Washington (Parliament Politics Magazine) January 18, 2026 – US Treasury Secretary Scott Bessent defended a Department of Justice criminal investigation into Federal Reserve Chair Jerome Powell over his congressional testimony regarding a $2.5 billion renovation of the Fed’s Washington headquarters. Bessent stated Powell failed to respond to DOJ inquiries, while Powell called the probe unprecedented political intimidation over interest rate disagreements. The investigation, approved by US Attorney Jeanine Pirro, has triggered market volatility and White House damage control.

US Treasury Secretary Scott Bessent appeared on NBC’s Meet the Press and Fox Business’s Kudlow programme on January 18 to address the escalating Department of Justice probe into Federal Reserve Chair Jerome Powell. The investigation centres on Powell’s June 2025 Senate testimony about the $2.5 billion renovation project at the Fed’s Eccles Building headquarters. As reported across financial media, Bessent argued that Fed independence does not exempt it from oversight or legal accountability.

The DOJ served grand jury subpoenas on the Federal Reserve on January 10, threatening criminal indictment if Powell’s statements proved misleading. US Attorney for the District of Columbia Jeanine Pirro stated her office made multiple attempts to contact the Fed regarding cost overruns and testimony accuracy, receiving no response.

Background to DOJ Investigation Over Fed Renovation Testimony

The probe originated from discrepancies between Powell’s June 2025 congressional testimony and subsequent revelations about the Fed headquarters renovation. Powell told the Senate Banking Committee the project remained within budgeted parameters and faced no significant delays. Documents later showed costs escalated from $1.8 billion to $2.5 billion due to construction incompetence, as Bessent described on Fox Business.

As detailed in Fox Business reporting from January 16, the DOJ launched the criminal investigation to determine if Powell lied to Congress about renovation scope and expenses. Federal law prohibits false statements to Congress, carrying potential five-year prison terms. The Fed’s Inspector General had flagged management failures in a December 2025 audit, prompting initial complaints.

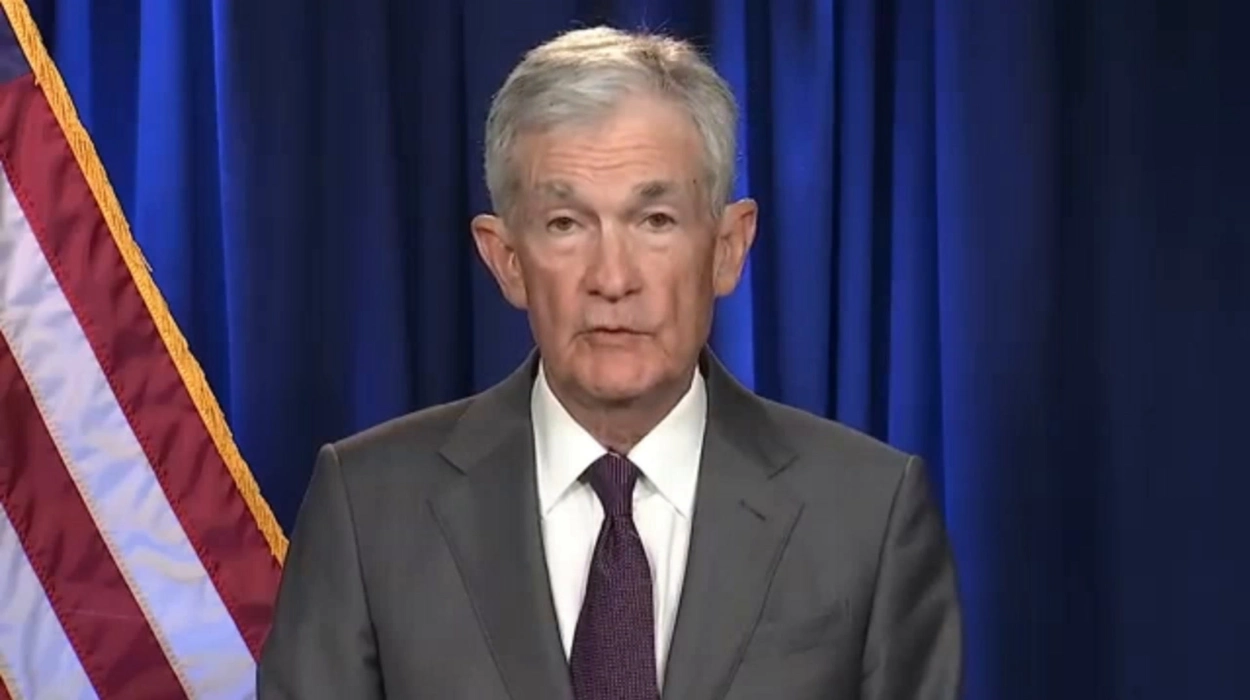

Powell issued a rare video statement on January 12 describing the subpoenas as unprecedented. He linked the probe directly to President Trump’s public demands for faster interest rate cuts, stating monetary policy would not bend to political pressure. The Fed chair’s term expires in May 2026.

Bessent Addresses Powell’s Lack of Response to DOJ

During his Meet the Press appearance, Treasury Secretary Bessent directly criticised Powell’s handling of DOJ communications. Rapid Response 47 quoted Bessent saying in X post,

“.@SecScottBessent on Fed Chair Jerome Powell: ‘I don’t know about you. If I were to receive inquiries from the Justice Department, I would answer them. They went unanswered.'”

.@SecScottBessent on Fed Chair Jerome Powell: “I don’t know about you. If I were to receive inquiries from the Justice Department, I would answer them. They went unanswered.” pic.twitter.com/nSA8AJsB0h

— Rapid Response 47 (@RapidResponse47) January 18, 2026

AJ Huber similarly highlighted Bessent’s remarks from the same interview. AJ Huber said in X post,

“Scott Bessent on Fed Chair Jerome Powell: ‘I don’t know about you. If I were to receive inquiries from the Justice Department, I would answer them. They went unanswered.’ Meet the Press.”

Scott Bessent on Fed Chair Jerome Powell: “I don’t know about you. If I were to receive inquiries from the Justice Department, I would answer them. They went unanswered.” Meet the Press.

pic.twitter.com/HV9Fj4kDT6— AJ Huber (@Huberton) January 18, 2026

Bessent reiterated on Fox Business that the probe stemmed from “construction incompetence” at the Fed, denying knowledge of deeper misconduct but emphasising accountability. He distanced the investigation from rate policy disputes while acknowledging Trump’s disappointment with Powell’s performance.

Powell’s Defence and Accusations of Political Motivation

Federal Reserve Chair Powell responded forcefully in his video message, calling the DOJ actions a threat to central bank independence. He noted the Fed consistently publishes FOMC minutes, transcripts, and economic projections for public scrutiny. Powell maintained all testimony reflected accurate project status at the time of delivery.

Fed Vice Chair Lael Brainard supported Powell in Bloomberg interviews, citing routine Inspector General audits that found no ethical violations. The Fed Board of Governors met emergently on January 17, reaffirming operational continuity amid the legal pressures.

US Attorney Pirro countered on X that her office sought clarification on cost overruns through standard channels before escalating to subpoenas. She described the action as procedural, not punitive.

Treasury Secretary’s Mixed Signals on the Probe

Initial reporting revealed Treasury Secretary Bessent privately expressed concerns to President Trump about market fallout from the investigation. Axios reported on January 12 that Bessent called the situation a “mess” during a Sunday call, warning of financial instability. CNN and ABC News confirmed Bessent conveyed unease without defending Powell or questioning the probe’s merit.

By January 18, Bessent publicly aligned with the DOJ position during television appearances. A Treasury spokesperson told Axios no disconnect existed between Bessent and Trump, characterising sources differently. Bessent leads the search for Powell’s successor, stating final interviews concluded with decisions expected before or after Trump’s Davos trip.

Economic Context and Market Reactions

The controversy erupted against 2025’s monetary policy battles. Inflation fell from 5.2% in March to 2.8% by December after nine Fed rate hikes to 5.25-5.50%. Regional bank stresses in Q2 2025 saw three failures, with $47 billion in emergency Fed lending. Critics tied these to Powell’s tight policy; supporters credited it with taming inflation.

Markets reacted sharply post-subpoena news. The dollar declined while bond yields and gold rose on January 13, per NBC News. Ten-year Treasury yields climbed 15 basis points on January 18 after Bessent’s comments. Futures priced a 65% March rate cut probability.

President Trump called Powell “incompetent or crooked” on January 13, per ABC News. He confirmed Kevin Hassett’s continued National Economic Council role, removing him from Fed chair contention.

Political and Legal Ramifications Explored

The probe marks unprecedented scrutiny of a sitting Fed chair. Past DOJ inquiries targeted lower officials for trading violations, resolved with fines. Proving false congressional statements requires evidence of knowing misrepresentation.

Housing Finance Director Bill Pulte reportedly suggested the investigation, per Axios sources, though he denied involvement to Bloomberg. Pulte previously advocated charges against other officials without advancement.

Congressional reactions split along partisan lines. House Financial Services Chair French Hill scheduled subpoenas for FOMC records; Senate Banking Chair Tim Scott backed DOJ independence. Bipartisan criticism emerged over potential market disruption.

Historical Precedents and Fed Independence

The 1951 Treasury-Fed Accord enshrined central bank autonomy from executive pressure. Courts historically defer to Fed expertise in policy matters. Powell’s predicament tests these boundaries amid Trump’s second-term push for influence.

Bessent, a former hedge fund executive, emphasised oversight during Economic Club of Minnesota remarks on January 8. He described Trump as deliberate in successor selection, focusing market-desired criteria.

The investigation continues with grand jury proceedings. Powell faces no formal charges; DOJ threats remain conditional. Fed operations proceed normally, with next FOMC meeting scheduled February 4-5.

Reporting compiles statements from Treasury, Fed, DOJ, and media interviews as of January 18. Attributions trace to original broadcasts and outlets including Fox Business, NBC, CNN, Axios, ABC News, and Reuters.