Bangladesh, January 2026, Bangladesh finds itself at the center of an intense national debate over energy governance, affordability, and accountability following the release of a government-commissioned review into a major cross-border electricity deal. The findings have triggered scrutiny of a power purchase agreement that underpins a significant portion of the country’s imported electricity supply. As electricity demand continues to rise alongside industrial growth, the controversy has exposed deeper questions about how long-term energy contracts are structured and approved.

For policymakers, the issue extends far beyond a single contract. It touches on fiscal sustainability, public trust, and the balance between securing reliable power and protecting consumers from excessive costs. For citizens, the debate resonates directly through electricity bills, subsidies, and the broader cost of living.

Background How the Deal Came Into Force

The agreement was signed during a period of acute power shortages, when rapid economic expansion placed heavy pressure on domestic generation capacity. To avoid prolonged outages and support industrial output, authorities sought external power sources that could deliver large volumes of electricity quickly.

The power purchase agreement was presented as a strategic solution, ensuring stable supply through long-term commitments. At the time, officials argued that urgency justified accelerated approvals, emphasizing energy security over extended procurement processes.

What the Review Examined

The review panel was tasked with examining financial terms, procedural compliance, and long-term implications of the contract. Its mandate included assessing tariff benchmarks, escalation clauses, fuel cost assumptions, and risk allocation between the public sector and the supplier.

In doing so, the panel treated the power purchase agreement as a case study for broader energy procurement practices, rather than an isolated transaction. This approach allowed reviewers to contextualize the deal within regional market norms and domestic policy frameworks.

Pricing Concerns at the Core of the Debate

At the heart of the controversy lies pricing. The panel concluded that electricity tariffs embedded in the contract exceed comparable regional rates, raising concerns about value for money. Analysts noted that fixed pricing mechanisms limit flexibility, particularly during periods of declining global fuel costs.

The report found that the power purchase agreement effectively transfers market risk to the buyer, locking Bangladesh into payments that may remain high even if cheaper alternatives become available in the future.

Procedural Shortcomings Highlighted

Beyond pricing, the review identified procedural gaps. These included limited competitive bidding, compressed approval timelines, and insufficient documentation at critical stages. Such deviations, the panel warned, weaken institutional safeguards designed to protect public interest.

The handling of the power purchase agreement has therefore become emblematic of broader governance challenges, prompting calls for stricter adherence to procurement standards.

Government Reaction and Official Position

Government officials acknowledged the findings and emphasized that the review was part of an ongoing effort to improve transparency. While no immediate renegotiation was announced, authorities indicated that future contracts would be subject to tighter scrutiny.

The debate surrounding the power purchase agreement has also influenced internal policy discussions, with ministries reassessing approval protocols and oversight mechanisms.

Economic Impact on Consumers and Industry

Electricity pricing affects every sector of the economy. Higher generation costs can lead to increased tariffs for households or higher subsidy burdens for the state. Both outcomes carry long-term consequences.

Economists warn that the power purchase agreement, if left unchanged, could constrain fiscal space and reduce competitiveness, particularly for export-oriented industries sensitive to energy costs.

Energy Security Versus Affordability

Bangladesh’s energy strategy has long prioritized reliability, given the economic damage caused by power shortages. However, the current controversy underscores the tension between short-term security and long-term affordability.

The power purchase agreement illustrates how urgency-driven decisions can carry lasting financial implications, highlighting the need for balanced planning even during periods of crisis.

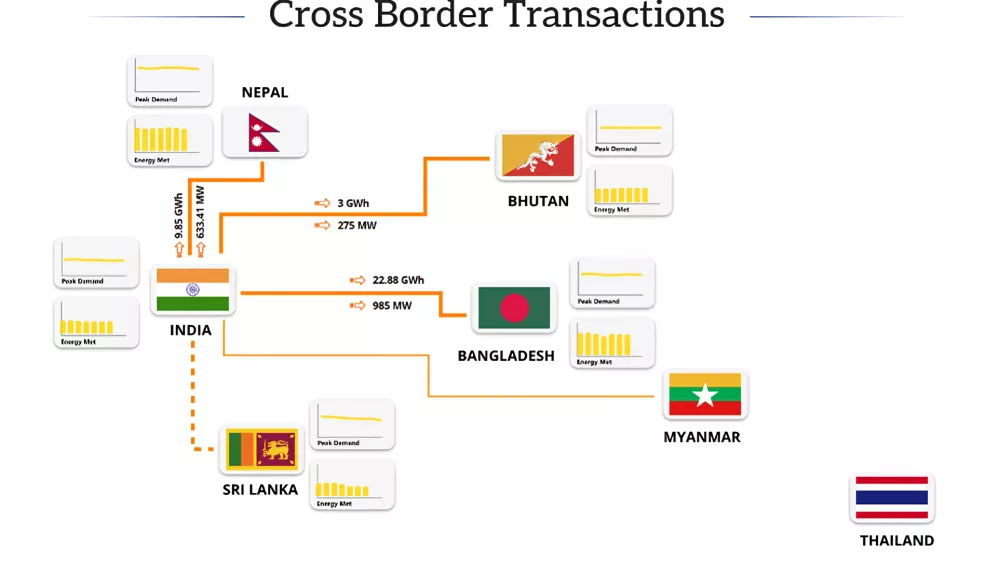

Regional Dimensions of Cross-Border Energy

Cross-border power trade is becoming increasingly common in South Asia, offering economies of scale and shared resources. Such cooperation can enhance stability, but only if pricing and governance are transparent.

Observers say scrutiny of this power purchase agreement may influence future regional negotiations, encouraging clearer terms and more balanced risk sharing.

Investor and Market Reactions

Financial markets have closely followed the debate, particularly given its implications for public finances and energy subsidies. Rating agencies and investors monitor such developments as indicators of policy stability.

The uncertainty surrounding the power purchase agreement has reinforced the importance of predictable regulatory environments in attracting long-term investment.

Expert Perspective on Long-Term Risks

One senior energy economist said,

“When governments commit to long-term electricity contracts, pricing assumptions must be stress-tested across multiple scenarios, because small miscalculations can compound into major fiscal pressures over time.”

The observation reflects widespread concern about long-term exposure embedded in fixed contracts.

This assessment encapsulates why the power purchase agreement has become a focal point for policy analysts and economists alike.

Civil Society and Public Accountability

Civil society organizations have seized on the report to demand greater transparency. Advocacy groups argue that public disclosure and competitive bidding reduce costs and improve trust.

The controversy around the power purchase agreement has energized calls for reform, with campaigners urging lawmakers to strengthen oversight of large infrastructure deals.

Legal and Contractual Considerations

Legal experts note that revisiting signed contracts can be complex, particularly when international partners are involved. Renegotiation, if pursued, would require careful navigation to avoid legal disputes.

Nevertheless, the power purchase agreement review has sparked discussion about incorporating stronger safeguard clauses in future contracts to allow adjustments under defined conditions.

Fiscal Sustainability and Budget Pressures

Energy subsidies already represent a significant portion of public expenditure. Locking in high electricity costs could exacerbate budget pressures, limiting spending on health, education, and infrastructure.

From this perspective, the power purchase agreement is not merely an energy issue but a fiscal one, shaping broader economic priorities.

Comparisons With Other Energy Contracts

Analysts have compared the agreement with similar deals in neighboring countries, noting differences in pricing, duration, and risk allocation. Such comparisons suggest that alternative structures may have offered better value.

The findings reinforce concerns that the power purchase agreement deviates from best practices observed elsewhere in the region.

Impact on Long-Term Energy Planning

Bangladesh aims to diversify its energy mix, investing in renewables and domestic generation. Long-term contracts, however, can influence planning flexibility by committing capacity and funds decades in advance.

The debate over the power purchase agreement has therefore intersected with discussions about transitioning toward more flexible and sustainable energy systems.

Policy Reform Momentum

The panel’s report has created momentum for reform. Policymakers are considering changes to procurement rules, including mandatory competitive bidding and enhanced parliamentary oversight.

Whether these reforms materialize may depend on how decisively authorities respond to lessons from the power purchase agreement review.

International Perception and Credibility

How Bangladesh manages the controversy will shape international perceptions of its investment climate. Transparent handling could enhance credibility, while uncertainty may raise concerns.

The power purchase agreement has thus become a test of governance as much as energy policy.

Future of Cross-Border Energy Deals

Despite criticism, cross-border power trade remains an important tool for meeting demand. The challenge lies in designing agreements that balance speed, cost, and accountability.

The experience of this power purchase agreement is likely to inform future negotiations, encouraging more robust evaluation processes.

Lessons for Emerging Economies

Many emerging economies face similar dilemmas as they expand infrastructure rapidly. The Bangladesh case highlights the risks of prioritizing urgency over scrutiny.

For policymakers elsewhere, the power purchase agreement debate offers a cautionary tale about the long-term consequences of contract design.

A Turning Point for Energy Governance

The review of the electricity deal has marked a turning point in Bangladesh’s energy policy discourse. By exposing pricing and procedural concerns, it has prompted a broader reckoning with how major infrastructure commitments are made.

As the country looks ahead, the lessons drawn from this power purchase agreement will shape procurement standards, fiscal planning, and public expectations. Whether this moment leads to lasting reform will determine how Bangladesh balances growth, affordability, and accountability in the years to come.