UK (Parliament Politics Magazine) – OECD warns UK growth softens as Labour migration curbs and Chancellor Rachel Reeves’ tax rises hit productivity, raise unemployment, and keep inflation above 2%.

As reported by The Independent, Labour’s tougher migration measures are slowing UK economic growth, delivering a fresh setback for Chancellor Rachel Reeves.

What did the OECD say about UK growth and inflation?

The Organisation for Economic Co-operation and Development has issued a warning over the UK economy, citing a slowdown in productivity. It highlighted that a decline in incoming workers is contributing to weaker growth, saying that economic “momentum is softening” amid these trends.

The international body said inflation in Britain will be the highest among all G7 advanced economies this year, and next year it is expected to rank second, behind only the United States.

According to its annual report, the OECD projected UK growth to weaken to 1.2 per cent next year, down from 1.4 per cent in 2025, before rising slightly to 1.3 per cent in 2027.

The economic forecaster also reported that the UK’s unemployment rate could rise to 5 per cent in 2025, with inflation expected to remain above the 2 per cent target at 2.5 per cent, gradually easing to 2.1 per cent by 2027.

It argued that the UK is suffering due to

“past tax and spending adjustments weighing on household disposable income and slowing consumption.”

The international body concluded that

“sluggish labour productivity and weak working-age population growth, partly due to slowing inward migration, will continue to act as a drag on the economy.”

The OECD said sluggish growth is

“due to the continued effect of budgetary tightening on consumption and to the drag from global uncertainty.”

It stated that a slight 0.1 per cent growth in 2027 is

“supported by business investment and exports as financial conditions and global trade improve.”

The global economic forecaster warned that the chancellor faces limited options, as

“fiscal policy will remain restrictive given high government borrowing costs.”

Following a warning from the Office for Budget Responsibility, the UK’s economic watchdog, none of Ms Reeves’ policies are expected to deliver growth, the OECD also warned,

“Tax and spending measures should also aim to further support growth potential, complementing ongoing structural reforms such as the overhaul of infrastructure planning The OECD findings on unemployment follow criticism by businesses of Ms Reeves’ hike in national insurance contributions for employers was playing a part in reducing the number of vacancies.”

It warned,

“The labour market is cooling, with the number of payrolled employees falling by about 0.4 per cent in the year to September, and the number of vacancies declining by almost 14 per cent over the same period.”

“The recent rise in payroll taxes and in the minimum wage has slowed labour cost disinflation. Annual pay growth in the private sector reached 4.4 per cent in the three months to September, even though pay settlements have declined more rapidly,”

the OECD added.

The report highlighted that UK manufacturers continue to feel the impact of US tariffs from the Trump era, adding that “survey measures of new manufacturing export orders are weak.”

It added,

“This reflects the 7 per cent point increase in the aggregate effective tariff rate faced by domestic goods exporters in US markets since the beginning of the year, despite the recent bilateral trade agreement. By contrast, services trade has continued to grow steadily.”

According to OECD Secretary-General Mathias Cormann, low growth reflects resilience in the face of global trade uncertainties. However, he warned that productivity remains weak across the organisation’s 38 member countries, including Vietnam, Mexico, Canada, and Costa Rica.

He added,

“Constructive dialogue between countries is central to ensure a lasting resolution to trade tensions and improve the economic outlook.”

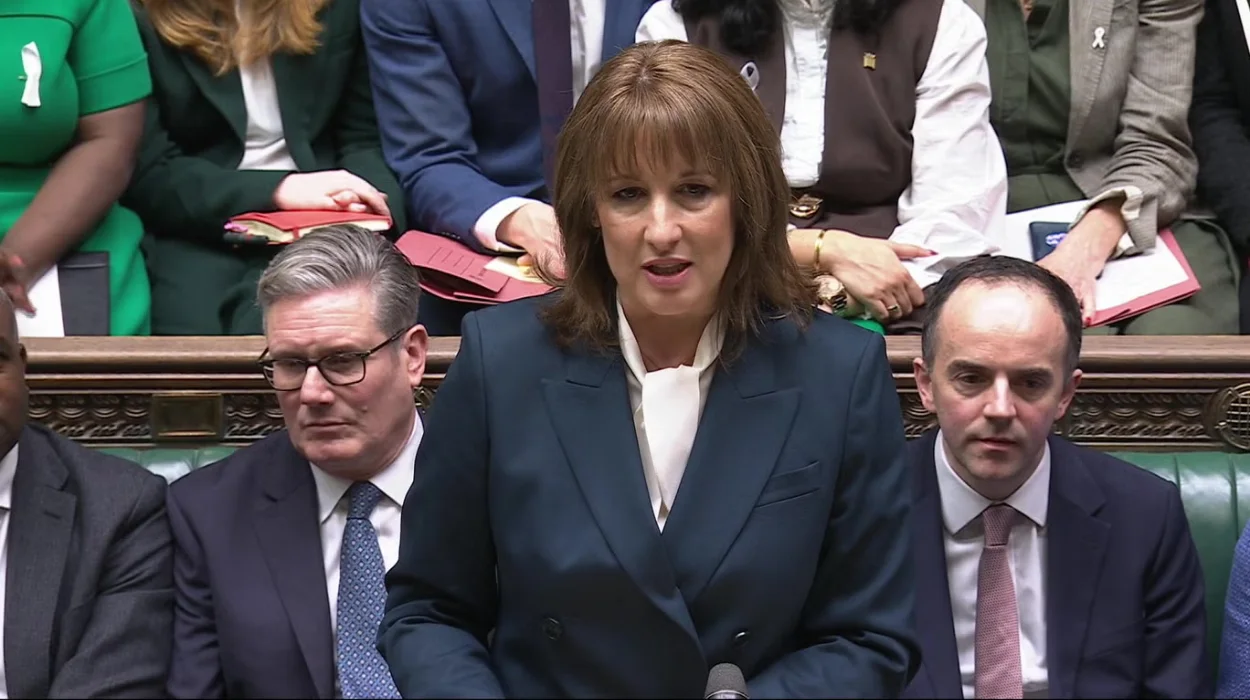

How did Rachel Reeves defend her Budget after the OECD report on the UK economy?

In response to the OECD’s forecast on the UK economy, Rachel Reeves defended her Budget measures targeting healthcare and child poverty, even after shifting focus away from economic growth as her top priority.

She said,

“Last week, my Budget cut waiting lists, cut borrowing and debt, and cut the cost of living. Less than a week later, the OECD has upgraded our growth and cut its forecast for inflation next year.”

The chancellor added,

“The choices that I made at the Budget are expected to cut inflation by 0.4 percentage points, helping cut the cost of living for households and costs for our businesses. Alongside our plans to deliver growth, by investing in this country’s infrastructure, attracting major private investment, and pushing through bold planning reforms, we’ll deliver on our number one mission to put more money in people’s pockets.”

How did Tories react to the OECD report on the UK economy?

Shadow chancellor Sir Mel Stride stated,

“The OECD are clear: unemployment is set to rise, driven in part by Labour’s jobs tax, and inflation will stay above target for the rest of their forecast.”

He added,

“Rachel Reeves promised growth but growth is expected to weaken next year, because of her choices. This is the cost of policies that punish work, businesses and investment.”

How is Labour cracking down on migration amid economic challenges?

In an effort to counter growing support for Reform UK leader Nigel Farage, Sir Keir Starmer’s Labour government has announced crackdowns on both legal and illegal migration.

Home Secretary Shabana Mahmood unveiled last month the “biggest overhaul” of the UK migration system, including a 20-year settlement wait for benefit-dependent migrants, four times longer than the current period, and the longest in Europe.

Under the new rules, migrants paying into National Insurance will face a 10-year wait before becoming eligible for settlement. The government also imposed visa restrictions, including bans on several countries that failed to cooperate with the return of illegal migrants.

The plans also aim to weaken the human right to a family life in an effort to prevent migrants from bringing relatives or overstaying in the UK.

What are the key measures in the UK Budget 2025?

- Income tax & NI freeze: Thresholds frozen for three years, keeping headline rates unchanged.

- Council tax surcharge: “Mansion tax” on homes over £2m and £5m from April 2028.

- Pension cap: £2,000 annual limit on salary-sacrifice pension contributions from 2029.

- ISA limit cut: Cash ISA limit reduced to £12,000 from April 2027.

- Energy relief: £150 off household bills after scrapping the ECO scheme.

- Two-child benefit limit removed: Ends cap on universal credit/tax credits, aiding 450,000 children.

- Minimum & living wage rise: 18–20-year-olds to £10.85/hr; living wage to £12.71/hr.

- Sugar tax expansion: Dairy drinks added; threshold lowered to 4.5g per 100ml.