Nuuk, Greenland, January, 2026 — Parliament News turns global attention toward the Arctic as global oil prices adjust following a visible easing of geopolitical tension linked to Greenland. From early Asian trading through European sessions and into North American markets, investors reassessed risk exposure after political rhetoric surrounding trade and tariffs softened, reducing fears of abrupt disruption in strategically sensitive regions.

The market response was not dramatic, but it was decisive. Relief replaced caution, and energy markets began re-calibrating around fundamentals rather than headlines. Greenland’s expanding geopolitical relevance, despite its limited oil production, has elevated its role as a symbolic trigger for market sentiment in an era where perception often moves prices as much as physical supply.

Why Greenland Commands Global Energy Attention

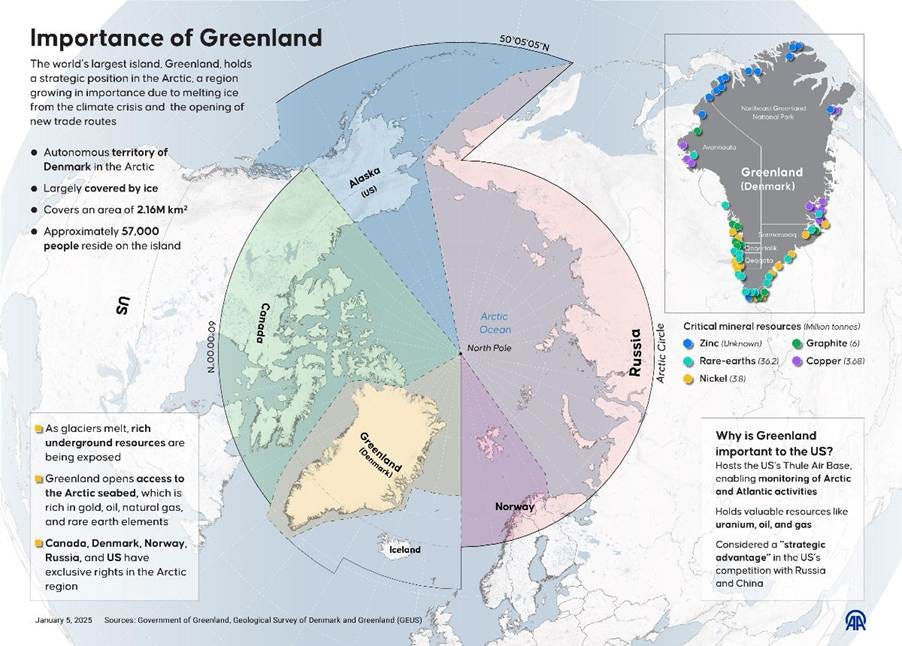

Greenland occupies a unique geographic and political position between Europe and North America. As Arctic sea routes become increasingly accessible and geopolitical competition intensifies, the island has moved from the periphery to the center of strategic discussions.

Energy markets are inherently forward-looking. Even symbolic developments can shape expectations, which explains why global oil prices frequently respond to signals connected to Greenland despite the absence of large-scale extraction on the island. Investors see Greenland as a proxy for broader stability in the Arctic and transatlantic relations.

Measured Market Moves Replace Volatility

Oil markets responded with restraint rather than sharp swings. Benchmarks traded within narrow ranges, signaling re-calibration instead of speculative repositioning. Traders described the atmosphere as controlled, with risk premiums easing gradually rather than collapsing.

This behavior suggested that markets interpreted the developments as a pause in geopolitical tension, not a structural shift in energy supply. Such discipline reflects how energy markets have matured after years of exposure to geopolitical shocks.

Political Tone Shapes Investor Psychology

The adjustment in sentiment followed remarks from Donald Trump indicating a retreat from earlier tariff-related rhetoric involving Greenland. While no formal policy announcement accompanied the comments, the reduced intensity of language was enough to calm markets.

One senior energy strategist said,

“Markets are responding to reduced uncertainty rather than any change in physical supply.”

That perception played a critical role in stabilizing global oil prices by lowering short-term geopolitical risk.

Supply Fundamentals Remain the Market Anchor

Beyond politics, physical supply conditions continue to underpin price stability. OPEC production discipline has largely held, US shale output remains predictable, and global shipping routes have not experienced major disruption.

These fundamentals have allowed global oil prices to absorb headline-driven volatility without sharp dislocation. Market participants continue to emphasize that sentiment alone cannot sustain extreme movements unless reinforced by tangible supply changes.

Demand Trends Show Regional Contrast

On the demand side, consumption patterns remain uneven but broadly supportive. Asian economies continue to provide structural demand through transportation, manufacturing, and aviation recovery. In contrast, European demand reflects seasonal moderation, efficiency gains, and the gradual impact of energy transition policies.

This regional contrast has created an environment where markets favor balance over aggressive directional bets, particularly when geopolitical stress appears contained.

Currency and Bond Markets Signal Calm

Foreign exchange markets echoed the calmer tone in energy trading. Traditional safe-haven currencies softened slightly, while risk-sensitive currencies gained modest ground. Bond yields stabilized, reflecting reduced demand for defensive assets.

These cross-market signals reinforced confidence that global oil prices were unlikely to face abrupt downside shocks in the near term unless fresh geopolitical stress emerged.

Energy Stocks Follow Oil’s Steady Path

Energy equities tracked the broader commodity environment, posting modest gains across European and US exchanges. Investors favored companies with disciplined capital expenditure, strong balance sheets, and reliable dividend policies.

Equity analysts described the movement as valuation-driven rather than momentum-led, indicating cautious optimism rather than speculative enthusiasm.

Greenland’s Growing Role in Arctic Strategy

Greenland’s importance extends well beyond energy into defense, logistics, and diplomacy. Its role in Arctic governance discussions has amplified market sensitivity to any political signal associated with the island.

This evolving context explains why global oil prices increasingly function as a barometer of geopolitical confidence rather than a simple reflection of barrels produced and consumed.

Interconnected Markets React at Speed

The rapid transmission of sentiment from political statements to commodity prices highlights the interconnected nature of modern markets. A shift in tone in one region can influence trading behavior worldwide within hours.

Emerging markets benefited modestly as risk premiums narrowed and capital flows steadied, reflecting a synchronized global response to easing geopolitical concern.

What Traders Are Watching Closely Now

With immediate political pressure easing, attention has shifted back to fundamentals. Inventory data, refinery utilization rates, shipping flows, and macroeconomic indicators are now guiding market expectations.

Analysts caution that any reversal in diplomatic tone or unexpected supply disruption could quickly reintroduce volatility into global oil prices, particularly in a market still sensitive to headline risk.

Long-Term Investors Maintain Balance

Institutional investors have largely avoided dramatic repositioning. Instead, they continue to balance energy exposure within diversified portfolios that include equities, fixed income, and alternative assets.

Within this framework, global oil prices are viewed as stable reference points rather than catalysts for aggressive allocation shifts, reinforcing disciplined investment strategies.

How 2026 Differs From Earlier Cycles

Compared with previous periods of geopolitical stress, markets in 2026 appear more resilient. Improved transparency, diversified supply sources, and coordinated policy responses have reduced sensitivity to isolated headlines.

This evolution has helped global oil prices remain steadier even during politically sensitive moments, suggesting a more mature response to uncertainty.

Economic Data Reclaims Influence

As geopolitical tension fades from the foreground, economic fundamentals are reclaiming influence. Inflation trends, growth forecasts, and central bank policy decisions are expected to shape the next sustained move in energy markets.

For now, global oil prices reflect a balance between cautious optimism and structural support, with traders waiting for clearer signals before committing to directional bets.

An Arctic Signal With Global Reach

The developments linked to Greenland demonstrate how regional signals can generate global consequences. Energy markets responded not with exuberance, but with measured confidence, underscoring a disciplined approach to geopolitical risk.

This episode highlights how tone and perception can be as influential as physical supply in shaping short-term market behavior.

Why This Moment Matters for Energy Markets

This period of relative calm offers insight into how markets interpret restraint. Even without concrete policy changes, a reduction in rhetorical intensity can ease pressure and restore balance.

For investors and policymakers alike, the response provides a clear case study in how global oil prices absorb geopolitical signals in an interconnected financial system.

Confidence Without Complacency Defines the Outlook

As mid-2026 progresses, energy markets remain alert. Global oil prices have stabilized for now, but confidence remains conditional and open to rapid reassessment.

The developments surrounding Greenland highlight how quickly sentiment can shift and how essential clarity and restraint are in maintaining balance across global markets.