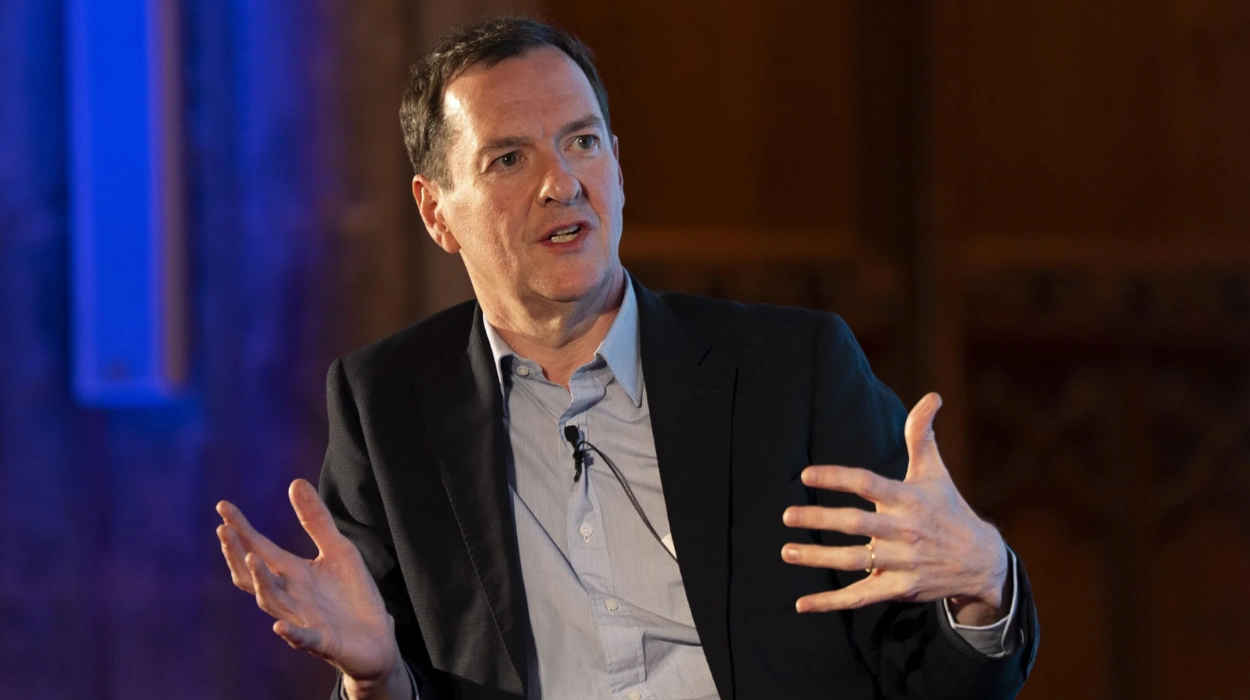

UK (Parliament Politics Magazine) – Ex-Chancellor George Osborne has been shortlisted as an unexpected candidate for HSBC chairman, joining two rivals to replace Sir Mark Tucker.

As reported by Sky News, former Tory Chancellor George Osborne has been listed as a surprise contender for HSBC Holdings’ chairmanship.

According to reports, George Osborne, who served as chancellor from 2010 to 2016, was approached this summer to succeed Sir Mark Tucker as HSBC chairman.

City insiders confirmed this weekend that the former chancellor is among the final contenders to lead the London-based banking giant.

Who are the other two contenders for the HSBC chair alongside George Osborne?

Former Standard Chartered deputy head and ex-Barclays finance director, Naguib Kheraj, remains in contention for HSBC’s top role.

Reports show Kevin Sneader, former McKinsey chief and current Goldman Sachs executive in Asia, is also in the race for HSBC chair.

As of this weekend, it was unclear whether other candidates were still being considered or if the board had identified a frontrunner.

How George Osborne became a shock HSBC contender?

George Osborne’s shortlist spot surprises many, given his lack of proper corporate board experience.

HSBC, valued at nearly £190bn, ranks as the FTSE-100’s second-largest company, behind pharmaceutical leader AstraZeneca. The bank has spent almost a year looking for a replacement for Sir Mark Tucker, with critics describing the process as “disorganized.”

Mr Tucker stepped down as HSBC chairman to become AIA’s non-executive chairman, while remaining an adviser to the HSBC board.

Last month, ex-KPMG vice-chair Brendan Nelson assumed the interim chair at HSBC and will remain until a permanent successor is selected.

If appointed, Mr Osborne would be a striking choice for one of Britain’s leading corporate roles, having served as editor of the London Evening Standard until 2020.

After leaving the newspaper, he joined merger advisory firm Robey Warshaw, now owned by Evercore, a role he would have to resign if appointed HSBC chairman.

Mr Osborne also serves as chair of the British Museum, adviser to Coinbase, and chairman of Lingotto Investment Management, controlled by Italy’s Agnelli family.

As chancellor under former PM David Cameron, he worked to strengthen trade ties between the UK and Beijing.

During a speech in Shanghai in 2015, Mr Osborne said,

“Of course, there will be ups and downs in the road ahead, but by sticking together we can make this a golden era for the UK-China relationship for many years to come.”

Reports revealed that the former chancellor intervened for HSBC in 2012 to avoid US prosecution over money laundering.

Mr Tucker’s successor at HSBC will face the challenge of navigating a major geopolitical backdrop amid strained UK-China ties and allied relations.

Despite his proven experience, appointing Mr Osborne to such a top corporate role would be rare given his limited public company background.

Over the past year, HSBC shares climbed more than 50%, overcoming challenges from US President Donald Trump’s global tariff policies.

Mr Tucker’s appointment made HSBC’s first outsider chairman in 152 years, with the bank maintaining a strong high street presence after acquiring Midland Bank in 1992.

He led a swift leadership reshuffle, naming John Flint to succeed Stuart Gulliver as CEO. Mr Flint was sacked after 18 months as CEO, with Noel Quinn stepping in as interim in 2018 and confirmed permanently in April 2020.

After four years as chairman, Mr Quinn stepped down, and in July 2024, Georges Elhedery, former HSBC CFO and long-serving markets executive, was appointed his successor.

Under Mr Tucker, HSBC sold off non-core operations in Canada and France, sharpening its focus on Asian markets.

HSBC added in a statement in September,

“The process to select the permanent HSBC Group Chair, led by Ann Godbehere, Senior Independent Director, is ongoing. The company will provide further updates on this succession process in due course.”

How big is HSBC and what are its global operations?

HSBC is the largest Europe-based bank by total assets, with around US$3.1 trillion as of September 2024. This makes it the 7th largest bank in the world by assets.

The bank was founded in 1865 in Hong Kong. It has a strong historical link to East Asia and now operates in 57 countries and territories, serving around 39 to 41 million customers globally.

HSBC operates through three main business segments:

- Wealth and personal banking

- Commercial banking

- Global banking and markets