Chile — January — Rising global copper demand is reshaping the international commodities landscape as mining nations, industrial consumers, and investors confront a tightening supply environment. Copper, a foundational material for electrification, construction, and digital infrastructure, has moved beyond its traditional role as a cyclical industrial metal to become a strategic resource closely tied to long-term economic and energy policy planning.

The current moment reflects a convergence of structural demand growth, limited production flexibility, and heightened geopolitical sensitivity, placing unprecedented pressure on supply chains that were designed for a very different era.

Copper’s Expanding Role in the Modern Economy

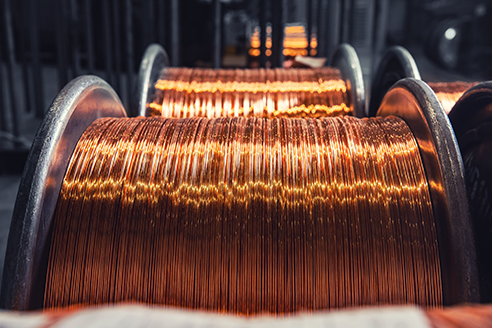

Copper’s importance has grown steadily over the past two decades, but its relevance has accelerated sharply as economies pursue electrification and digitalization. The metal’s unmatched conductivity makes it indispensable for power transmission, electric motors, data centers, and telecommunications infrastructure.

This shift has elevated global copper demand from a market variable to a strategic concern. Governments increasingly view access to copper as essential for national competitiveness, particularly as energy systems transition away from fossil fuels toward electricity-based solutions.

Structural Demand Replaces Cyclical Consumption

Unlike previous commodity cycles driven by construction booms or consumer electronics sales, current copper usage is anchored in long-duration investment programs. Renewable energy installations, electric vehicle charging networks, and grid modernization projects unfold over decades rather than quarters.

These patterns have fundamentally altered how global copper demand behaves. Consumption now shows greater resilience during economic slowdowns, reducing the effectiveness of traditional forecasting models based on short-term growth indicators.

Mining Supply Faces Inherent Constraints

Copper mining is capital-intensive and slow to scale. New projects often require ten to fifteen years from discovery to commercial production, with permitting, environmental review, and infrastructure development accounting for much of the delay.

As consumption rises faster than production capacity, the gap between supply and global copper demand has widened. This imbalance leaves markets vulnerable to disruptions caused by labor disputes, weather events, or logistical bottlenecks.

Chile’s Pivotal Position in the Market

Chile remains the world’s largest copper producer, accounting for roughly a quarter of global output. Its mines supply manufacturers across Asia, Europe, and North America, making the country central to supply chain stability.

However, declining ore grades, water scarcity, and rising costs have constrained output growth. These challenges highlight how even dominant producers struggle to respond quickly to global copper demand, despite strong price incentives.

Energy Transition Drives Consumption Growth

The transition toward low-carbon energy systems is one of the most powerful drivers of copper usage. Wind turbines, solar installations, battery storage systems, and electric vehicles all require significantly more copper than their conventional counterparts.

As governments expand climate commitments, global copper demand increasingly reflects policy-driven investment rather than discretionary industrial activity, adding durability to consumption forecasts.

China’s Enduring Influence on Copper Markets

China remains the largest consumer of copper worldwide, absorbing more than half of annual production. Infrastructure development, grid expansion, and manufacturing upgrades continue to underpin strong usage, even as the country’s property sector experiences volatility.

This sustained consumption reinforces global copper demand, anchoring prices and shaping investment decisions across the mining industry.

Financial Markets Reassess Copper’s Strategic Value

Investors have increasingly treated copper as a long-term strategic asset rather than a short-term trading vehicle. Commodity funds, pension managers, and sovereign wealth funds have expanded exposure in response to structural demand signals.

Confidence in the durability of global copper demand has supported elevated price levels, while also increasing sensitivity to supply-side news and policy developments.

Manufacturing Costs and Economic Transmission

Rising copper prices directly affect manufacturing costs across construction, transportation, electronics, and energy sectors. These higher input costs can ripple through supply chains, influencing inflation and consumer pricing.

As global copper demand persists, manufacturers are reassessing sourcing strategies, long-term contracts, and recycling initiatives to manage exposure.

Recycling Gains Importance but Remains Insufficient

Copper recycling offers environmental benefits and supply flexibility, particularly during periods of market stress. Secondary copper production has grown steadily, supported by improved collection and processing technologies.

Despite these gains, recycling cannot fully offset global copper demand, especially as new applications expand total consumption rather than replacing existing uses.

Infrastructure Investment Anchors Long-Term Use

Large-scale infrastructure projects provide a stable foundation for copper consumption. Urban transit systems, power grids, data centers, and water networks all rely heavily on copper components.

These investments anchor global copper demand to public spending cycles and long-term development plans, reducing volatility relative to purely market-driven consumption.

Geopolitical Risk Enters the Supply Equation

Copper has gained strategic significance amid rising geopolitical tension. Trade policy, resource nationalism, and investment screening increasingly influence where and how new mines are developed.

Such dynamics complicate efforts to align supply growth with global copper demand, introducing political risk alongside geological and financial considerations.

Environmental Regulation Shapes Production Capacity

Stricter environmental standards governing water use, emissions, and land rehabilitation have raised costs and extended approval timelines for mining projects. While these measures address legitimate concerns, they limit the pace of capacity expansion.

Environmental constraints are now a key factor shaping the relationship between supply and global copper demand.

Labor Challenges Affect Mining Output

The mining sector faces workforce shortages as experienced workers retire and fewer young professionals enter the industry. Training new personnel requires time and investment, adding another constraint on output growth.

Labor availability has become an increasingly important variable in meeting global copper demand, particularly in remote mining regions.

Logistics and Transportation Vulnerabilities

Copper supply chains span continents, relying on ports, rail networks, and shipping routes that are vulnerable to disruption. Congestion, labor action, and geopolitical conflict can quickly affect delivery schedules.

These vulnerabilities amplify price volatility during periods of tight supply, reinforcing the strategic importance of global copper demand planning.

Technological Innovation and Material Efficiency

Advances in engineering aim to improve copper efficiency through better design and integration. While substitution with alternative materials is possible in limited applications, copper’s unique properties restrict widespread replacement.

As a result, efficiency gains are unlikely to significantly reduce global copper demand in the foreseeable future.

Market Perspective on the Current Cycle

One senior commodities analyst said,

“Copper is no longer just a cyclical metal, it has become a structural input for modern economies.”

This perspective reflects a broader reassessment of copper’s role within global economic systems.

Investment Strategy Adjusts to Long Horizons

Mining companies are increasingly cautious about overexpansion, prioritizing balance-sheet strength and project quality over rapid capacity growth. This discipline reflects lessons from past commodity cycles.

While this approach supports financial stability, it also limits the industry’s ability to respond quickly to global copper demand growth.

Emerging Markets Add to Consumption Base

Urbanization and industrialization in emerging economies continue to add incremental copper demand. Power generation, housing, and transportation infrastructure all contribute to rising usage.

These trends broaden the geographic base of global copper demand, making it less dependent on any single region.

Digital Infrastructure Expands Material Needs

The expansion of cloud computing, data centers, and telecommunications networks has added a new layer of copper consumption. High-capacity data transmission and power redundancy require extensive wiring and cooling systems.

Digital growth further reinforces global copper demand, linking the metal’s fortunes to technological expansion.

Long-Term Supply Outlook Remains Tight

Analysts broadly agree that supply growth will struggle to keep pace with consumption over the coming decade. While new projects are planned, execution risk remains high.

This outlook suggests that global copper demand will continue to exert upward pressure on prices and investment priorities.

Copper’s Transition From Commodity to Strategy

Copper’s evolving role illustrates how industrial materials are becoming strategic assets in a world defined by electrification and technological competition. Access, reliability, and sustainability now rival cost as primary considerations.

As global copper demand continues to shape policy, investment, and trade decisions, the metal’s influence will extend far beyond traditional commodity markets.

When Supply Chains Meet Strategic Reality

The current strain on copper supply chains marks a turning point in how industrial materials are managed. Long-term planning, cross-border cooperation, and sustainable development are becoming essential components of market stability.

The future of global copper demand will be determined not only by consumption trends, but by how effectively supply systems adapt to a more complex and strategic operating environment.