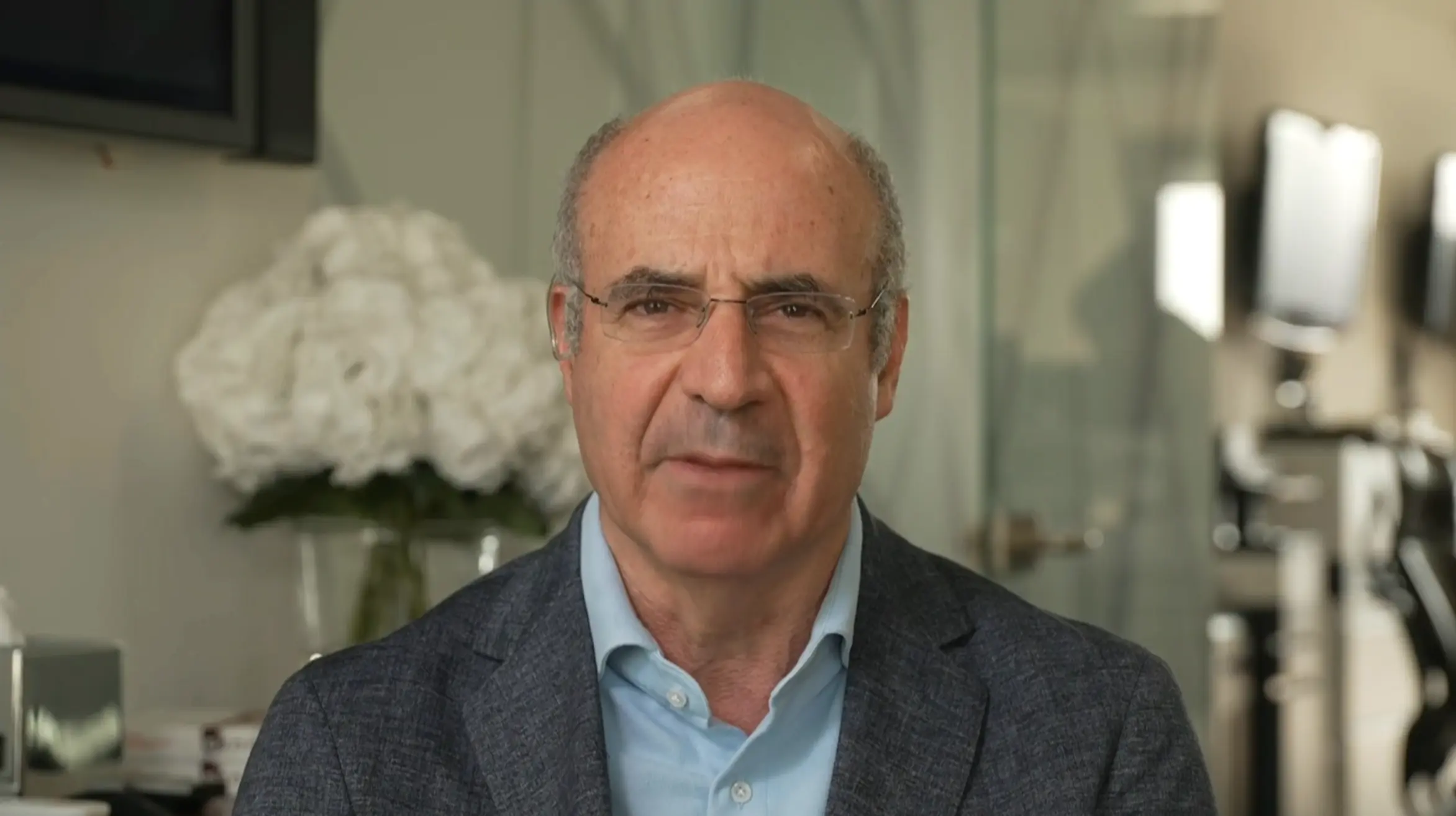

London (Parliament News) – Kremlin critic Bill Browder expresses that US-style legislation would give the UK power to confiscate capital to support Ukrainian military efforts

The Russia critic and anti-corruption campaigner Bill Browder has insisted MPs introduce a US-style law that would permit the government to seize frozen Russian assets to support military efforts in Ukraine.

What US-style law does Browder suggest the UK adopt regarding seized Russian assets for Ukraine aid?

Browder, who became a major campaigner after his lawyer, Sergei Magnitsky, died in custody in Russia in 2009, conveyed to the UK’s Treasury committee that passing laws similar to Washington’s could “transform the whole nature of the war”, and help move the burden from taxpayers to businesses and individuals subject to sanctions.

“Should Vladimir Putin’s legal rights to his money be more important than the taxpayer of this country’s rights? I don’t think so, and I don’t think any of you would find any objection in any of your constituencies if you went and had that conversation,” Browder suggested to MPs.

“What I think the UK should do is what the US has done: they have now resolved any legal ambiguity, and the United States government has the right to confiscate the money. What I would suggest is done here is some version of the Repo Act,” he stated, referring to a law enacted by US Congress alongside a $61bn aid package.

How much aid could be unlocked from frozen Russian assets if this law is enacted?

The move could initiate similar laws among allies, including the EU, and ultimately unlock up to $300bn in grants from Russian assets that have been frozen as a consequence of sanctions related to the invasion of Ukraine.

The US-born financier declared funding was crucial if Ukraine was to succeed in the conflict, and cautioned that Putin was “banking” on waning resolve in the West. “Quite simply, if the West – the UK, US, EU and other allies – were to impound $300bn, that would change the whole nature of the war,” Browder said.

What argument does Browder make for using confiscated Russian assets to aid Ukraine?

The US-born financier said it would also function as an insurance policy against a potential U-turn on foreign policy in the US if Donald Trump succeeds in the upcoming presidential election. The US currently delivers half the funding for Ukraine. “This money, this $300bn, would solve that problem – it would basically be an insurance policy against that problem.”

Britain has been ramping up force on Western governments to use frozen Russian assets to assist rebuild Ukraine’s war-shattered economy. The foreign secretary, David Cameron, described the World Economic Forum in Davos in January that there were legal, moral and political justifications for action.

However, the EU has fallen short of taking US-style action and only favours utilising the profits from those assets to finance arms supplies to Kyiv. Browder denounced the proposal, saying it was “a typical EU bad compromise”.

What potential consequences does Browder dismiss regarding the impact on financial markets?

Browder told MPs there was no distinction between taking the profits and simply taking the money itself, and that the EU’s objective was a “fudge”. If the US and the UK both supported such legislation it would put more stress on the European Union to “do the right thing in the end”.

He also pushed back against assertions that confiscated sanctioned assets would have a significant impact on financial markets, or flash capital flight to rival financial centres, particularly if allies banded together and passed similar legislation.

How does Browder suggest such legislation could influence China’s behaviour towards Taiwan?

Browder indicated such a law could end up deterring China from striking Taiwan, noting that Beijing had a lot more to lose than Russia. “The note here, if we do this, is that if you launch an unprovoked war of aggression against a neighbouring nation that did nothing, you’re likely to have your foreign exchange reserves confiscated.”