LONDON (Parliament Politics Magazine ) – Reports suggest Liz Truss is exploring a “nuclear” option that would reduce the VAT to 15% from 20%.

A source, while speaking to Sky News said that Ms. Truss would think about ways to support people, but it would be wrong for her to disclose her plans before being elected as the PM or before she has seen all the facts.

The estimates reveal a VAT decrease of this scale would save the average household over £1,300 annually, but the Institute for Fiscal Studies estimated that it would cost taxpayers £3.2 billion each month, or £38 billion annually.

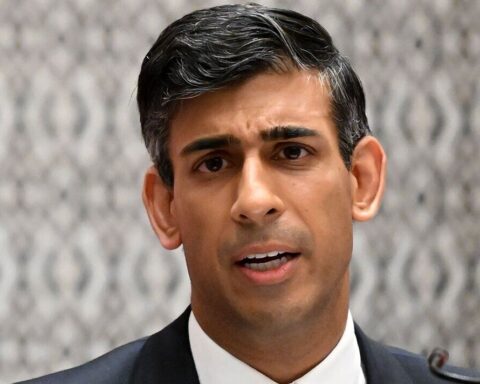

The plan was criticised by Rishi Sunak’s team as being “incredibly regressive” and expensive.

The Sunday Telegraph was told by a source close to Truss’ discussions that they [the Treasury] had talked about the Gordon Brown approach that he had used at the time (of the financial crisis), when it appeared like consumer confidence was plummeting.

They were discussing the Treasury’s response to the most recent huge economic shock that struck the entire economy and consumers in 2008, they said.

Another asserted that she didn’t have time to provide specific assistance and forewarned that people would start running out of business from the moment she takes the office.

There has been increasing pressure on Liz Truss and Rishi Sunak to explain how they can assist the millions of Britons who are coping with record energy prices and inflation.

Any strategy to address the cost of living crisis must be “serious, affordable, and targeted,” Conservative MP Simon Hart, who is supporting the former chancellor in the leadership contest said.

He defended Mr. Sunak when he didn’t precisely disclose the amount he intended to invest , saying it would be “irresponsible.”

Ms. Truss is also considering extending the 5p fuel duty reduction past March and restarting the assistance for companies that was provided during the worst of the COVID-19 pandemic, such as a bigger VAT concession for the tourism, hospitality, and agricultural sectors.

Greater Manchester’s night-time economy adviser Sacha Lord stated on Saturday, there was no energy price cap for the hospitality industry. An untenable situation he called it.

Without intervention, they would regrettably witness a record number of closures. It was criminal, he said.

He reposted a tweet from the owners of the Merseyside pub, Rose and Crown, who reported receiving a quote for their electricity bill of £61,000.

The Sunday Times said that Ms. Truss’s team is also taking into consideration boosting the personal tax-free threshold, lowering the basic tax rate below 20%, and raising the point at which people pay the 40% rate of tax.

According to a source, if Ms. Truss decides against implementing immediate tax reductions, she may decide to include them in a longer-term review of the tax code that she is anticipated to publish alongside a fiscal package.

On Saturday, Mr. Sunak argued in The Times that low-income families and pensioners should receive assistance with their energy bills through the welfare system, as well as through compensation for winter fuel and cold weather.

Additionally, he noted that real help would be a multibillion-pond venture.

A spokesperson for the Treasury said the department was making the necessary preparations to make sure the next administration had options to provide additional assistance as early as possible.