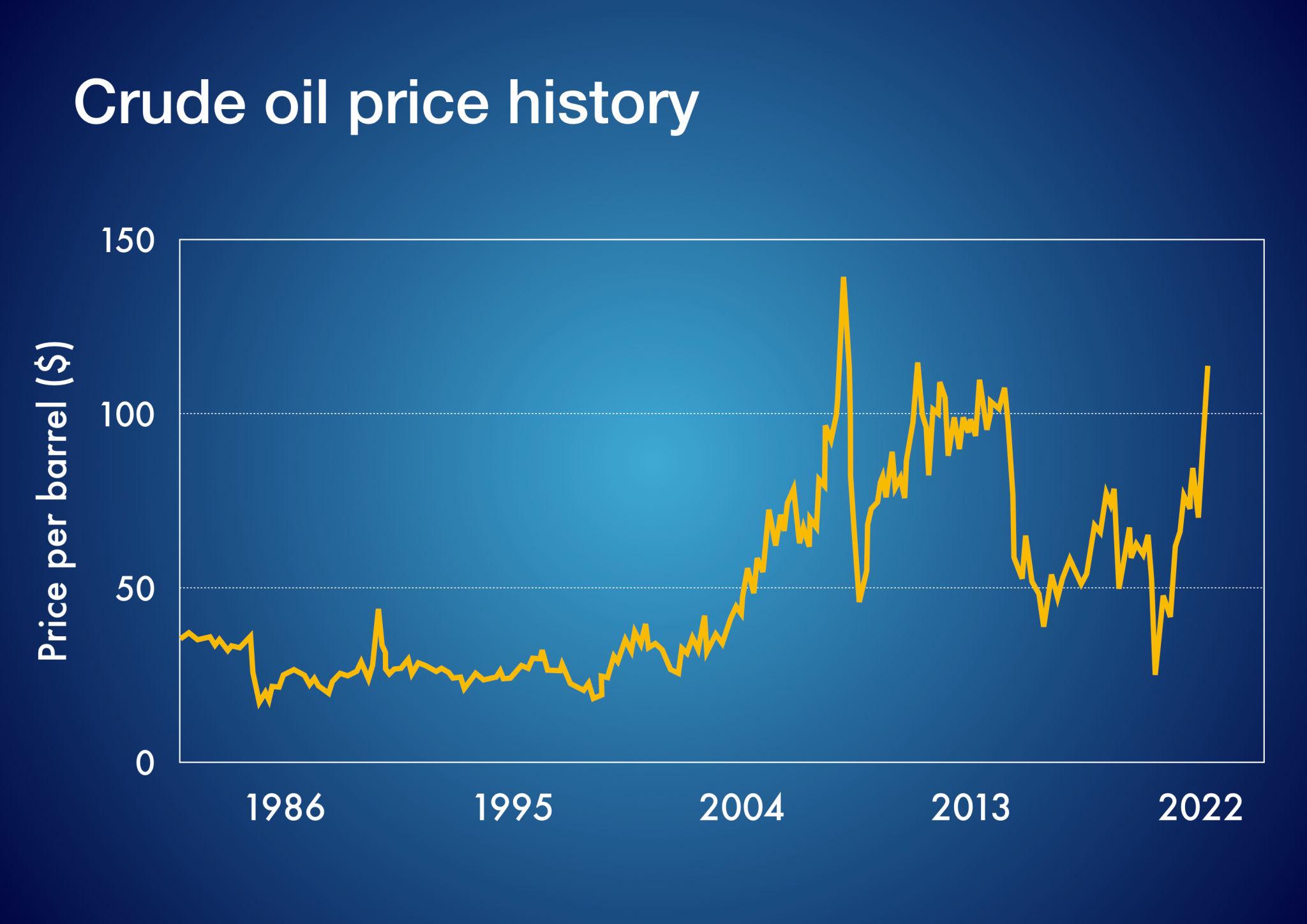

Oil markets have historically responded to cycles of supply discipline, demand surges, and geopolitical realignments. From the oil crises of the 1970s to the shale revolution of the early 2000s, each era reshaped market structures.

When comparing earlier cycles with crude oil prices 2026, analysts highlight similarities in volatility patterns but note faster information dissemination in today’s digital trading environment.

Past cycles demonstrate that stability often follows coordinated policy efforts and balanced supply growth.

Consumer Sentiment and Retail Fuel Prices

Retail gasoline prices across New York reflect broader crude trends. Consumers remain sensitive to even modest increases, particularly in densely populated urban areas where transportation costs are significant.

Small business owners also monitor fuel expenses closely. Delivery services, logistics firms, and manufacturing operations adjust budgets based on prevailing energy conditions.

The public perception of crude oil prices 2026 influences consumer confidence and spending behavior.

Investment Outlook and Risk Management

Institutional investors are implementing structured risk management strategies. Options contracts, futures spreads, and diversified commodity allocations are common approaches.

Asset managers emphasize long term structural trends, including renewable energy adoption and energy transition policies. While traditional hydrocarbons dominate current supply, diversification efforts continue shaping capital allocation.

Analysts forecast moderate volatility through the remainder of the year, contingent upon stable geopolitical conditions.

Technology and Infrastructure Evolution

Advancements in drilling efficiency and refining technology have improved production capabilities. However, infrastructure upgrades require sustained investment.

Renewable energy projects are expanding, yet oil remains central to transportation and petrochemical sectors. The interplay between innovation and traditional supply will influence crude oil prices 2026 in the years ahead.

Energy strategists highlight the importance of balanced investment across both conventional and alternative sources.

Global Trade and Currency Dynamics

Oil priced in US dollars affects currency valuations worldwide. Strong energy benchmarks can support exporting nations’ currencies while creating cost pressures for import dependent economies.

Trade balances and shipping rates are closely linked to energy markets. The performance of crude oil prices 2026 therefore resonates beyond commodity exchanges.

International cooperation on supply transparency remains essential to minimizing abrupt market disruptions.

Strategic Outlook for the Second Half of 2026

Forecast models indicate continued fluctuations, with potential stabilization if supply discipline remains intact. Inventory levels and demand data will serve as key indicators.

Analysts project that crude oil prices 2026 could moderate slightly if production growth aligns with consumption patterns. However, unexpected geopolitical events may introduce renewed volatility.

A commodities strategist observed,

“Balanced output and steady demand are the foundations of market confidence in 2026.”

Energy at the Crossroads of Economic Confidence

As New York stands at the financial heart of global trading, crude oil prices 2026 symbolize more than commodity metrics. They reflect economic confidence, strategic policymaking, and the interconnected nature of international markets.

The months ahead will determine whether equilibrium can be sustained or whether volatility will persist. Market participants remain vigilant, understanding that energy pricing influences inflation, corporate profitability, and consumer welfare alike.

With disciplined production strategies and resilient demand, crude oil prices 2026 continue shaping the trajectory of global economic discussions throughout the year.