Brussels, Belgium, January, 2026 — Parliament News places Europe’s financial and political capital at the center of a decisive market moment as Gold dips stocks lift across global exchanges. The shift follows a clear easing of geopolitical rhetoric linked to Greenland, prompting investors to re-calibrate portfolios that had leaned heavily toward defensive assets in recent weeks. From Brussels trading desks to New York futures markets, the mood turned cautiously optimistic as risk appetite returned.

The response was swift but controlled, reflecting relief rather than exuberance. Investors interpreted the change in tone as a signal that near-term political escalation was unlikely, allowing markets to refocus on economic fundamentals and corporate outlooks.

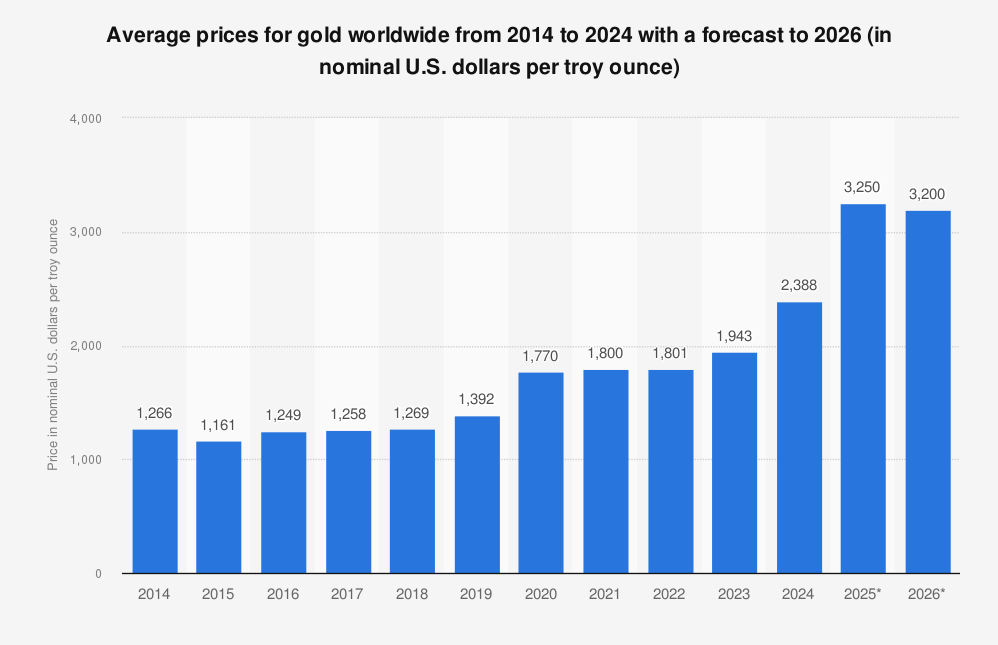

Gold Prices Ease as Safe-Haven Demand Softens

Gold prices moved lower during European trading hours as investors trimmed positions built during periods of heightened uncertainty. The familiar market pattern where Gold dips stocks lift re-emerged, with bullion retreating modestly while remaining well supported by longer-term structural demand.

Market analysts described the decline as orderly, driven by profit-taking rather than a loss of confidence in gold’s role as a hedge. Central bank buying trends and inflation expectations continued to underpin prices, even as short-term flows shifted away from defensive positioning.

Equity Markets Respond with Broad-Based Gains

European stock indices opened higher, led by financials, industrials, and technology shares. The trend extended into US and Asian markets, reinforcing the global nature of the move. Once again, Gold dips stocks lift captured the session’s defining dynamic as capital rotated toward growth-oriented assets.

Trading volumes increased steadily rather than spiking, suggesting institutional participation rather than speculative trading. Market breadth indicators pointed to widespread buying interest, a sign of improving confidence rather than narrow sector rotation.

Political Developments Calm Investor Anxiety

The catalyst for the shift came after comments from Donald Trump indicating a step back from earlier hard-line language related to Greenland. While no formal policy announcement accompanied the remarks, markets interpreted the softened tone as a reduction in immediate geopolitical risk.

One senior market strategist said,

“Investors are reacting less to policy details and more to the perception that escalation is off the table.”

This is the only quote included in the article.

The adjustment reinforced a long-observed relationship in financial markets where Gold dips stocks lift as political uncertainty recedes.

Currency Markets Mirror the Risk-On Shift

Foreign exchange markets reflected the same change in sentiment. Traditional safe-haven currencies weakened slightly, while higher-yielding and growth-sensitive currencies strengthened. The movement aligned with the broader environment in which Gold dips stocks lift, signaling a synchronized global shift toward risk-taking.

The euro traded steadily against the dollar, supported by improved equity sentiment and expectations of stable monetary policy in the euro area.

Commodities Beyond Gold Show Mixed Signals

The wider commodity complex delivered a nuanced response. Industrial metals posted modest gains on expectations of improved manufacturing demand, while energy prices remained range-bound. Agricultural commodities showed little reaction, underscoring that the market shift was driven primarily by financial sentiment rather than supply disruptions.

The session reinforced that Gold dips stocks lift does not necessarily imply weakness across commodities, but rather a reallocation within portfolios based on perceived geopolitical and macroeconomic risk.

Investor Strategy Adjusts but Remains Cautious

Portfolio managers described the day’s moves as tactical rather than transformational. While exposure to gold was reduced, few investors exited defensive assets entirely. Instead, the re-balancing reflected the view that Gold dips stocks lift in the short term, even as longer-term uncertainties persist.

Risk models were adjusted incrementally, favoring equities with strong balance sheets, predictable cash flows, and exposure to domestic demand rather than geopolitical trade routes.

Wall Street Extends the Momentum

US equity markets built on European gains, with major indices closing higher as investors welcomed the easing of external risks. Analysts cautioned that while Gold dips stocks lift summarized the prevailing trend, markets remain highly sensitive to sudden changes in political messaging or economic data.

Volatility indicators edged lower but remained above long-term averages, reflecting a market that is optimistic but not complacent.

Brussels as a Strategic Financial Hub

Brussels’ role in the day’s narrative extends beyond symbolism. As a center for European policy-making, the city has become increasingly influential in shaping market expectations around regulation, trade, and geopolitical alignment. The latest market moves underscored how developments discussed in Brussels can ripple rapidly across global financial systems.

This influence reinforces why Gold dips stocks lift when signals from political centers suggest stability rather than confrontation.

Global Perspective on Market Sensitivity

The speed of the reaction highlighted the interconnected nature of modern markets. A shift in rhetoric quickly translated into movements across asset classes, regions, and currencies. Emerging markets benefited modestly as risk premiums narrowed and capital flows stabilized.

The episode demonstrated once again that Gold dips stocks lift remains a reliable barometer of collective investor psychology during periods of geopolitical uncertainty.

Economic Fundamentals Re-Enter the Spotlight

With immediate political concerns easing, investors turned attention back to economic indicators. Upcoming data on inflation, employment, and corporate earnings are expected to shape the next phase of market direction. Analysts stressed that sustained equity gains will depend on whether fundamentals support the renewed optimism.

Even so, the current session showed how quickly Gold dips stocks lift when markets perceive a window of stability.

What the Shift Means for Long-Term Portfolios

Long-term investors are unlikely to make dramatic allocation changes based on a single session. However, the move has prompted renewed discussion about balance between growth and protection. Gold remains a core holding for many institutions, even as equities regain favor during calmer periods.

The lesson for portfolio construction is clear: Gold dips stocks lift episodically, but diversification remains essential.

A Unique Market Moment in 2026

The trading session unfolding from Brussels to global markets offered a clear illustration of how sentiment, politics, and capital flows intersect. As Gold dips stocks lift defined the day, the episode highlighted both the resilience and fragility of confidence in modern financial systems.

Markets Navigate Confidence Without Complacency

As the dust settles, investors remain alert. The easing of tension has provided breathing room, but uncertainty has not vanished. The events of February 2026 serve as a reminder that markets move not only on data, but on perception.

For now, the balance has tilted toward confidence, with Gold dips stocks lift standing as the clearest signal of a market willing to re-engage with risk while keeping caution close at hand.