LONDON (Parliament Politics Magazine) – Following a dispute over her non-domicile status, Akshata Murty, Chancellor Rishi Sunak’s wife has announced she would pay UK taxes on her income from overseas.

She holds £700 million in shares in the Indian IT behemoth Infosys, which her father founded and from which she received £11.6 million in dividends last year.

She is not compelled by law to pay UK taxes on her abroad income since she is a non-domiciled (non-dom) UK resident.

She did not want to be a “distraction” for her husband, she told the BBC.

Ms Murty’s decision of changing her tax arrangement comes after Labour accused the chancellor of hypocrisy, claiming that his family was profiting from it at a time when the cost of living was rising and the government in which he served was boosting National Insurance payments.

Mr Sunak, on the other hand, has accused his opponents of “smearing” his wife in order to discredit him.

Ms Murty will keep her Indian citizenship and non-dom status, which, according to the BBC, allows her family to avoid paying £280 million in inheritance tax in the United Kingdom.

Her decision to pay UK tax on all of her worldwide income would not change the fact that India remained the country of her birth, citizenship, parents’ home, and place of domicile, Ms Murty said in her statement.

Her decision of paying UK taxes on her worldwide income came on the same day it was disclosed that she and her husband were able to live and work in the US under a green card, which necessitates that holders consider the US their permanent home for over a year after Mr Sunak became the chancellor in the year 2020, .

Ms Murty stated that her tax arrangements were quite lawful, but that many did not believe it was compatible with her husband’s position as chancellor.

She understood and admired the British sense of justice, and she didn’t want her tax situation to be a source of contention for her husband or have an impact on her family.

She stated that she would now pay UK tax on all of her worldwide income, that included dividends and capital gains, wherever that income came from in the world.

She did it because she wanted to, not because it was required by the regulations. These new arrangements would take effect immediately and would also apply to the current tax year (2021-22), Ms Murty continued.

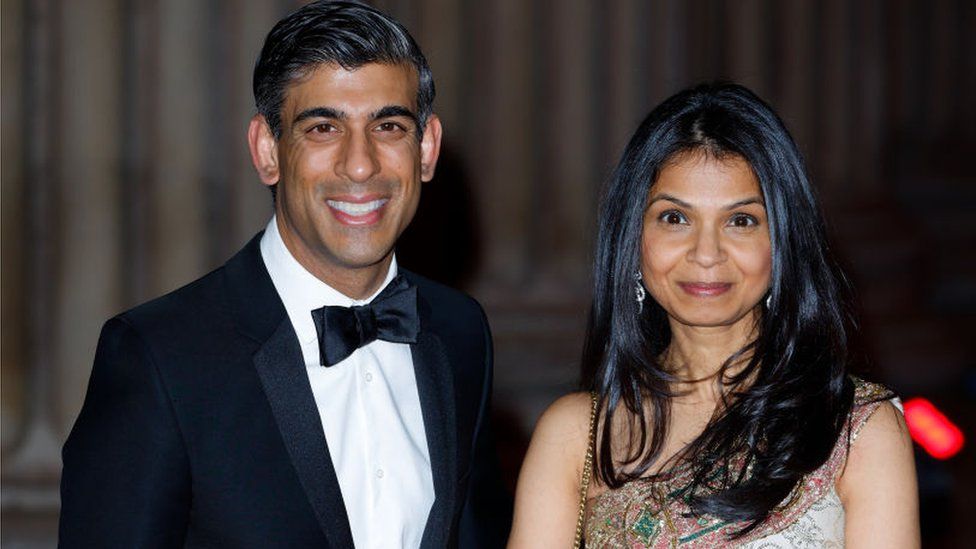

Image via BBC