UK (Parliament Politics Magazine) – Labour MP Anna Dixon urged tax relief for unsold retirement homes, but the party rejected the call, leaving grieving families burdened with double taxation.

As reported by The Telegraph, despite internal pressure, Labour has refused to ease council tax burdens on families inheriting hard-to-sell retirement homes.

What did Anna Dixon say about the council tax on inherited retirement homes?

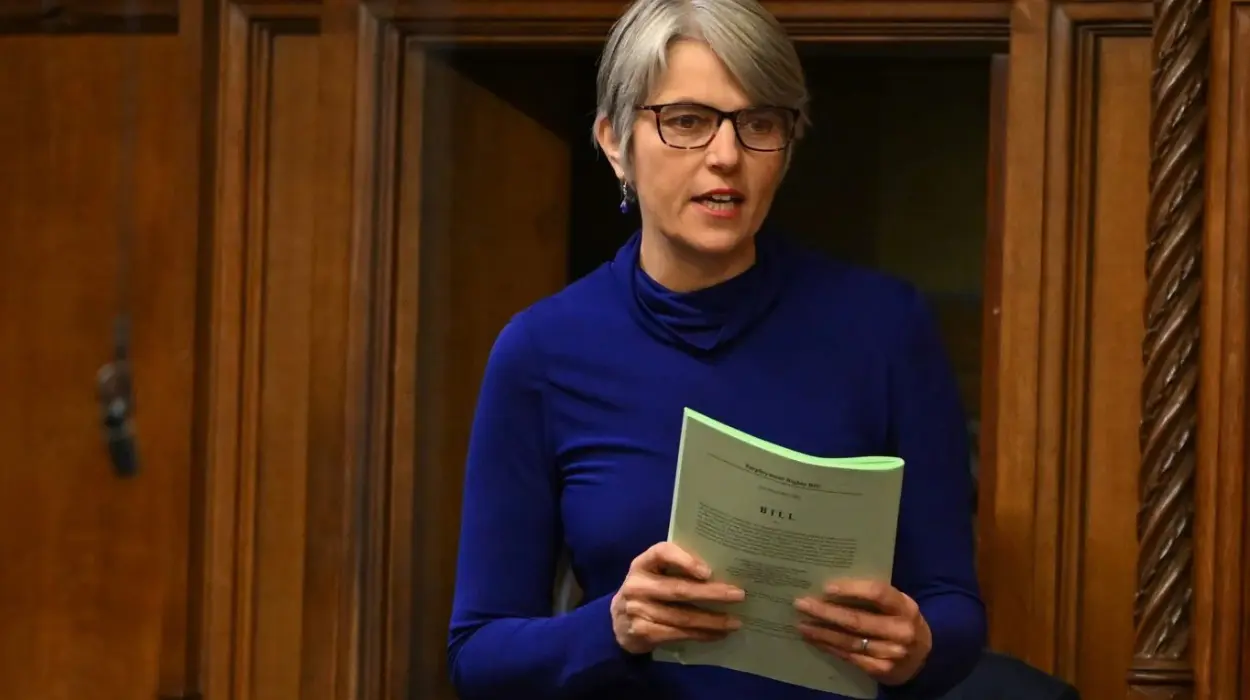

Shipley MP Anna Dixon appealed to the Ministry of Housing, under Angela Rayner’s leadership, to give families more time to sell inherited retirement properties before facing second home tax charges.

She raised a formal inquiry in Parliament, asking Ms Rayner if she planned to

“extend the time limit on exceptions to council tax premiums to cover the full period for which a property is being actively marketed for sale for (a) long-term empty homes, (b) second homes and (c) leasehold retirement properties.”

Housing Minister Jim McMahon said the Government had

“no plans to change the exceptions to the council tax premiums.”

What did Kevin Hollinrake say about Labour’s stance on the retirement home tax?

Kevin Hollinrake, shadow housing minister, stated,

“Labour should be actively reviewing how the new regime is working in practice. Their refusal to even consider extending the exemption for retirement properties shows a shocking disregard for bereaved families.”

He added,

“These homes are notoriously hard to sell, and this tax burdens grieving families with unexpected and often unaffordable bills at one of the most difficult times in their lives.”

What did Dennis Reed say about taxing unsold retirement homes?

Dennis Reed, from the senior citizens charity Silver Voices, said,

“This inflexibility and obstinacy by the Government flies in the face of fairness and equity. A hard to sell flat in a retirement complex is clearly not a second home unless a member of the family is living there.”

He added,

“All the reasons for second home premiums do not apply in such circumstances, and Labour should be showing some empathy to those who have lost a loved one.”

What did the Housing Ministry say about the second home tax?

A Ministry for Housing, Communities and Local Government spokesman stated,

“It is for councils to determine whether to apply a premium on the council tax bills of second homes.”

They added,

“Councils can opt to add up to 100pc extra on the council tax bills of second homes to help local leaders protect their communities.”

How do council tax rules impact unsold retirement homes?

Inherited retirement homes are restricted to buyers aged 55 and over, limiting the pool of potential purchasers. Their declining market value and steep maintenance charges further reduce buyer interest.

As of April 1, local authorities in England have been given the authority to impose a 100% council tax premium on second homes within their jurisdictions.

The 100% council tax exemption on second homes applies for a year after the property is listed for sale. If it remains unsold, the charge is reapplied.

Why are retirement properties losing their appeal in the UK?

The 1980s saw a rise in demand for retirement housing, with the trend continuing into the early 21st century.

The Elderly Accommodation Counsel reported that, by 2019, approximately 730,000 retirement homes were available across the UK.

The popularity of retirement homes has sharply declined amid growing complaints from early owners, many citing high maintenance fees that apply even when unoccupied.

Data from Hamptons shows that one in every ten retirement flats takes more than 12 months to find a buyer.

Labour housing target

- OBR forecasts 1.3M new UK homes by 2029–30; target is 1.5M

- Only 1M expected in England; rest in devolved nations

- Govt says reforms may add 170K homes – just 25% of the shortfall

- Jul-Dec 2024: 59,680 starts, 72,960 completions in England

- 2023-24 saw a record low only 30,000 planning permissions approved in England