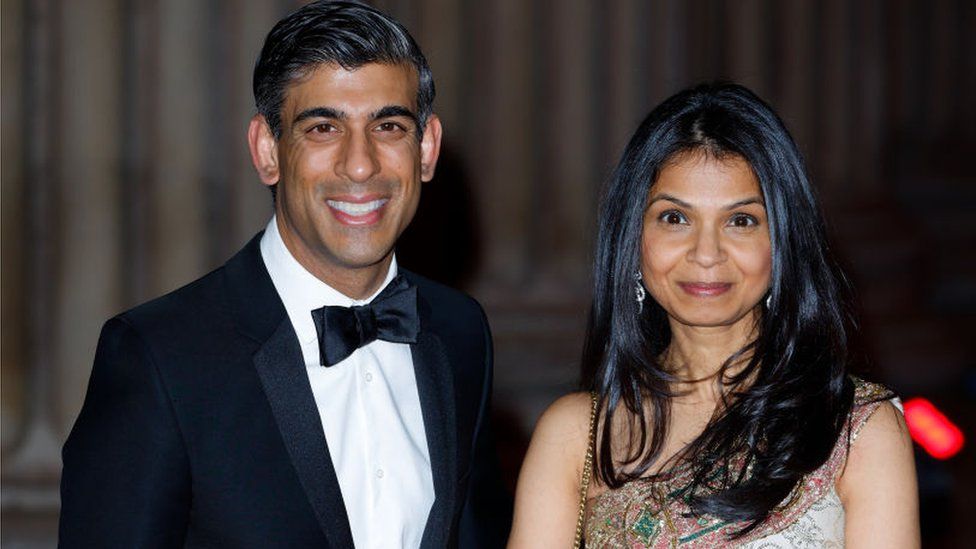

LONDON, (Parliament Politics Magazine) – According to the BBC, a Whitehall investigation is underway into how Akshata Murty, the Chancellor Rishi Sunak’s wife’s tax affairs were leaked to the media.

Following a controversy over her non-domicile status, Akshata Murty has stated that she will pay UK taxes on her offshore earnings.

She owns £700 million in shares in Infosys, the Indian IT behemoth founded by her father, from which she collected £11.6 million in dividends last year.

The row, according to Labour, raises doubts about Mr Sunak’s judgement.

Ms Murty is not compelled to pay taxes in the Uk on her abroad income by law since she is a non-domiciled (non-dom) UK resident. According to the BBC, this would have saved her £2.1 million per year in UK taxes.

Mr Sunak said his wife had done nothing wrong and it was unfair to criticise her as a “private citizen” after facts of her non-dom status were revealed in the press on Wednesday evening.

Ms Murty, however, stated on Friday that she would amend her tax arrangements, telling the BBC that she didn’t want to be a “distraction” to her husband.

On the BBC’s Sunday Morning programme, Policing Minister Kit Malthouse was asked about the U-turn and stated the pair had realised the situation “offended against a British sense of fair play.”

They recognised that there was possibly a gap in the British public’s sense of what was appropriate, he continued, and they had remedied that scenario now for the future.

Sajid Javid, the Health Secretary, told this to the Sunday Times that he claimed non-domicile status for a period of six years while working as a banker between the years 2000 and 2006.

What is a non-dom?

A non-dom is a resident of the UK who claims their permanent residence, or domicile, outside the United Kingdom.

A domicile is usually the country where his or her father considered his permanent home when they were born, or it might be a location outside of the country where someone has moved with no intention of returning.

Non-doms must present documentation to the tax authority about their origin, lifestyle, and future intentions, such as where they own property or plan to be buried.

Those with the status must still pay UK tax on their UK earnings, but they are exempt from paying UK tax on their foreign profits. They have the option to terminate their non-dom status at any moment.