WASHINGTON (Parliament Politics Magazine) – On Friday, Twitter Inc. released poor second-quarter sales figures, dealing yet another setback to a business already engaged in a high profile lawsuit with Elon Musk over the future of the social network.

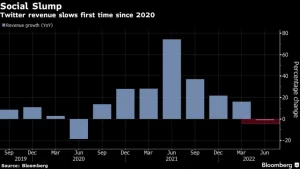

Revenue decreased 1% in the quarter compared to the year earlier, marking the first annual loss since the pandemic’s peak in 2020. Sales for the quarter came to $1.18 billion, less of the $1.32 billion experts had predicted. The company attributed the unsatisfactory results to headwinds in the advertising market relating to the macro environment and uncertainty related to the imminent acquisition of Twitter.

As predicted by analysts, Twitter gained 8.8 million new users throughout the quarter.

Given the uncertainty surrounding the company’s future, it’s unclear how much Friday’s earnings announcement will actually mean to investors. Up until two weeks ago, Twitter’s financial reports were merely a formality as it awaited the closing of the deal to sell the firm to Musk for $54.20 per share.

On July 8, Musk made an attempt to back out of the agreement, alleging Twitter had been secretive about the number of phoney accounts that were growing on the platform. In its earnings announcement on Friday, Twitter repeated that it thinks fraudulent or spam accounts make up fewer than 5% of its total user base, a claim that Musk has questioned repeatedly.

Both parties are getting ready for a trial that should take place in October and in which Twitter will urge a judge to order the CEO of Tesla Inc. to uphold his acquisition agreement to acquire the business for about $44 billion.

After Musk’s announcement, Truist Securities analyst Youssef Squali noted that this made the investment case for Twitter impossible to build at that point. If the sale falls through, Truist predicted that the shares may price “in the high $20s.”

Twitter’s operations may suffer if the acquisition does not go through. The business had previously set a target of 315 million daily users and $7.5 billion in yearly sales by the end of 2023. Twitter isn’t currently on track to fulfil its user target. In the second quarter, it recorded an average of 237.8 million monetizable daily active users.

Twitter revenue graph as shown by Bloomberg

Twitter is struggling with a significant decline in advertiser revenue and escalating competition from TikTok for viewers, similar to many of its social media competitors. When Snap Inc. foreshadowed challenges in the industry on Thursday, the company hinted to the challenges facing the sector. It cited advertisers’ higher-than-anticipated budget cuts due to the volatility in the global economy as well as heightened competition for scarce marketing funds.

In New York’s premarket trade, Twitter shares plummeted 2.2 percent as Snap’s results further damaged the stock. They have decreased by roughly 9% so far this year.

Twitter’s net loss for the quarter was $270 million, or a loss of 35 cents per share. In comparison, the same period a year prior had net profits of $66 million and earnings per share of 8 cents.

In contrast to its customary shareholder letter, Twitter did not host an analyst call to discuss its financial results and instead issued a brief press statement with little information. Twitter retracted its former outlook and declared it would no longer offer forward-looking information in its most recent quarterly results, released in April.