London (Parliament Politic Magazine) – A rapidly expanding British semiconductor producer is on the brink of securing a £200 million infusion of funds from prominent investors, among them the asset management powerhouse M&G.

Pragmatic Semiconductor, a manufacturer of affordable microchips utilized in various applications like packaging and apparel, is in the final stages of securing a significant funding round with backing from Saudi Arabian investors.

People who know about finance in the city said that M&G’s Catalyst fund, which invests in tech companies, will give a big portion of the new money.

Last year, Prosperity7 Ventures, which is linked to the big Saudi oil company Aramco, supported Pragmatic by buying its shares. One person said that either Prosperity7 Ventures or Aramco might join in the new funding round.

Pragmatic’s Operational Presence and Expansion

They also mentioned that the UK Infrastructure Bank and Northern Gritstone, a company connected to a university, might become new investors in Pragmatic. A person with inside knowledge mentioned that the agreement, anticipated to assess Pragmatic at £300 million before additional funding, is likely to be made public in November.

This fundraising effort will serve as a significant show of faith in a company that is quickly growing to become a major player in the British semiconductor industry. Pragmatic works from a 15-acre location in Durham and is increasingly establishing itself in Cambridge, where it has its main office.

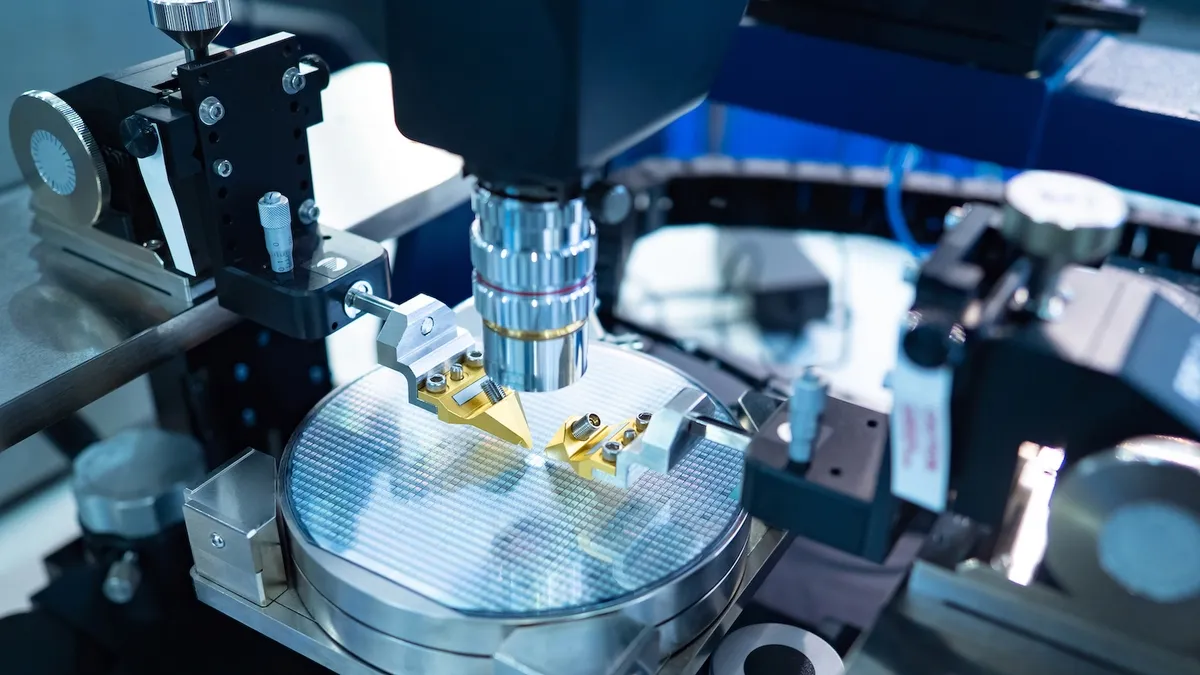

The company is also working on growing its production capabilities in the United States. However, earlier this year, it dismissed the idea of shifting away from its British home. Pragmatic’s chips are unique because they are made without using silicon and can create integrated circuits thinner than a human hair.

Pragmatic’s Unique Silicon-Free Chip Technology

The company was established in 2010 by Scott White, a tech entrepreneur with a history of starting and running technology businesses. However, earlier this year, he passed on the CEO position to experienced industry professional David Moore.

The global rise in connected devices has led to a sharp increase in the need for advanced chips. This growth has propelled companies like Nvidia, which has achieved a rare milestone by reaching a market value of $1 trillion (£823 billion).

Current backers of Pragmatic include Arm, the chip designer that recently had its initial public offering on the New York stock market, and British Patient Capital, which is a subsidiary of the British Business Bank.

In December of the previous year, when Pragmatic unveiled its Series C fundraising of $125 million (£103 million), the company emphasized how its growth underscored the “strategic significance of our pioneering semiconductor technology platform, especially in a period when governments worldwide are prioritizing the secure management of supply chains for vital electronic components.”

Prime Minister Rishi Sunak also revealed a 20-year plan in May to ensure the long-term stability of the UK’s semiconductor industry.

Read More: Deloitte UK to Eliminate 150 Graduate Consulting Positions

Pragmatic’s Founding and Leadership Transition

The National Semiconductor Strategy, which incorporates as much as £1 billion in public funding, is considered a vital element of the United Kingdom’s future national security priorities by government officials.

“Semiconductors form the foundation of the devices we rely on in our daily lives and will play a pivotal role in advancing future technologies,” stated Mr. Sunak.

Prosperity7 Ventures, affiliated with the major Saudi oil company Aramco, supported Pragmatic’s most recent share offering at the end of the previous year. One source suggested that either Prosperity7 Ventures or Aramco itself had committed to participating in the upcoming round.

The UK Infrastructure Bank and Northern Gritstone, the university-affiliated startup platform, are reported to be among the fresh investors in the company.

An insider shared that the deal, expected to value Pragmatic at £300 million before the new investment, is scheduled for announcement in November.

This fundraising endeavor serves as a substantial expression of confidence in a company swiftly expanding to become a significant player in the semiconductor sector of the United Kingdom.

Additionally, the company has plans to expand its manufacturing capabilities in the United States. However, earlier this year, it dismissed any suggestions of relocating away from its British headquarters.

Pragmatic’s unique chips are created without using silicon and can produce integrated circuits thinner than a human hair.

The company was established in 2010 by Scott White, a serial tech entrepreneur. This year, he transitioned the CEO role to industry veteran David Moore.