EDINBURGH (Parliament Politics Magazine) – Scotland’s and the United Kingdom’s administrations have agreed to create two “green freeports” in the country.

Boris Johnson is scheduled to visit Scotland on Monday as part of the agreement.

The UK government is promoting freeports, which are special economic zones that offer tax incentives and cheaper tariffs to enterprises, as part of its “levelling-up” policy.

Bidding will commence in the spring, with the new locations expected to open in 2023.

Previous year, the Scottish government warned that establishing freeports in Scotland or Wales without the approval of the developed governments would jeopardise devolution.

Ministers in Edinburgh later announced that they would explore an alternate model known as “green ports,” but they would now be branded as “green freeports” under the current agreement.

“Freeports will help to accelerate our plan to level up communities across the whole of the United Kingdom, ” the PM stated.

They have the potential to be really transformative by produce investment opportunities and jobs that enable people to achieve their full potential, and he was happy that people across Scotland would benefit from the two new green freeports.

Kate Forbes, Scotland’s Finance Secretary, said that she was pleased they successfully came to an agreement on a joint approach that understands the differing needs of Scotland and codifies commitment of the Scottish government to achieve net zero and embed fair work practises through public investment.

She added Scotland had a long history of inventive manufacturers, and the construction of green freeports would assist in creating new green jobs, ensuring a just transition, and supporting the economic transformation as they strived to achieve net zero.

The UK government has promised £52 million to the project, and bidders must pledge to achieving net zero by 2045.

Ministers from both countries will be involved in the bid evaluation and selection process.

The Scottish government and the Treasury will support the freeports by using their tax powers, including rates relief.

What are freeports, exactly?

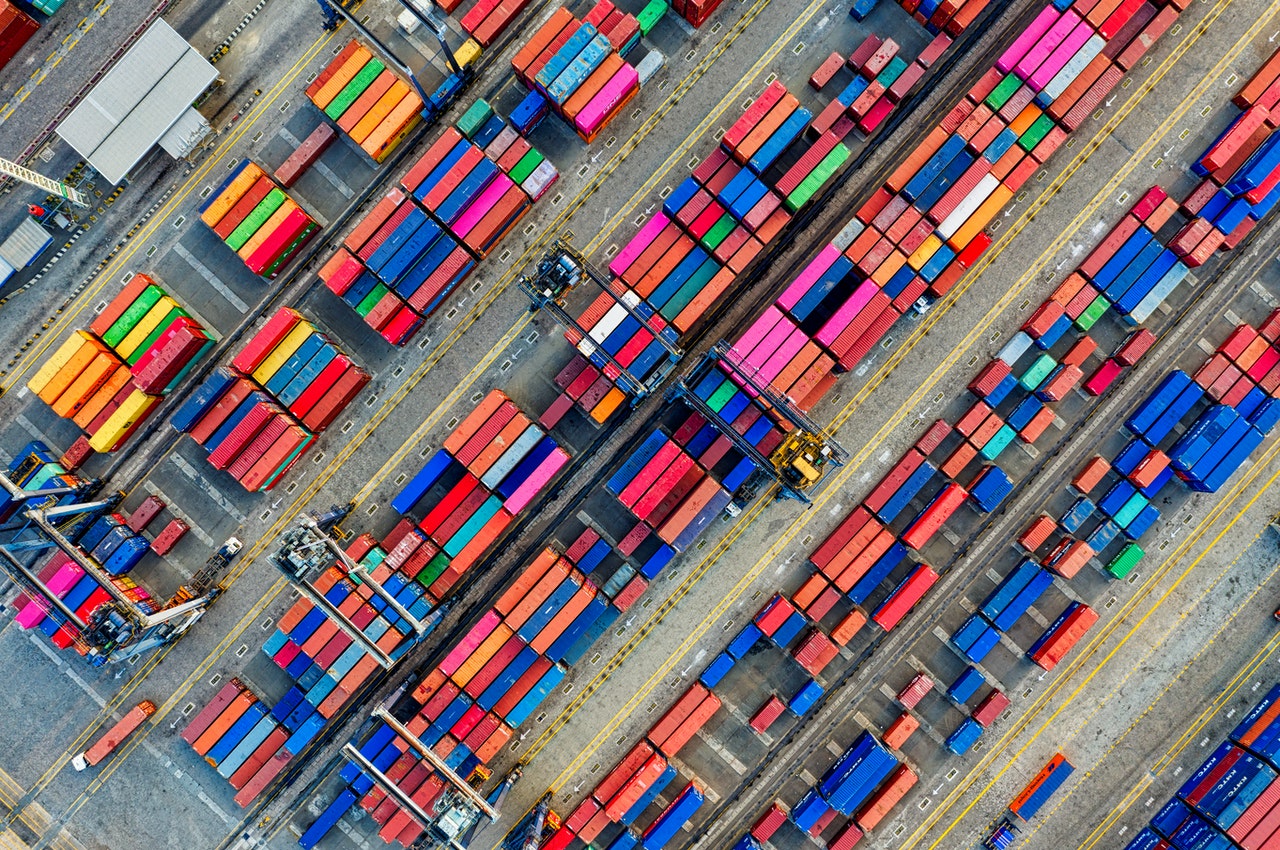

They are designated places where the standard tax and tariff regulations of the country in which they are headquartered do not apply. They are also known as free trade zones.

They allow goods to be manufactured, re-exported and imported, without having to pass through customs, fill out paperwork, or pay tariffs.

This means that raw materials can be imported and then turned into finished goods for export.

Companies that operate in the zone typically pay cheaper taxes, such as decreased VAT and lower employment tax rates.

However, detractors contend that they just postpone the payment of import tariffs, which must still be paid at some point.

Freeports are centred around at least one air, rail, or sea port, but can extend up to 45 kilometres (28 miles) beyond that, according to the UK government’s plan.

The phrase “green freeport” was coined by the Scottish government to represent the country’s unique net-zero goals.

Michael Gove, the Secretary of State for Levelling-Up, said that it was a very exciting time for Scotland, and he was thrilled that UK would be collaborating with the Scottish government to establish two new green freeports.

Green freeports contribute billions to the local economy while also levelling the playing field by providing jobs for locals and possibilities for people from all across the UK.