UK (Parliament Politics Magazine) – Chancellor Rachel Reeves outlined reforms to ease City rules, promote stock market investment, and drive economic growth across the UK.

As reported by The Guardian, Rachel Reeves announced new City reforms to cut rules and help grow the economy by encouraging more people to invest.

The Leeds Reforms strategy includes measures to boost the UK’s financial services industry. It involves easing rules for senior bankers and launching a campaign to push consumer investment in stocks.

The government will review safeguards introduced after the 2008 financial crisis, designed to keep consumer money safe from risky banking activities.

What did Reeves’s City reforms mean for consumer rights?

The government plans to reduce the powers of the Financial Ombudsman Service, which handles disputes between businesses and consumers.

Banks and other financial firms will have fewer duties, as both interest and total payouts to affected customers will be reduced.

The measures were revealed shortly before Reeves delivers her Mansion House address to senior City leaders at a formal dinner on Tuesday in London.

What did Rachel Reeves say about UK growth?

Rachel Reeves said,

“We fixed the public finances and stabilised the economy. Now we need to double down on our global strengths to put the UK ahead in the global race for financial businesses, creating good, skilled jobs in every part of the country and helping savers’ money go further through our plan for change.”

According to the Treasury, the reforms are aimed at dismantling investment barriers and at

“reintroducing informed risk-taking into the system, cutting unnecessary red tape, driving more finance into public markets and actively helping international companies to set up in the UK.”

During London’s speech, she will say,

“This is the foundation of an economy and a country that is more active and more confident. Where people and businesses look to the future and talk about hope about opportunity. Assured of their capability, and of the ability of our country to boldly face the challenges that lie ahead.”

The chancellor will add,

“I welcome the recent changes the Financial Policy Committee has announced to the loan-to-income limit on mortgage lending, which the PRA and FCA are implementing immediately. With an instant impact for consumers, such as Nationwide offering its ‘Helping Hand’ mortgage to more first buyers, supporting an additional 10,000 each year.

Who attended the Leeds reforms summit in West Yorkshire?

The following key figures attended the summit in West Yorkshire at the unveiling of the Leeds Reforms.

- Charlie Nunn – Chief Executive, Lloyds Banking Group

- Nikhil Rathi – Chief Executive, Financial Conduct Authority

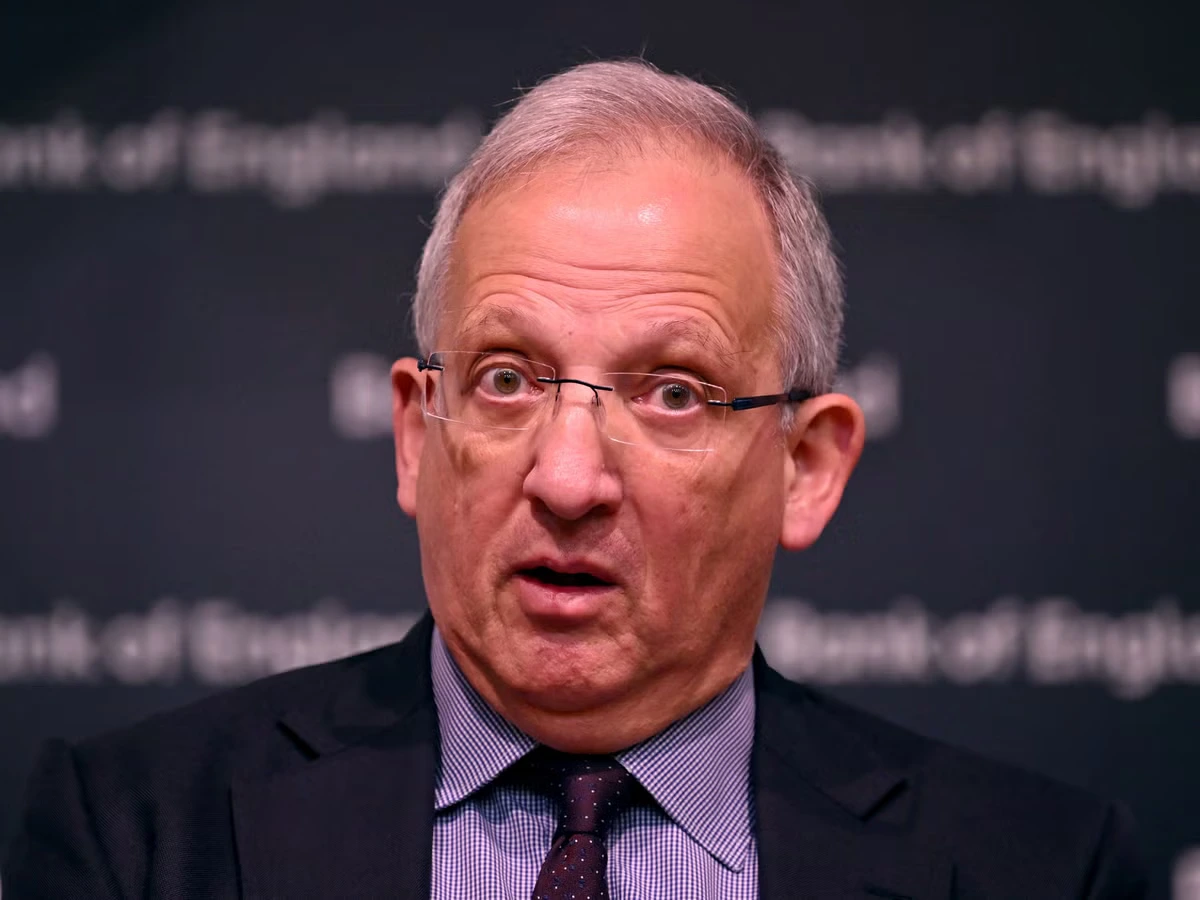

- Sam Woods – Head, Prudential Regulation Authority, Bank of England

What’s driving business backlash against Reeves’s tax plans?

The chancellor faces pressure after figures showed a 0.1% economic decline in May. She is expected to announce more tax increases in the upcoming autumn budget.

Business groups have slammed Ms Reeves’s £25bn rise in NICs for slowing growth. The change came into force in April.

What did Jesse Griffiths say about deregulating the City?

Jesse Griffiths, head of Finance Innovation Lab, said putting global finance firms first hasn’t helped the British economy.

He added,

“Buying the City’s push for further deregulation risks derailing the government’s industrial strategy and increasing the risks of costly financial crises. Instead of a more ‘globally competitive’ financial sector, we need reform to better serve UK businesses and drive domestic investment to where we need it, particularly for the green transition that will lower people’s bills and create the good jobs of the future.”