New York, February 11, 2026 — Parliament News — The US stock market 2026 entered a critical phase this week as investors assessed fresh labor data, corporate earnings updates, and evolving Federal Reserve expectations. Trading activity across Wall Street reflected cautious positioning after new economic figures suggested steady job growth alongside persistent wage pressures.

Analysts describe the tone of the US stock market 2026 as disciplined and data driven rather than reactive. While volatility remains contained, traders are closely watching macroeconomic signals that could shape policy decisions later in the year.

Market participants say the balance between economic resilience and interest rate uncertainty will determine performance in the coming quarters.

Labor Market Data Sets the Immediate Tone

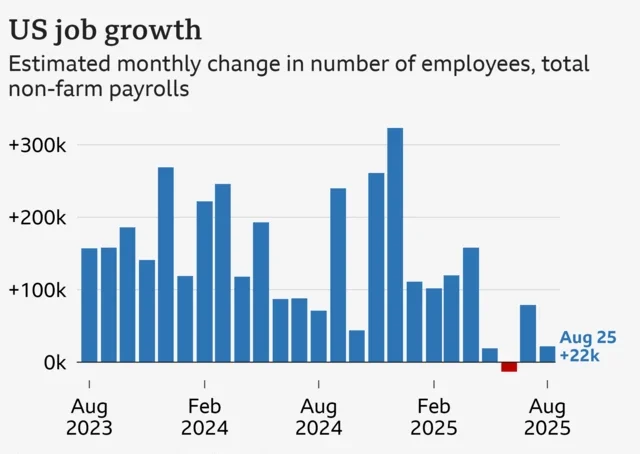

Fresh employment figures showed moderate payroll growth, reinforcing the perception that the US economy remains durable. However, wage growth slightly exceeded forecasts, introducing renewed questions about inflation sustainability.

The reaction within the US stock market 2026 was measured. Investors welcomed continued job expansion but remained cautious that stronger wages could delay potential rate cuts.

Bond yields edged higher following the data release, influencing equity valuations. Growth stocks, particularly in the technology sector, experienced mild pressure as higher yields impacted future earnings expectations.

Technology Stocks Face Selective Consolidation

Large capitalization technology companies saw modest pullbacks during the session. Profit taking after strong multi quarter rallies contributed to the downward movement.

Despite these headwinds, the broader US stock market 2026 displayed resilience due to gains in energy, healthcare, and industrial sectors. Portfolio managers emphasized that sector rotation is typical in environments where monetary policy remains uncertain.

One senior market strategist noted,

“Investors are repositioning, not retreating. The fundamentals remain intact.”

This selective consolidation suggests disciplined capital allocation rather than panic selling.

Federal Reserve Policy Remains the Key Catalyst

Interest rate expectations continue to anchor investor sentiment. Federal Reserve officials have reiterated their commitment to data dependency, signaling that policy adjustments will depend on inflation and employment trends.

The direction of the US stock market 2026 hinges largely on the timing of potential rate cuts. Markets currently anticipate gradual easing later in the year, though recent wage data complicates that narrative.

Traders remain attentive to upcoming speeches and economic releases that may provide clarity on the policy trajectory.

Sector Rotation Reflects Strategic Positioning

Capital flows shifted toward defensive sectors during recent sessions. Healthcare and consumer staples attracted investor interest as technology shares softened.

Energy companies gained modestly amid stable oil prices, helping stabilize the US stock market 2026 despite selective weakness elsewhere. Financial stocks showed mixed performance as rising yields improved margins but dampened growth sensitive segments.

Analysts argue that this rotation reflects balanced portfolio management rather than a structural shift in market outlook.

Corporate Earnings Paint a Mixed Picture

Earnings season has delivered varied outcomes across industries. Some companies exceeded revenue expectations, citing strong demand and cost discipline. Others issued cautious forward guidance due to global uncertainties.

The uneven corporate landscape influenced movements within the US stock market 2026, rewarding firms demonstrating operational efficiency while pressuring those facing margin compression.

Market observers suggest that sustained earnings growth will be necessary to support further index gains.

Broader Economic Indicators Provide Stability

Beyond employment data, consumer spending remains steady, and manufacturing activity shows gradual improvement. Housing market metrics also indicate incremental recovery.

These broader signals contribute to the underlying strength of the US stock market 2026, limiting downside risk even as investors monitor inflation trends closely.

Economists emphasize that consistent domestic demand helps cushion markets from external volatility.

Global Developments Influence Domestic Trading

International economic conditions and geopolitical developments continue to affect investor sentiment. Currency movements, commodity prices, and trade dynamics are closely monitored.

The interconnected structure of the US stock market 2026 means global events can influence sector performance rapidly. However, diversified revenue streams among multinational corporations help mitigate isolated shocks.

While uncertainties persist abroad, domestic fundamentals remain comparatively strong.

Investor Discipline and Risk Management

Institutional investors in 2026 demonstrate heightened attention to risk management. Diversification strategies, hedging instruments, and liquidity management remain central themes.

The controlled movement of the US stock market 2026 reflects disciplined allocation rather than speculative exuberance. Volatility indices remain relatively moderate compared with previous cycles.

Retail investors also show increased awareness of macroeconomic influences on asset pricing.

Historical Context of Market Cycles

Understanding past economic cycles provides perspective on current trends. Periods of moderate expansion often involve recalibration as markets adjust to policy shifts.

The US stock market 2026 benefits from stronger corporate balance sheets and enhanced regulatory oversight compared to earlier decades. Lessons learned from previous downturns have strengthened financial system resilience.

Historical comparison underscores the importance of long term strategic thinking.

Bond Markets and Inflation Expectations

Treasury yields continue to serve as a key barometer for equity valuations. Recent yield increases reflected confidence in economic strength but created headwinds for growth stocks.

The dynamic between fixed income markets and the US stock market 2026 remains central to portfolio strategy. Investors are closely monitoring inflation expectations to anticipate monetary adjustments.

Stable credit spreads indicate orderly financial conditions.

Long Term Outlook for American Equities

Looking ahead, analysts expect markets to remain sensitive to economic data releases and corporate earnings guidance. The balance between growth and inflation will shape sentiment.

The trajectory of the US stock market 2026 may ultimately depend on whether economic expansion remains steady without reigniting inflationary pressures. If stability persists, gradual upward momentum could continue.

Strategists emphasize diversification and disciplined investment as the most effective approach in the current environment.

A Measured Year for Wall Street

As trading sessions conclude in New York, the prevailing narrative remains one of cautious optimism. The US stock market 2026 reflects resilience amid policy uncertainty and global influences.

While short term fluctuations are inevitable, structural strengths in employment, corporate governance, and financial regulation provide support.

The developments of February 11, 2026 illustrate how modern markets respond to evolving data with balance rather than volatility. If current trends continue, 2026 may be defined by steady recalibration and disciplined market navigation.

Market Crossroads Defining the Remainder of 2026

The path ahead for Wall Street now depends on disciplined policy signals and sustained economic balance.

Investors are navigating a narrow corridor between growth optimism and inflation vigilance.

Momentum remains intact, but conviction requires clearer direction from monetary authorities.

Strategic patience rather than aggressive positioning appears to define this phase.

If stability persists, equities may continue their gradual climb through the second half of 2026.

The coming months will reveal whether resilience transforms into renewed expansion.