London, January — Britain’s banking sector showed renewed strength after Lloyds Banking Group reported a 12 percent rise in annual profit, prompting the lender to upgrade its financial targets and reinforcing confidence in UK banks earnings at a time when the domestic economy continues to stabilise following years of volatility.

The results, released during a period of cautious optimism in global markets, were closely watched by investors and policymakers alike. Lloyds, as the UK’s largest mortgage lender and a predominantly domestic-focused bank, is often viewed as a barometer for broader financial conditions across Britain.

Profit growth reflects resilient core banking performance

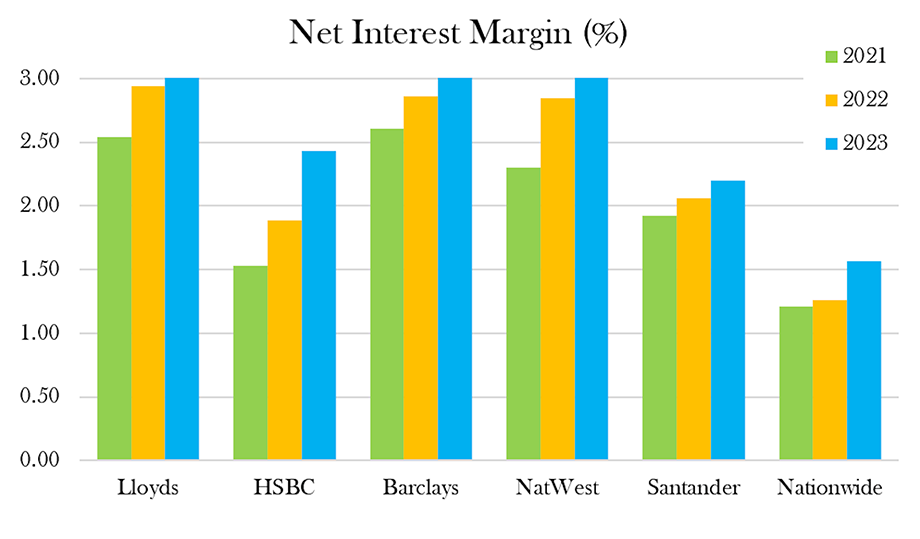

Lloyds said its improved performance was primarily driven by stronger net interest income, reflecting the impact of higher interest rates on lending margins. Mortgage pricing remained stable, while customer deposit balances continued to provide a relatively low-cost source of funding.

The bank’s cautious approach to lending helped contain credit risk, with impairment charges remaining below earlier expectations. This balance between income growth and risk discipline has become central to assessments of UK banks earnings, particularly as economic growth remains uneven.

Retail and commercial banking divisions both contributed to the overall profit increase, highlighting the breadth of Lloyds’ earnings base. Management said this diversification provides resilience against potential sector-specific pressures.

Target upgrades underline confidence in medium-term outlook

Following the profit increase, Lloyds revised its medium-term financial targets, including improved returns on tangible equity and stronger capital generation. Executives said the upgrade reflects greater clarity around income sustainability rather than reliance on short-term market conditions.

The move has prompted renewed discussion around the durability of UK banks earnings, especially as interest rates are expected to eventually stabilise or decline. Lloyds maintained that its projections remain conservative, based on realistic assumptions around economic growth and customer behaviour.

Analysts said the decision to lift targets sends a clear signal to markets that management believes structural improvements will continue to support profitability beyond the current rate cycle.

Capital strength reinforces balance sheet stability

Lloyds’ results highlighted a capital position that remains comfortably above regulatory requirements. Strong capital generation has allowed the bank to maintain flexibility in its approach to dividends and share buybacks, while continuing to invest in technology and risk management.

Robust capital buffers have become a defining feature of UK banks earnings in the post-financial-crisis era, reflecting stricter regulation and more conservative balance-sheet strategies. This resilience has helped restore confidence among long-term investors.

The bank said it remains committed to maintaining a strong balance sheet, even as it returns capital to shareholders.

Digital transformation reshapes operating efficiency

A significant contributor to Lloyds’ improved performance has been its ongoing digital transformation. The bank has continued to migrate customers to online and mobile platforms, reducing reliance on physical branches and lowering operating costs.

Automation and data-driven decision-making have also improved efficiency across back-office functions. These changes are increasingly influencing UK banks earnings, allowing lenders to offset inflationary pressures and adapt to evolving customer preferences.

Lloyds said investment in technology will remain a strategic priority, supporting both cost control and customer experience improvements over the long term.

Household finances and credit quality remain stable

Despite ongoing cost-of-living pressures, Lloyds reported stable credit quality across its loan book. Mortgage arrears remained low by historical standards, while consumer credit performance showed no significant deterioration.

This stability has provided reassurance regarding the sustainability of UK banks earnings, as concerns about a sharp rise in defaults have so far failed to materialise. The bank said it continues to monitor customer behaviour closely, particularly among more vulnerable segments.

Management emphasised that prudent underwriting standards remain in place, ensuring that growth does not come at the expense of long-term asset quality.

Sector-wide implications for British lenders

Lloyds’ results have been closely analysed across the banking industry, with peers expected to reference similar trends in upcoming earnings updates. The performance suggests that UK-focused lenders may be better positioned than international peers to navigate ongoing global uncertainty.

Improving UK banks earnings could support increased lending activity, providing a modest boost to economic growth. However, analysts cautioned that competitive pressures and regulatory scrutiny remain key challenges for the sector.

The results have also reignited debate about how banks balance profitability with their broader economic role.

Market reaction reflects renewed investor confidence

Shares in Lloyds edged higher following the announcement, with analysts revising earnings forecasts and price targets. Investors welcomed the combination of profit growth, upgraded guidance, and continued capital discipline.

The market response reflects broader optimism around UK banks earnings, particularly as fears of a sharp economic downturn have eased. Analysts said investor sentiment would depend on whether banks can sustain returns as interest rates eventually normalise.

Trading volumes increased modestly following the results, indicating renewed engagement from institutional investors.

Economic risks remain part of the outlook

While the results were broadly positive, Lloyds acknowledged ongoing risks, including geopolitical tensions, inflationary pressures, and potential shifts in monetary policy. The bank said it remains cautious in its outlook, maintaining provisions to guard against unexpected shocks.

“The banking sector is benefiting from years of balance-sheet repair and disciplined risk management, which is now translating into more resilient performance,”

said one senior banking analyst, commenting on UK banks earnings and their evolving profile.

Management stressed that flexibility and prudence will remain central to its strategy as economic conditions continue to evolve.

Regulatory environment continues to shape strategy

Regulatory expectations remain a significant influence on how banks deploy capital and manage risk. Lloyds said it continues to engage closely with regulators to ensure compliance while supporting sustainable growth.

The emphasis on financial stability has reshaped UK banks earnings, encouraging a focus on steady returns rather than aggressive expansion. This approach has helped rebuild trust in the sector among both regulators and the public.

The bank said regulatory clarity has improved planning certainty, supporting longer-term investment decisions.

Lending trends and support for the real economy

Lloyds said demand for mortgages and business loans remained steady, though competition in key segments continues to pressure pricing. The bank emphasised its role in supporting households and businesses through responsible lending.

Stronger UK banks earnings may provide capacity for increased lending, but management said growth will remain selective and risk-aware. Analysts said this cautious approach reflects lessons learned from previous economic cycles.

Support for small and medium-sized enterprises remains a strategic focus, particularly as businesses navigate changing economic conditions.

Technology and data reshape customer relationships

Beyond cost efficiency, Lloyds’ investment in technology has enhanced its ability to personalise services and manage risk. Advanced analytics are being used to better understand customer needs and anticipate potential financial stress.

These capabilities are increasingly important in sustaining UK banks earnings, allowing lenders to improve retention and reduce losses. Lloyds said responsible use of data remains a core principle of its digital strategy.

Customer satisfaction scores have shown gradual improvement, according to the bank.

Long-term outlook for the UK banking sector

As 2026 progresses, attention will remain focused on whether improved profitability can be sustained amid shifting economic conditions. Lloyds’ upgraded targets suggest confidence that the sector has adapted to a new operating environment shaped by regulation, technology, and changing consumer behaviour.

For now, the latest results indicate that UK banks earnings are on firmer footing, providing reassurance to investors and policymakers that Britain’s banking system is better prepared to support economic stability and growth.