UK (Parliament Politics Magazine) – 26 MPs, including senior Labour figures, are urging a vote on a 2% wealth tax on assets over £10m ahead of the autumn Budget to ease public spending gaps.

As reported by The Telegraph, MPs have called for a potential wealth tax ahead of the Budget, raising concerns over increasing financial pressure.

What is pushing Labour MPs to back a new wealth tax?

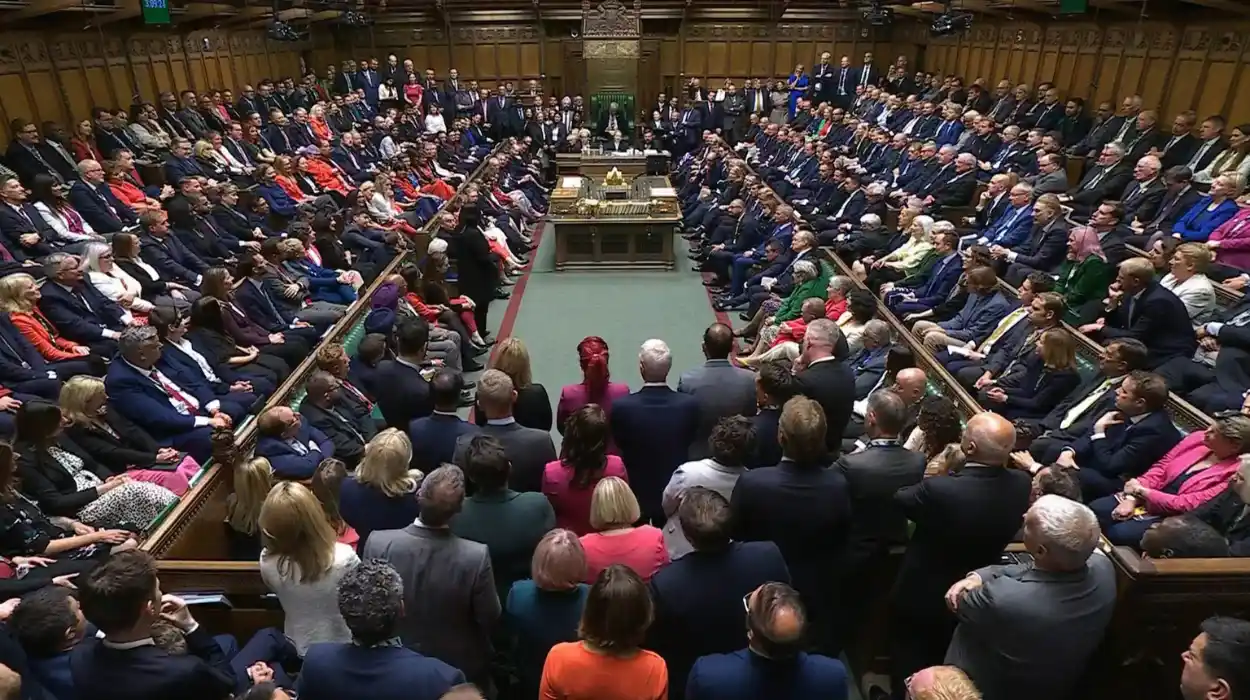

A group of 26 MPs, including 14 from Labour, have signed an early day motion earlier this week. The motion supports a proposed 2% annual tax on individual assets worth over £10 million.

MPs often file early day motions to reveal their support for certain policies. These motions are usually the first step in launching a formal debate in Parliament.

A cross-party group of 26 MPs, including six Independents, four from Plaid Cymru, and one from the Alliance, have backed a proposed wealth tax. They claim it could raise up to £24 billion annually. Their support comes as government borrowing rose to £20.7 billion in June.

The MPs’ statement added,

“That such a measure would represent a fairer alternative to cuts and could provide urgently needed resources to tackle the poverty and inequality that blights our society – and calls on the Government to bring forward proposals for such a tax on extreme wealth ahead of the next Budget.”

Diane Abbott, one of the motion’s co-signatories, faced disciplinary action earlier this month over comments in which she suggested antisemitism was less severe than other forms of racism.

Which MPs are backing the new wealth tax proposal?

Labour MPs who sponsored the motion:

- Richard Burgon

- Imran Hussain

- Bell Ribeiro-Addy

- Kate Osborne

- Kim Johnson

- Ian Byrne

Independent MPs (formerly Labour) who signed:

- Rachael Maskell

- Neil Duncan-Jordan

- Brian Leishman

Some other supporters of the motion are:

- Apsana Begum (Vocal Corbyn supporter)

- John McDonnell (Vocal Corbyn supporter)

- Sorcha Eastwood (Alliance MP)

- Ben Lake (Plaid Cymru MP)

- Llinos Medi (Plaid Cymru MP)

- Liz Saville Roberts (Plaid Cymru MP)

- Ann Davies (Plaid Cymru MP)

What did MPs say about introducing a wealth tax?

Ms Maskell stated,

“Increasingly, those with the highest levels of wealth are deriving their income from investments and assets, and yet their tax burden is inequitable.”

She added,

“A wealth tax of 2pc on assets over £10m is popular, and is a first step in recognising progressive means of contributing to our country’s future at a time when we need investment.”

Mr Leishman MP said,

“There are grotesque levels of inequality in Britain, the sixth largest economy in the world. It does not have to be this way. We should be redistributing wealth and power across society for the benefit of the many.”

He added,

“While the Government has taken some welcome steps in the right direction, addressing non-dom status and imposing VAT on private school fees, these policies do not come close enough to tackling the gross inequalities the working class faces today.”

Ann Davies, Plaid Cymru MP, stated,

“An overwhelming majority of people across the UK support a 2% wealth tax on assets over £10m. It’s time Labour started listening.”

She added,

“People are still struggling with the cost of living crisis, and our public services are on their knees. Yet, Labour continues to target those least able to shoulder the burden, from cutting disability benefits to slashing pensioners’ winter fuel payments. A wealth tax offers a genuine opportunity to tackle the deepening inequality in our society.”

Labour MP Dawn Butler, poised to contest the 2028 London mayoral election, reaffirmed her support for a wealth tax. In March, she argued that raising funds through taxing the rich would be more beneficial than cutting public services.

Ms Butler added,

“That is a better way to bring money in to help fill the black hole that we have found ourselves in because of the disaster of 14 years of Tory government.”

What did the Treasury spokesman say about strengthening public finances?

A Treasury spokesman stated,

“The best way to strengthen public finances is by growing the economy, which is our focus. Changes to tax and spend policy are not the only ways of doing this.”

They added,

“We are committed to keeping taxes for working people as low as possible.”

Which countries have kept or scrapped wealth taxes?

- Austria

- Denmark

- Germany

- Finland

- Iceland

- Luxembourg

- Sweden

- France

What is a wealth tax?

- A yearly tax on a person’s total wealth (assets minus debts)

- Includes things like property, investments, and luxury items

- Often doesn’t tax your main home or small amounts (e.g., below $1 million)

- Only a few countries like Norway, Spain, Switzerland, and Colombia still use it