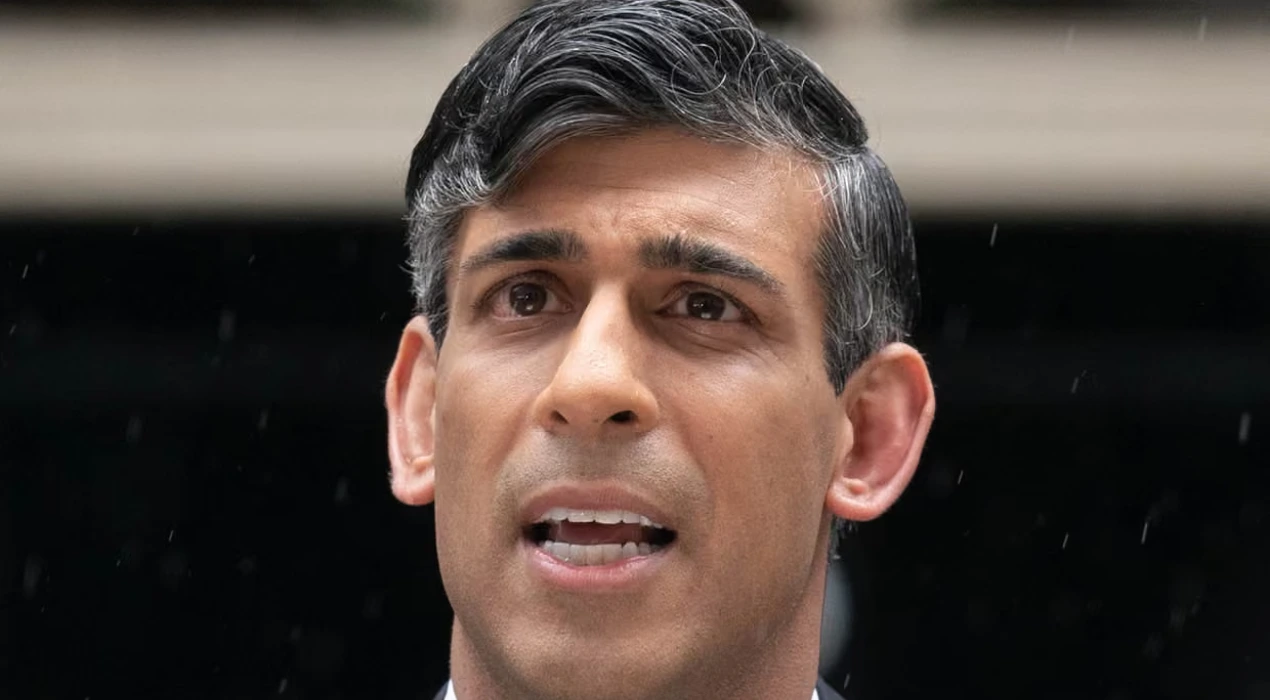

Rishi Sunak (Parliament Politics Magazine) – UK taxpayers lost £400m after hundreds of startups backed by Rishi Sunak’s Covid-era investment fund collapsed, raising fresh scrutiny of the scheme.

The Future Fund invested £1.14 billion to support 1,190 businesses, some of which were not typically included in government portfolios, like the now-defunct festival ticket company Pollen and the sex party organizer Killing Kittens.

Additionally, the firm spent close to £2 million in businesses connected to Rishi Sunak‘s wife, Akshata Murty.

According to the most recent annual report from the Department for Business and Trade, 334 businesses that were supported by the Future Fund have since failed, costing the public hundreds of millions of pounds.

According to the study, the fund’s worth plummeted to £609 million as of March of this year. However, the British Business Bank (BBB), which oversaw the program, explained that the actual figure was greater at £736 million due to revenue and investment returns.

In May 2020, Sunak established the Future Fund to support start-up companies across the epidemic. Under the plan, the BBB would fund businesses between £125,000 and £5 million, matching private investors’ parallel contributions. The loans would then be transformed into shares when the business raised additional capital.

The plan left the government with stakes in businesses like Oto International, which produces the cannabis extract CBD oil, Oneskee, which creates ski outfits, and Secret Group, which operates the immersive film events known as Secret Cinema.

Since it was impossible to assess if the plan would be cost-effective, ministers had to provide their approval before it could be implemented.

Keith Morgan, the BBB’s former CEO, cautioned ministers shortly after the program’s debut that it would mostly draw “second-tier” businesses who were unable to draw in outside investment and that it was “highly uncertain” that the taxpayer would get value for their money.

According to the business department’s annual report, around 47 companies, or 3.9% of its investments, were highlighted for possible fraud. This represents £79.5 million of the Future Fund’s total investment.

How does the Future Fund compare to other government investment schemes?

Launched by Rishi Sunak as a short-lived investment program for startups during the Covid pandemic, the Future Fund deviates considerably from other, more recognized government investment funds in objective and return.

Established with a very limited, emergency-focus, the UK Future Fund was a high-risk & rapid response program designed to respond to the pandemic. Because of this, it incurred significant write-offs when many startups failed following the pandemic.

In contrast, long-term and sustainable government investment funds, like Australia’s Future Fund, have lower risk exposures and clearly defined fiscal objectives to invest for a return to contribute to economic stability that does not incur substantial losses.