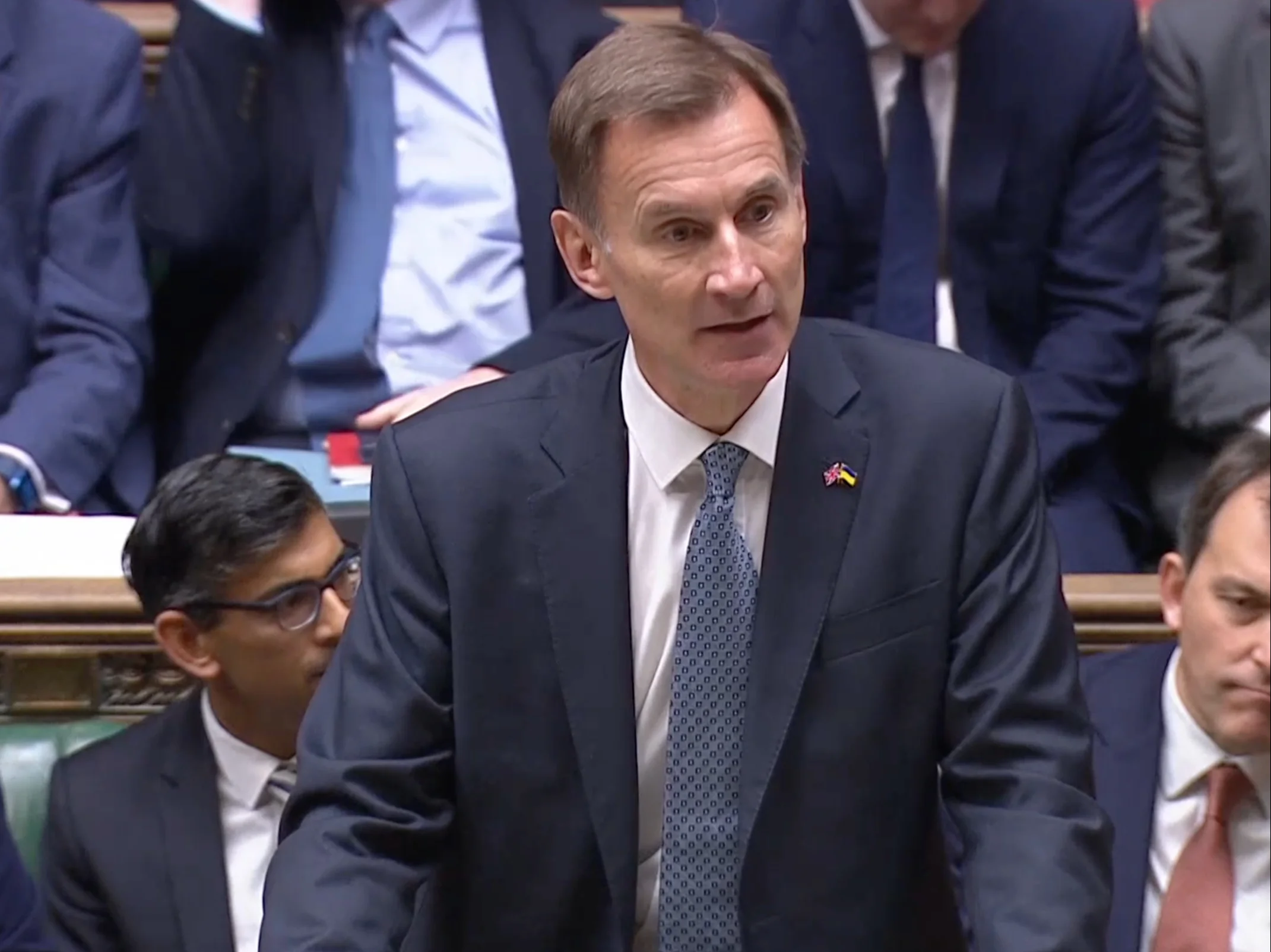

London, (Parliament Politics Magazine) – Jeremy Hunt takes axe to public spending, as he also unveils £24bn of tax hikes that will hit millions of ordinary families – by Alistair Thompson

Jeremy Hunt has just concluded his first Autumn Statement, in what is widely seen as a repudiation of Liz Truss’s short-lived premiership.

Mr Hunt unveiled a series of tax increases and cuts to public spending that will see millions of people paying more and receiving worse services. He warned the country that we all have to make “sacrifices” to weather the storm as the UK rebuilds its finances and deals with “global” problems such as the war in Ukraine, which has sent energy prices soaring. However, the Chancellor promised to do this with “compassionate”, something derided by Labour.

Alongside the package of tax increases, the chancellor announced spending cuts totalling an eye watering 30 billion pounds, while protecting defence spending at 2 per cent of national income, freezing overseas aid and giving an extra £3.3 billion of money to the NHS in each of the next two years.

Many of the increases in tax revenue will be achieved by freezing personal allowances, basic and higher thresholds dragging more and more people into the tax system as salaries increase. Mr Hunt tried to downplay the fact that millions of ordinary workers faced higher bills by stressing that the wealthy face the biggest increases as he announced plans to cut the level at which people start to pay the 45 pence rate from 150,000 to 125,140, catching an additional 250,000 people in the top rate of income tax.

The chancellor also announced plans to slash the level of support to hard pressed energy bill payers. In a white be trailed move he announced that the cap on energy bills would be allowed to rise from £2,500 to £3000 from April, laying the blame for spiralling energy costs at the door of the Russian president.

And in another trailed measure Mr Hunt announced an increase in the windfall tax on oil and gas companies from 25per cent to 35 per cent and that it would be extended until 2028. This means that those companies will face a tax rate of 75 per cent on profits from their UK operations. He claimed that in addition to the 40 per cent tax on the profits of older renewable and nuclear electricity generation the measure would raise an estimated £14 billion next year.

Alongside the package of tax increases, the chancellor announced spending cuts totalling an eye watering 30 billion pounds, while protecting defence spending at 2% of national income, increasing overseas aid and giving an extra £3.3 billion of money to the NHS in each of the next two years.

This means that even larger cuts will be needed in areas that are neither protected or have been given an increase. One of these is local government which already warned of appending financial crisis, saying that local councils across the country will have to make draconian cuts to key services if they are to balance the books. In a sop to this the chancellor indicated that he councils might be given the freedom to raise council tax by as much as 5 per cent without the need for a local referendum.

Critics of Mr Hunt’s plan pointed out that majority of the £24 billion tax increase and £30 billion of spending cuts will come after the next general election, expected in 2024. They highlighted that spending is actually set to increase next year by over £9 billion, while modest tax increases of just £7.4 billion will have kicked in. Noting that the government has given itself five years to hit debt and spending targets instead of the current three.

Responding Rachel Reeves MP, Labour’s Shadow Chancellor of the Exchequer, commented: “Britain is a great country, with fantastic strengths.

“But, because of this government’s mistakes, we are being held back.

“What people will be asking themselves at the next general election is this: Am I and my family better off with the Tories?

“And the answer is no.

“The mess we are in is not just a result of 12 weeks of Conservative chaos but 12 years of Conservative economic failure.

“And all they offer today is more of the same – with working people paying the price for their failure.

“Labour knows that there are fairer choices to make, and that what our country needs is a serious long-term plan to get our economy growing again – powered by the talent and effort of millions of working people and thousands of businesses.”

Other measures announced by the chancellor include raising means tested benefits, including Universal Credit and alsostate pensions by 10.1 per cent, a cap on rent rises in the social sector to seven per cent and a delay of two years on the lifetime cap on social care costs in England.

And in a surprise move Mr Hunt announced that electric vehicles will no longer be exempt from vehicle excise duty from April 2025 in a move denounced by green campaigners as a Tesla tax.

There are three big questions that now remain for the chancellor, how will the budget land with ordinary voters, the City and his backbenches?

Early indications suggest that the City was calm with the cost of 10 year gilts only fractionally up. The bigger challenges for the chancellor is how ordinary voters and his own backbenchers will respond to a budget that will see significant tax increases alongside massive public sector spending cuts.Has he done enough to calm his restless backbenchers who are worried that they face the electorate in a couple of years time? And how will the budget be perceived by ordinary voters – a budget that includes official government forecasts that say we will see living standards fall to a level last seen since the 1950s?

Responding to the Autumn Statement announced by the Chancellor today, Cllr James Jamieson, Chairman of the Local Government Association, commented: “Local government is the fabric of the country, as has been proved in the challenging years we have faced as a nation. It is good that the Chancellor has used the Autumn Statement to act on the LGA’s call to save local services from spiralling inflation, demand, and cost pressures.

“While the financial outlook for councils is not as bad as feared next year, councils recognise it will be residents and businesses who will be asked to pay more. We have been clear that council tax has never been the solution to meeting the long-term pressures facing services – particularly high-demand services like adult social care, child protection and homelessness prevention. It also raises different amounts of money in different parts of the country unrelated to need and adding to the financial burden facing households.

“Councils have always supported the principle of adult social care reforms and want to deliver them effectively but have warned that underfunded reforms would have exacerbated significant ongoing financial and workforce pressures. The Government needs to use the delay announced today to ensure that funding and support is in place for councils and providers so they can be implemented successfully. We are pleased that government will provide extra funding for adult social care and accepted our ask for funding allocated towards reforms to still be available to address inflationary pressures for both councils and social care providers.

“The revised social rent cap for next year is higher than anticipated and councils will still have to cope with the additional financial burden as a result of lost income. Councils support moves to keep social rents as low as possible but this will have an impact on councils’ ability to build the homes our communities desperately need – which is one of the best ways to boost growth – and retrofit existing housing stock to help the Government meet net zero goals.

“Financial turbulence is as damaging to local government as it is for our businesses and financial markets and all councils and vital services, such as social care, planning and waste and recycling collection, and leisure centres, continue to face an uncertain future. Councils want to work with central government to develop a long-term strategy to deliver critical local services and growth more effectively. Alongside certainty of funding and greater investment, this also needs wider devolution where local leaders have greater freedom from central government to take decisions on how to provide vital services in their communities.”