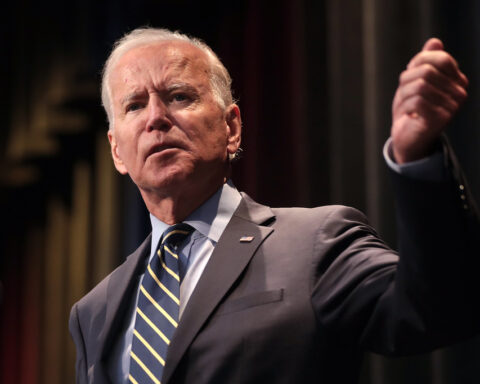

Joe Biden is allegedly mulling the first federal tax hike since 1993 to reboot the American economy and pay-off the costs of future programmes at the same time.

The US president is due to propose spending more than the $1.9 trillion (£1.36 trillion ) Covid-19 relief bill approved by Congress on longer-term initiatives, with tax hikes as a source of funding.

As reported by Bloomberg, the Biden administration is thought to be considering a whole suite of tax rises mostly targeting the wealthy — although it will not introduce an outright tax on wealth to pay for future bills.

“His whole outlook has always been that Americans believe tax policy needs to be fair,” said Sarah Bianchi, a former economic adviser for Mr Biden and head of US public policy at Evercore ISI.

“He has viewed all of his policy options through that lens, [and] that is why the focus is on addressing the unequal treatment between work and wealth,” Ms Bianchi told Bloomberg.

Some of the future initiatives to be proposed by Mr Biden include investing in infrastructure and the climate, as well as addressing systemic imbalances in the country’s tax system.

The US president promised during the 2020 campaign to only introduce tax rises for those who brought-in more than $400,000 (£287,000), while revoking a Trump-era tax break for big business.

Four people with knowledge of the Biden administration’s proposals told Bloomberg that other 2020 campaign promises, including a 28 per cent tax for corporations, are also being discussed.

Although no date has been set for announcing the first tax hikes in almost thirty years, the Biden administration has indicated in the past that it would follow the signing of the Covid-19 relief bill.

According to Bloomberg, analysts believe that tax rises could raise between $2 trillion to $4 within a decade, helping to fund the Biden administration’s spending.