UK (Parliament Politics Magazine) – Keir Starmer refused to rule out wealth or stealth taxes during PMQs, as pressure mounts to fill a £6.25bn gap after recent welfare and fuel U-turns.

As reported by The Independent, UK Prime Minister Sir Keir Starmer suggested the Labour government may consider wealth and stealth taxes to stabilise national finances.

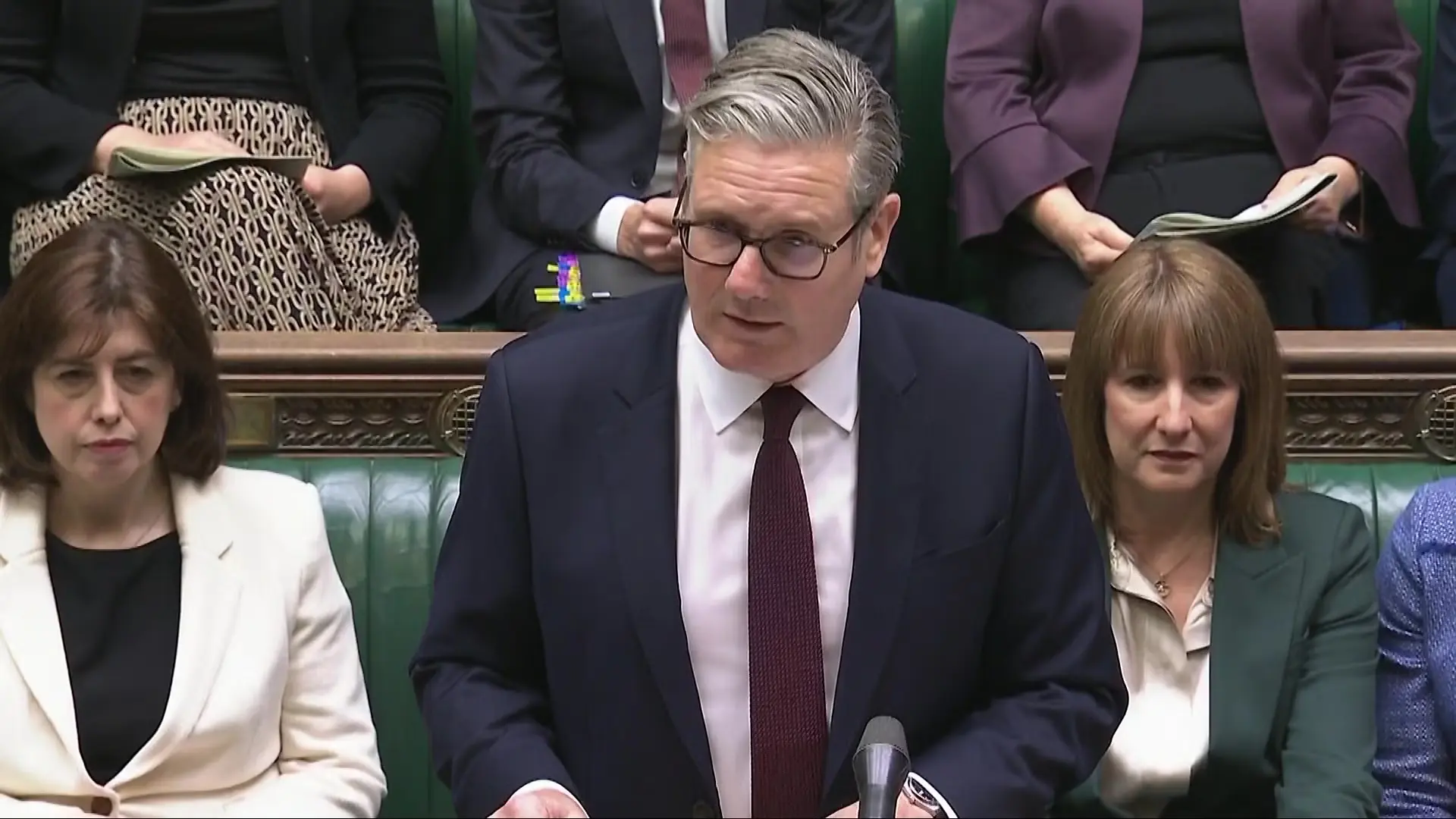

Keir Starmer’s response to tax pressure from Tories

During Prime Minister’s Questions, Tory leader Kemi Badenoch challenged Keir Starmer over public finance concerns, leaving him appearing cornered.

When asked if he would uphold his pledge not to raise income tax, VAT, or national insurance, the Labour leader replied, “Yes.”

The trade unions and former Labour leader Lord Kinnock called for wealth taxes, Mr Starmer avoided dismissing the idea during PMQs.

Ms Badenoch said, “What is more worrying is that now he’s flirting with Neil Kinnock’s demand for a wealth tax. Let’s be honest about what that means. This is a tax on all of our constituents, savings, on their houses, and on their pensions. It would be a tax on aspiration. Will the prime minister rule this out?”

The prime minister, who earlier gave a firm “yes” on tax pledges, failed to offer the same clarity when asked about wealth-related levies.

Mr Starmer said, “We will not be asking for [Tory] advice. What we did in the budget was stabilise the economy through the measures taken by the chancellor. What does that link to? For interest rate cuts for mortgage holders. That’s hugely important, because of what happened on the Liz Truss mini budget. So no, we don’t need lessons from them.”

When asked if income tax thresholds would be unfrozen under his leadership, Mr Starmer responded, “No prime minister is going to write the budget in advance, but we are absolutely fixed on our fiscal rules.”

How will Labour cover £6.25bn in U-turn spending?

Chancellor Rachel Reeves has opposed tax hikes, but Labour’s welfare and fuel U-turns have added £6.25bn in spending pressures.

Despite ruling out further borrowing, Reeves faced pressure after the OBR warned policy U-turns had left the UK economy “vulnerable.”

During the last budget announcement, Ms Reeves committed to ending the freeze on income tax thresholds after 2028.

If the threshold freeze continues through this parliament, it could raise billions, with around two million workers projected to move into higher tax bands by 2028.

Last week, the government made a U-turn on welfare reforms, slashing expected savings from £5bn to zero and creating a major gap in public finances.

Keir Starmer’s views say about UK-France ties

Keir Starmer called UK-France ties “as strong as ever” during his meeting with Emmanuel Macron at Downing Street.

He said, “It’s such a privilege and pleasure to welcome you here to Downing Street and the visit yesterday, the summit tomorrow and the meeting here today are so hugely symbolic of the closeness between our countries and our personal relationship and I’m so delighted to have you here, and I think you can see from last night, from today and tomorrow, just how much this means to everybody across the United Kingdom.”

Mr Starmer added, “And I’m proud of the fact that we have a strong history together as two countries. Whether it’s on defence and security, whether it’s on Ukraine, whether it’s on trade and economy, business opportunities, capabilities, we think alike, we work together, and I feel this relationship is as strong as it’s ever been.”

OBR’s warning about Britain’s public finances

The OBR has warned that UK public finances remain fragile, with recent fiscal efforts showing little impact.

Its report said, “The UK’s public finances have emerged from a series of major global economic shocks in a relatively vulnerable position. Planned tax rises have been reversed, and, more significantly, planned spending reductions have been abandoned.”