UK (Parliament Politics Magazine): The Joseph Rowntree Foundation analysis suggests that the average UK family could lose £1,400 annually by 2030 due to frozen tax thresholds and rising living costs.

A new financial study indicates that UK households may lose £1,400 annually by 2030.

JRF study’s about the decline in UK living standards

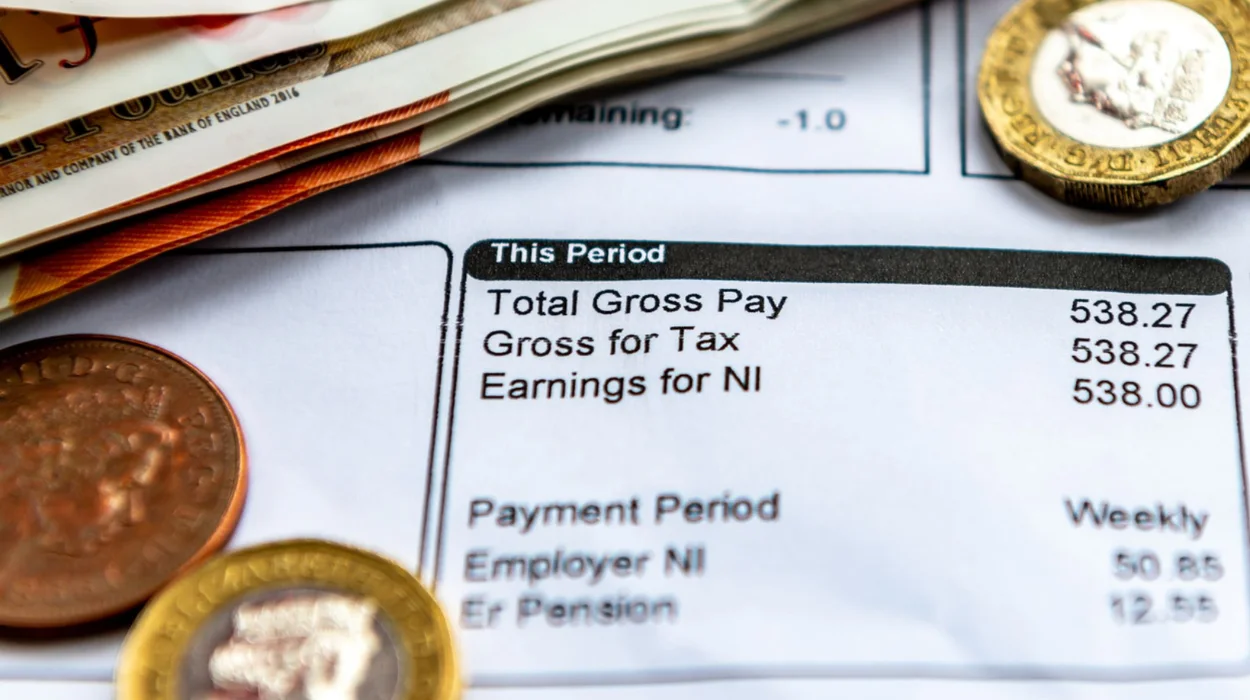

Households across Britain are facing financial strain as tax thresholds remain frozen, housing costs increase and real wages drop. The poorest third of the population is expected to see their living standards drop at twice the rate of those in higher income brackets.

The Joseph Rowntree Foundation warns that the government is at risk of failing to meet its pledge to improve living standards across the UK before the next election.

It reveals that by April 2030, the average British family will face a £1,400 reduction in disposable income, a 3% decline. Meanwhile, low-income households are expected to lose £900 annually, marking a 6% drop.

JRF analysis predicts that average earnings will drop by £700 annually by 2030.

According to the charity, which focuses on addressing poverty, its projection stems from economic forecasts from the Bank of England and other financial resources.

The foundation has condemned the government’s welfare cuts, describing them as “wrong” and counterproductive, urging for the plan to be scrapped.

The JRF advocates for introducing a “minimum floor” for Universal Credit to ease financial hardship. It argues that instead of welfare cuts, the government should explore increasing taxes on wealth and investments to secure funds.

The report is released three days before Chancellor Rachel Reeves‘ spring statement. Additional spending cuts are expected to be announced as part of efforts to tackle the nation’s finances.

JRF director’s stance on rising inequality and falling living standards

Alfie Stirling, director of insight and policy at the JRF, has warned that Labour is at risk of overseeing a rapid increase in inequality.

He raised concerns that this government risks becoming the “first parliament in modern history to witness a decline in average living standards from start to finish.”

What are the key announcements and concerns ahead of the spring statement?

The government is set to implement £2bn in cuts to civil services. However, sources indicate that these reductions will not affect front-line services.

Chancellor Rachel Reeves assured that there would be no additional tax increases. She will address the independent Office for Budget Responsibility in her spring speech, responding to projections on living costs and government finances.

The Bank of England has slashed its economic growth forecast for Britain to 0.75% this year, raising worries over Labour’s pledge to enhance economic growth.

Experts warn that the upcoming increase in employer national insurance and minimum wage could further hinder business investment.

What will Rachel Reeves announce on spending cuts?

Chancellor Rachel Reeves plans to reveal the largest spending cuts since the austerity era in next week’s spring statement, after rejecting tax hikes as a solution to address the fiscal gap.

Next Wednesday, she will inform MPs about a proposal to slash Whitehall budgets by billions more than anticipated. The decision could lead to department reductions of up to 7% over the next four years.

What did Whitehall sources say about government spending cuts?

One Whitehall source stated,

“The government has been clear that departments will have to find more efficiencies. That is why Wes Streeting [the health secretary] has cut NHS England, that is why Liz Kendall [the work and pensions secretary] has made reductions to welfare payments.”

Another said,

“I don’t know how much longer we can go on pretending this is not austerity when the reality is we’re making cuts to vital public services such as police and prisons.”

What did the IFS say about government spending cuts?

Ben Zaranko from the Institute for Fiscal Studies (IFS), said,

“The government will be hoping that the short-term cash injection provided last year, and efficiency improvements as public services continue to recover from the pandemic, will be enough to deliver service improvements even if money is tight.”

Mr Zaranko added,

“But we’re in a very different world to 2010 and, even though the pace of cuts would be substantially slower than in the peak austerity years, it would still represent the steepest cuts since 2019.”

What did the Treasury say about public service spending?

A Treasury source stated,

“Last year’s budget delivered £40bn of additional cash into our public service, including the largest real-terms growth in day-to-day NHS spending outside of Covid since 2010. On top of that, we unlocked more than £100bn of investment into our schools, hospitals and national infrastructure.”