Silicon Valley, California — February 13, 2026 — According to Parliament News, that AI semiconductor growth is accelerating across Silicon Valley in 2026 as manufacturers expand fabrication capacity to support surging artificial intelligence workloads. Industry leaders confirm that capital investment, advanced tooling orders, and infrastructure buildouts reflect a sustained transformation rather than a short term spike in demand.

Executives across the semiconductor ecosystem describe the current environment as a structural expansion phase fueled by enterprise level AI deployment, cloud infrastructure scaling, and national technology strategies. Investors have responded with renewed confidence, citing production backlogs and long range contracts as indicators of stability.

The scale of investment unfolding this year positions the semiconductor industry at the center of the global AI economy.

Capital Investment Signals Long Term Commitment

AI semiconductor growth is being reinforced by record levels of capital expenditure among major chip manufacturers. Fabrication plants are increasing spending on advanced lithography systems, materials engineering tools, and automated inspection platforms designed to handle increasingly complex chip architectures.

Unlike cyclical demand linked to consumer electronics upgrades, the current investment wave reflects enterprise transformation. Artificial intelligence is being embedded into logistics systems, healthcare analytics, financial modeling, cybersecurity frameworks, and manufacturing automation. Each of these applications requires high performance processors built at advanced nodes.

Chipmakers are committing multi year budgets to ensure production capacity aligns with projected AI workload expansion. The commitment signals confidence that demand will remain elevated beyond near term quarters.

Data Center Expansion Drives Output

The rapid construction of hyperscale data centers across North America and globally is directly tied to AI semiconductor growth. Cloud providers are expanding computing clusters capable of training and deploying increasingly sophisticated AI models.

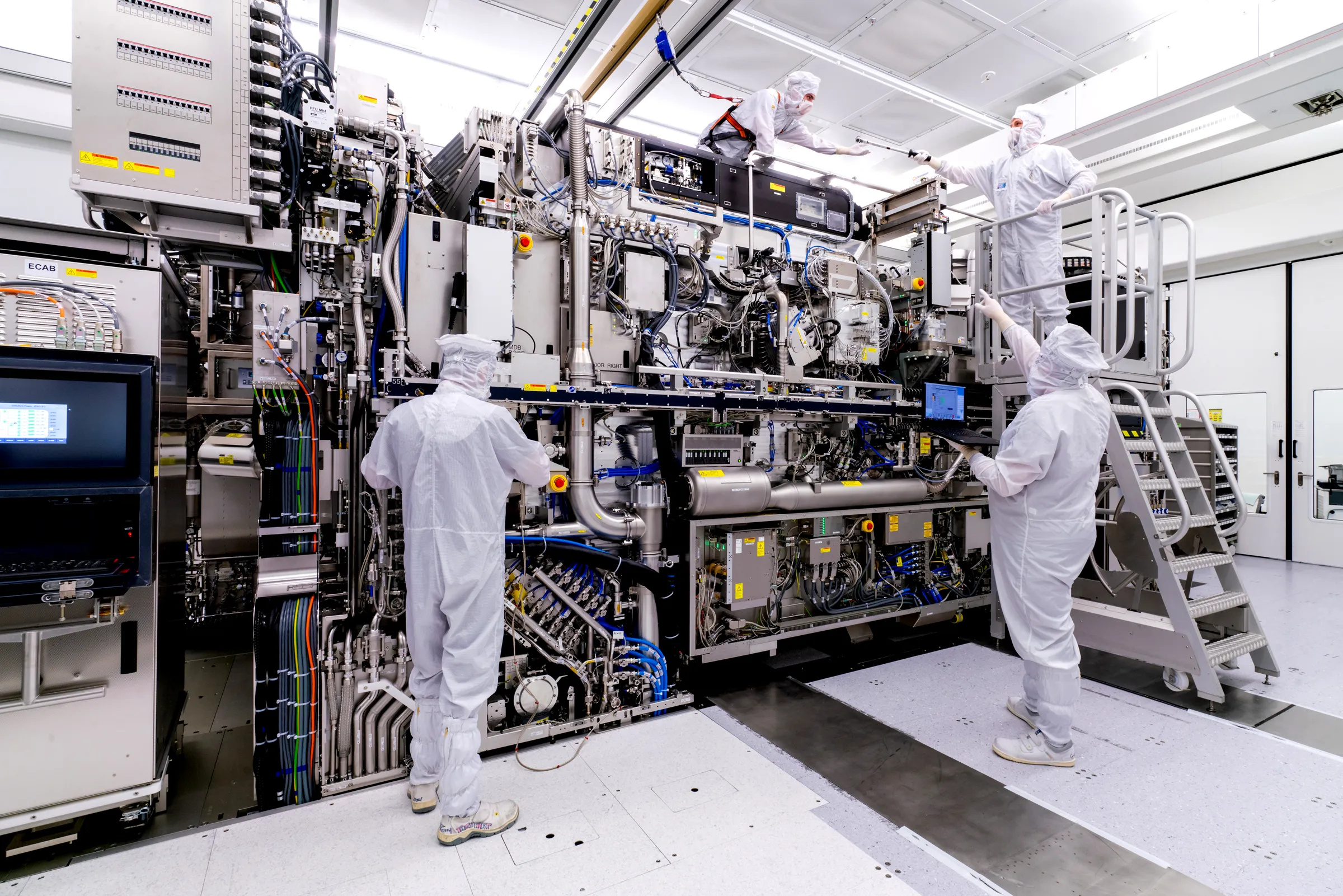

These facilities require advanced processors optimized for parallel computation and neural network acceleration. The production of such chips demands precision manufacturing at nanometer scales, supported by state of the art equipment and clean room facilities.

As data center capacity scales, semiconductor fabrication must scale in parallel. This synchronized expansion underpins current manufacturing momentum and strengthens supply chain confidence.

Manufacturing Complexity Reaches New Levels

Modern AI processors integrate billions of transistors and rely on advanced packaging techniques such as chip stacking and high bandwidth memory integration. This complexity intensifies the need for specialized fabrication equipment and quality control systems.

AI semiconductor growth depends on precision engineering across every stage of production. From wafer deposition to etching and metrology, each process step requires highly calibrated tools capable of operating within microscopic tolerances.

Manufacturers emphasize yield optimization as a core priority. Even marginal improvements in efficiency can significantly influence output volumes and profitability, particularly at advanced process nodes.

Equipment Orders Reflect Forward Visibility

Semiconductor equipment providers report expanding order books that extend well into future quarters. These forward commitments provide revenue visibility and signal customer confidence.

AI semiconductor growth often becomes visible first in equipment procurement trends. Before chips are produced and shipped, manufacturing tools must be installed and calibrated. Rising bookings therefore serve as early indicators of future output expansion.

Financial analysts closely track backlog metrics, viewing them as leading indicators of sustained industrial activity.

Supply Chain Reinforcement and Risk Mitigation

The semiconductor industry operates within a complex global supply network. Raw materials, specialty chemicals, precision components, and automation systems originate from diverse geographic regions.

AI semiconductor growth has encouraged companies to invest in supply chain resilience strategies. Diversification of suppliers, regional manufacturing partnerships, and inventory management improvements aim to reduce exposure to disruptions.

Companies are also enhancing transparency through digital supply tracking systems, allowing faster response to logistical challenges.

Workforce Expansion and Skills Development

As fabrication capacity expands, workforce development becomes increasingly important. Semiconductor manufacturing requires engineers trained in materials science, electrical engineering, process control, and automation.

AI semiconductor growth has intensified competition for skilled professionals. Universities and technical institutions are partnering with industry leaders to expand semiconductor focused curricula.

Training initiatives now emphasize advanced node manufacturing techniques, sustainable operations, and AI driven production optimization tools.

Financial Markets Respond to Structural Momentum

Equity markets have shown heightened interest in semiconductor related stocks throughout 2026. Portfolio managers identify AI semiconductor growth as a foundational theme with multi year implications.

Investment analysts highlight stable backlog trends, diversified customer bases, and ongoing research investments as positive indicators. While short term volatility remains possible, the long range demand outlook appears strong.

Market participants increasingly distinguish between cyclical semiconductor fluctuations and structural AI driven expansion.

Government Policy and Strategic Investment

Public policy plays a growing role in shaping manufacturing expansion. Incentive programs encourage domestic fabrication development to strengthen supply chain independence.

AI semiconductor growth intersects with national security and economic competitiveness priorities. Governments view advanced chip manufacturing as critical infrastructure.

Regulatory frameworks, export controls, and cross border collaboration agreements continue to influence global manufacturing decisions.

Sustainability Considerations in Advanced Manufacturing

Semiconductor fabrication is resource intensive, requiring significant electricity and water usage. Sustainability initiatives are now integral to expansion plans.

AI semiconductor growth is prompting manufacturers to adopt renewable energy agreements, water recycling systems, and energy efficiency improvements within fabrication plants.

Environmental accountability has become a strategic priority as companies seek to balance expansion with responsible resource management.

The Evolution of Semiconductor Cycles

During previous semiconductor cycles, such as the personal computer expansion of the 1990s and the smartphone boom of the early 2010s, production growth was largely tied to consumer adoption patterns. Those cycles generated rapid spikes followed by periods of inventory correction.

AI semiconductor growth differs in scale and durability. Rather than being driven primarily by consumer hardware refreshes, the current expansion stems from enterprise digital transformation and infrastructure investment. Artificial intelligence workloads require continuous computational upgrades, creating ongoing demand rather than replacement cycles.

Industry historians note that while earlier booms transformed communication and mobility, the present expansion may redefine productivity across entire economies.

Enterprise Integration of Artificial Intelligence

Corporations across industries are embedding AI into operational frameworks. Financial institutions leverage machine learning for risk analysis and fraud detection. Healthcare systems deploy predictive diagnostics powered by neural networks. Logistics companies optimize routing algorithms in real time.

AI semiconductor growth supports these applications by enabling faster training cycles and real time inference at scale. Advanced processors allow organizations to deploy increasingly complex models without sacrificing performance.

The broad applicability of artificial intelligence contributes to stable semiconductor demand across diverse sectors.

Innovation in Chip Architecture

Emerging design methodologies are reshaping semiconductor engineering. Three dimensional integration, advanced packaging, and heterogeneous computing platforms enable higher performance density.

AI semiconductor growth relies on continued innovation at both the design and manufacturing levels. Collaboration between chip designers and fabrication specialists ensures compatibility between architecture and production capabilities.

Research institutions play a critical role in advancing materials science and lithography techniques necessary for next generation chips.

Regional Expansion Beyond Silicon Valley

Although Silicon Valley remains a central hub, semiconductor expansion is occurring globally. New fabrication facilities are under development in multiple U.S. states as well as Europe and Asia.

AI semiconductor growth extends beyond one geographic cluster, reflecting international investment coordination. Regional diversification enhances supply stability and supports localized technology ecosystems.

Economic development agencies view semiconductor facilities as anchors for high skilled employment and technological advancement.

Investment in Research and Development

Sustained innovation requires robust research funding. Semiconductor companies allocate significant resources toward developing new process nodes and advanced materials.

AI semiconductor growth benefits from close integration between academic research and industrial application. Breakthroughs in photonics, quantum materials, and extreme ultraviolet lithography continue to expand manufacturing possibilities.

Long term competitiveness depends on maintaining research pipelines that anticipate future computational demands.

Market Risks and Economic Variables

While structural momentum remains strong, macroeconomic factors can influence short term performance. Interest rate shifts, currency fluctuations, and global trade conditions affect capital spending decisions.

AI semiconductor growth appears resilient, yet industry leaders remain cautious regarding geopolitical uncertainties and regulatory changes.

Prudent financial management and diversified customer relationships help mitigate cyclical pressures.

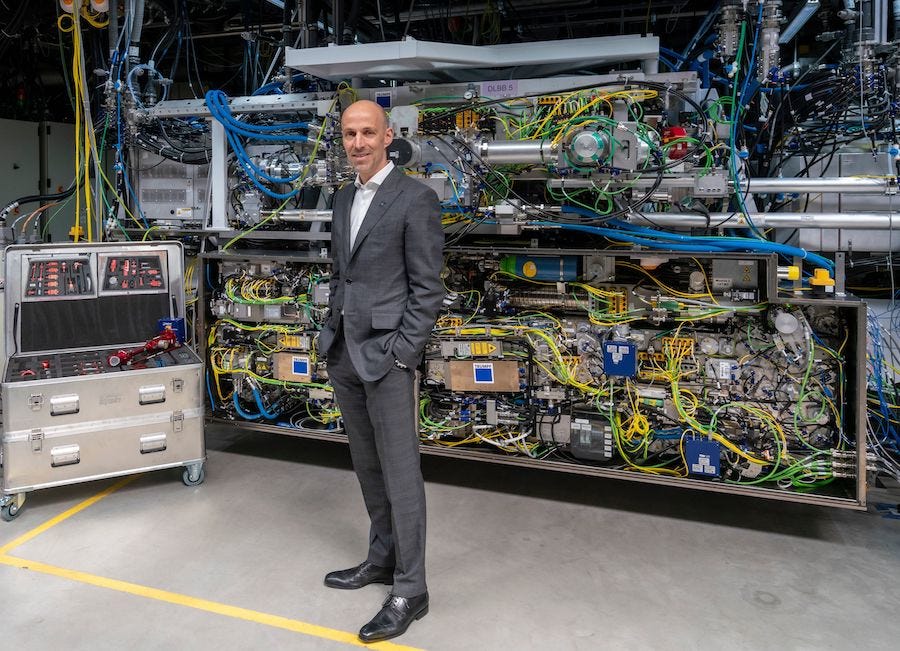

One Industry Perspective

A senior semiconductor executive recently stated,

“The transformation we are witnessing is not temporary enthusiasm but a generational shift in how computation powers the global economy.”

This sentiment reflects widespread belief that AI semiconductor growth represents a foundational change rather than a passing trend.

Infrastructure and Energy Demands

Expanding fabrication capacity requires robust infrastructure. Facilities must support clean room environments, precision climate control systems, and uninterrupted power supply.

AI semiconductor growth increases demand for high reliability energy grids and advanced cooling solutions. Utility providers collaborate with manufacturers to ensure sustainable capacity expansion.

Energy efficiency technologies are becoming central to long term operational planning.

Long Term Outlook Through 2030

Industry forecasts suggest that semiconductor demand tied to artificial intelligence will continue rising throughout the decade. Companies anticipate successive generations of AI models requiring enhanced performance and efficiency.

AI semiconductor growth is projected to remain a key driver of capital allocation strategies. Analysts expect ongoing facility upgrades and tool procurement as part of continuous improvement cycles.

Strategic partnerships across the technology ecosystem will likely accelerate innovation.

Economic Ripple Effects Across Industries

Semiconductor expansion influences construction, engineering services, materials supply, and automation software development. Local economies hosting fabrication plants experience secondary growth in housing, transportation, and retail sectors.

AI semiconductor growth stimulates broader economic multipliers. Policymakers often highlight these ripple effects when supporting manufacturing incentives.

The interconnected nature of the semiconductor ecosystem amplifies its economic impact.

The Next Chapter of Intelligent Manufacturing

Looking ahead, AI semiconductor growth may transform manufacturing processes themselves. Artificial intelligence is increasingly applied to optimize yield, predict equipment maintenance needs, and enhance supply coordination.

Smart factories integrate data analytics directly into production lines, creating adaptive systems capable of responding dynamically to operational conditions.

The convergence of artificial intelligence and semiconductor engineering signals a future in which computational power not only drives applications but also improves the very processes that create it.

AI semiconductor growth stands at the center of technological transformation in 2026. From Silicon Valley to global manufacturing hubs, sustained investment, research innovation, and enterprise integration underscore a structural shift in the digital economy. As artificial intelligence continues reshaping industries, semiconductor production remains the foundational engine powering progress.