UK (Parliament Politics Magazine) – Britain faces a potential £20bn fiscal hit as the OBR plans a sharp productivity downgrade, raising concerns of income tax increases.

As reported by The Guardian, Chancellor Rachel Reeves could face a £20bn hit to public finances due to weak productivity growth ahead of the Budget.

How a productivity downgrade could hit UK finances by £20bn?

The UK’s official forecaster, the Office for Budget Responsibility, is expected to cut productivity growth by 0.3 percentage points, the Financial Times reports.

The OBR will deliver its updated forecasts to the chancellor ahead of their publication on 26 November.

The Institute for Fiscal Studies warns that each 0.1 percentage point drop in productivity could add £7bn to public borrowing in 2029-30, making a 0.3 point cut a £21bn hit.

Experts had forecast a smaller productivity downgrade, which could trigger a £7bn to £14bn fiscal hit. The fiscal gap is projected at £20bn–£30bn, which could widen if productivity falls further, though other factors might offset the shortfall.

Britain’s persistent productivity challenges are raising pressure that the chancellor may breach Labour’s tax pledge, with speculation of an income tax rise.

What did Andrew Goodwin say about the UK productivity downgrade?

Andrew Goodwin, the chief UK economist at Oxford Economics, stated,

“They’re almost certainly going to downgrade it. [Some] £15bn to £20bn is a reasonable ballpark.”

He added,

“The motivation for doing so is that they are the most optimistic forecaster in the consensus. If your role is to be the sober judge of economic policy, then you can’t be the most optimistic forecaster.”

What did Matt Swannell say about the UK productivity forecast?

Matt Swannell, from Ernst & Young, stated,

“The OBR will likely curtail the rise in its medium-term productivity growth forecast that had been a feature of its recent projections.”

He added,

“It seems likely that productivity growth could now rise to just under 1pc per year, which is broadly comparable to the IMF and Bank of England’s latest forecasts, rather than picking up to around 1.25pc. On its own, this could reduce headroom by just under £20bn.”

What did Andrew Wishart warn about the OBR’s productivity downgrade?

Berenberg economist Andrew Wishart warned that lower productivity forecasts from the OBR could create an £18bn shortfall in the Chancellor’s Budget.

He predicts Rachel Reeves could face a £35bn–£40bn financial black hole, with lower productivity forecasts accounting for around half.

Mr Wishart said government borrowing has surged this year, raising the risk that major tax increases could become a regular occurrence.

He added,

“It feels like Parliament can’t really pass much in the way of spending cuts. If anything, any overshoot has to be met with tax hikes. There’s a risk that this is a repeated phenomenon.”

What did Rachel Reeves say about the UK’s productivity downgrade?

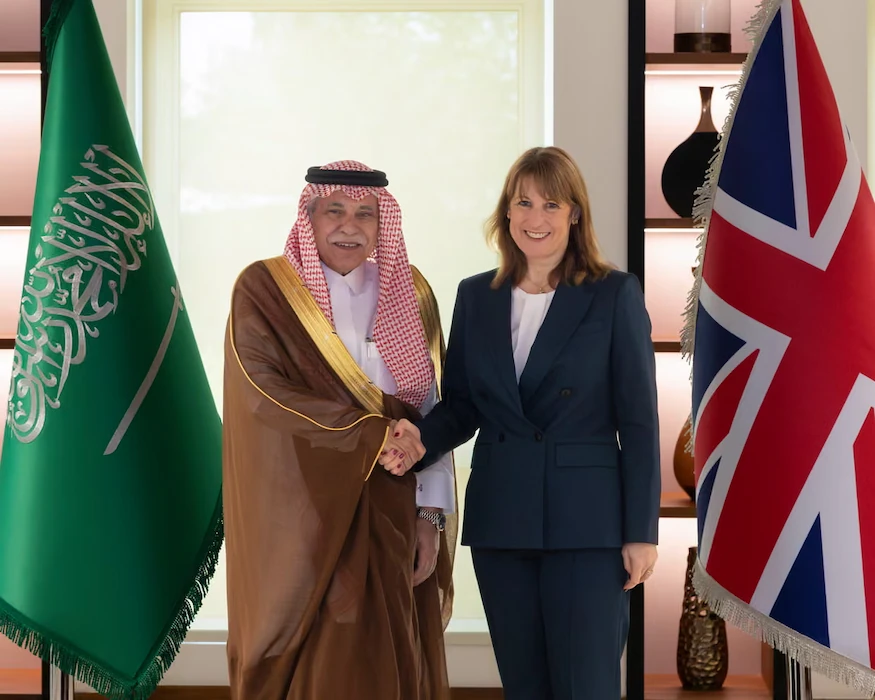

Speaking to business leaders in Saudi Arabia on Monday, 27 October, Rachel Reeves described productivity as “poor,” linking it to the financial crisis and Brexit.

She stated,

“Our independent forecaster is likely to downgrade the forecast for productivity in the UK, based not on anything this government has done but on our past productivity numbers, which, to be honest, since the financial crisis and Brexit, have been very poor.”

Ms Reeves hinted at possible tax increases ahead of next month’s Budget, amid speculation over how to tackle a potential £50bn shortfall.

Referring to a potential income tax increase, the Chancellor said she would keep taxes low for working people, adding that she was still “going through the process” of finalising the Budget.

She said,

“The underpinning for economic growth is stability, and I’m not going to break the fiscal rules that we’ve set.”

Ms Reeves stated,

“We are going to reduce that primary deficit, we are going to see debt starting to fall as a share of GDP, because we need more sustainable public finances, especially in the uncertain world in which we live today.”

She added,

“But we are looking, of course, at tax and spending to ensure that we both have resilience against future shocks, by ensuring we’ve got sufficient headroom, and also just ensuring that those fiscal rules are adhered to.”

What did the Treasury say about the OBR’s forecast and Reeves’s Budget?

A Treasury spokesman stated,

“We don’t comment on speculation. The OBR has been commissioned for a full economic and fiscal forecast that will be published on November 26.”

They added,

“As the Chancellor has made clear, Britain’s economy isn’t broken, but it does feel stuck. That’s why we will continue to invest in Britain’s renewal, to build an economy that works for working people.”

What tax changes could Rachel Reeves unveil in the Autumn Budget?

Chancellor Rachel Reeves will deliver the Autumn Budget to the House of Commons on Wednesday, 26 November 2025.

The government is considering tax reforms to address a fiscal shortfall. The Chancellor has pledged not to raise headline rates of Income Tax, National Insurance, or VAT.

Potential revenue-raising measures include extending the current freeze on income tax thresholds, reforming the tax treatment of Limited Liability Partnerships used by high-earning professionals, and possibly introducing National Insurance on landlords’ rental income.