New York, United States | January, 2026 — A broad-based recovery lifted the US stock market on Tuesday as Wall Street responded to steadier economic signals, improving earnings visibility, and a more predictable monetary policy outlook. The rebound followed weeks of cautious and range-bound trading, restoring confidence across major indices at a time when global investors were seeking reassurance that recent volatility had begun to ease. Activity during the opening session reflected a market re-calibrating expectations rather than chasing rapid gains.

The renewed momentum emerged after a stretch of uncertainty that had weighed on sentiment. Investors entered the session focused on stability, favoring confirmation over speculation. Early trading suggested a deliberate shift toward balance, with capital flowing selectively into sectors demonstrating resilience and earnings durability.

Opening Bell Sets a Measured Tone

From the opening bell, the mood across trading floors reflected discipline rather than exuberance. Market participants approached the session with caution, carefully digesting economic releases and corporate updates before making allocation decisions. The US stock market opened modestly higher, with gains spread across benchmark indices rather than concentrated in a narrow group of stocks.

Traders described the atmosphere as constructive but restrained. The emphasis remained on long-term positioning rather than short-term momentum, highlighting a maturing response to macroeconomic uncertainty. This approach has helped limit sharp intraday swings and fostered a more orderly trading environment.

Earnings Reports Provide Stability

Corporate earnings have been instrumental in supporting the recovery across the US stock market. While profit growth has moderated compared with earlier expansionary phases, results have largely met expectations. Companies have emphasized cost discipline, operational efficiency, and cautious optimism in forward guidance.

Large-cap firms have played a particularly important role in anchoring sentiment. Their ability to navigate inflationary pressures and manage supply chain adjustments has reassured investors that corporate fundamentals remain intact. The earnings season, so far, has reduced fears of widespread disappointment.

Federal Reserve Messaging Encourages Calm

Clearer communication from policymakers has contributed to stabilizing expectations surrounding the US stock market. Federal Reserve officials have reiterated a data-dependent approach, signaling patience while monitoring inflation and labor market trends. Although rates remain elevated, the absence of abrupt policy shifts has been welcomed by investors.

One senior market analyst said,

“Predictability has become more valuable than promises, and that clarity is helping markets regain balance.”

This consistent messaging has allowed investors to focus on fundamentals rather than reacting sharply to policy speculation.

Sector Rotation Reflects Broader Participation

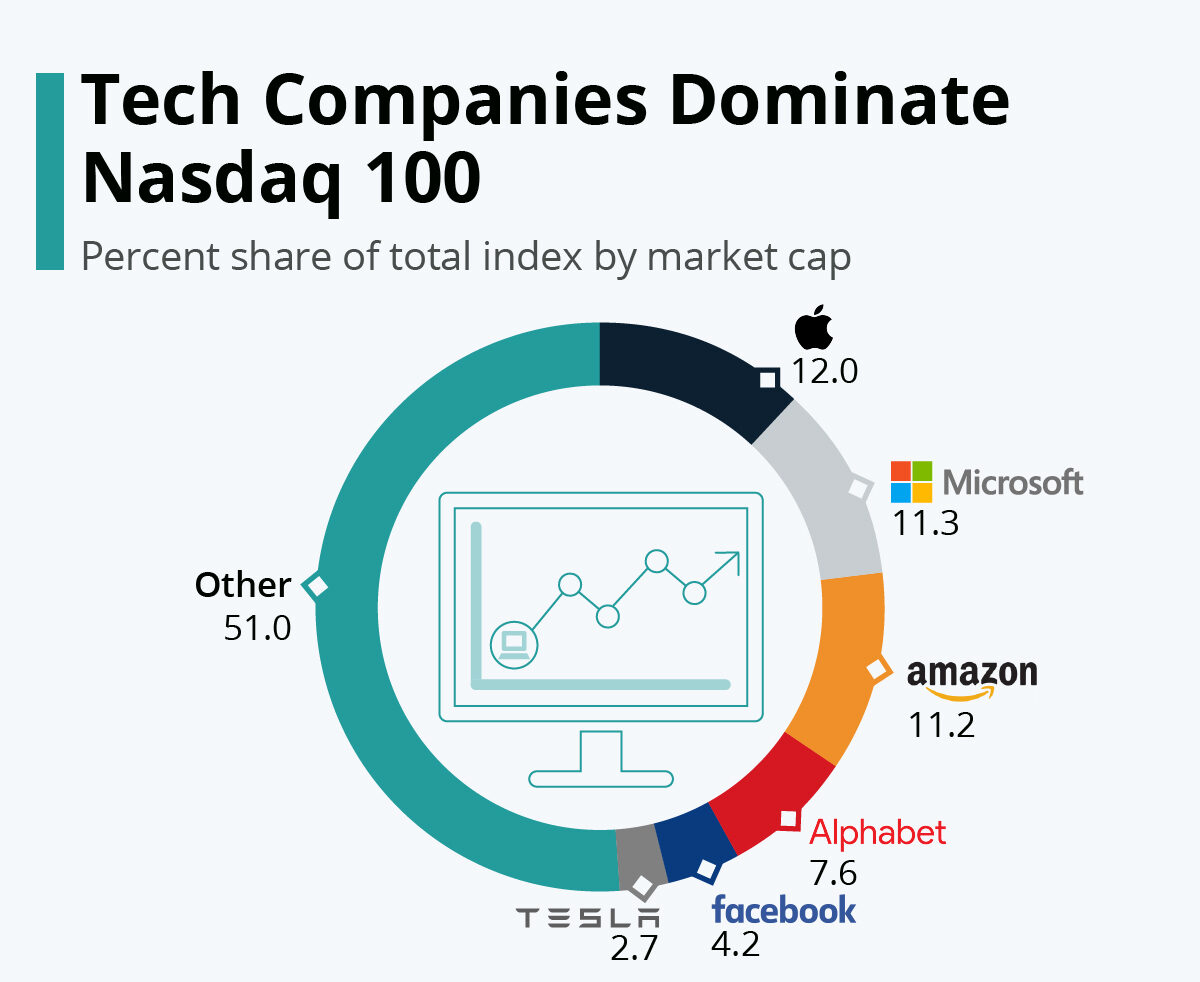

Sector-level movements highlight a broadening of participation across the US stock market. While technology stocks remain influential, leadership has expanded to include healthcare, financial services, and industrial companies. This diversification suggests that confidence is spreading beyond a single growth narrative.

Energy shares have tracked commodity price movements, while consumer-oriented sectors have reflected steady household spending. Defensive industries have also attracted selective interest, indicating that investors continue to balance opportunity with risk management.

Economic Indicators Support a Transitional Outlook

Recent economic data releases have reinforced the view that the economy is in a transitional phase rather than heading toward contraction. Employment figures continue to demonstrate resilience, supporting income stability and consumer demand. Inflation readings show gradual moderation, easing concerns about prolonged tightening.

These trends have shaped expectations for the US stock market, encouraging a balanced outlook. Investors are increasingly focused on sustainability rather than acceleration, aligning strategies with moderate growth assumptions.

Global Developments Influence Sentiment

International markets continue to influence daily sentiment in the US stock market. Developments in Europe and Asia, including currency movements and regional policy debates, have contributed to fluctuations in global risk appetite. Despite these factors, US equities have maintained relative strength.

Global investors continue to view American markets as a stabilizing anchor, supported by deep liquidity, transparent regulation, and diversified corporate exposure. Cross-border capital flows have remained steady, reinforcing confidence in long-term prospects.

Institutional Investors Reinforce Stability

Institutional participation has been a stabilizing force during the recent recovery. Pension funds, asset managers, and insurance firms have maintained disciplined allocation strategies, emphasizing governance standards and predictable earnings models. Their steady presence has helped absorb volatility.

Within the US stock market, this institutional commitment has supported orderly price discovery. Long-term capital continues to provide a foundation, reducing the likelihood of abrupt dislocations during news-driven sessions.

Retail Investors Adapt to New Conditions

Retail investors remain active, though behavior has evolved alongside market conditions. Improved access to real-time data and analysis tools has encouraged more informed decision-making. Many individual investors are adopting diversified strategies and longer holding periods.

Retail participation within the US stock market has added liquidity and broadened engagement. While short-term trading persists, there is growing evidence of alignment with institutional approaches focused on fundamentals.

Liquidity Conditions Remain Supportive

Liquidity across major exchanges has remained robust, supporting smoother market functioning. Consistent trading volumes have allowed markets to digest economic updates and corporate announcements without severe disruption.

The depth of the US stock market continues to distinguish it globally. Advances in trading infrastructure and regulatory oversight have enhanced efficiency, reinforcing investor confidence during periods of uncertainty.

Risk Awareness Shapes Positioning

Despite the rebound, investors remain aware of potential risks. Persistent inflation, geopolitical developments, and shifts in policy remain part of the broader landscape. As a result, hedging strategies and diversified exposure remain common.

This risk-aware approach within the US stock market reflects prudence rather than fear. Market participants appear focused on resilience, preparing for uncertainty without abandoning long-term objectives.

Innovation Supports Long-Term Confidence

Long-term optimism continues to be supported by innovation-driven productivity gains. Advances in artificial intelligence, automation, and digital infrastructure are reshaping business models across industries.

Companies aligned with these trends are viewed as core holdings, reinforcing confidence in the structural strength of the US stock market. Innovation remains a central pillar supporting growth expectations beyond short-term cycles.

Outlook for the Remainder of the Year

Looking ahead, analysts suggest that performance through the remainder of 2026 will depend on earnings consistency and policy steadiness. A controlled inflation environment combined with moderate growth could support further gains, while unexpected shocks may test resilience.

Expectations for the US stock market remain measured. Investors continue to emphasize adaptability, diversification, and disciplined strategy as guiding principles.

Long-Term Perspective Remains Constructive

From a historical standpoint, markets have demonstrated resilience through numerous economic cycles. Periods of volatility have often been followed by consolidation and recovery, rewarding patient and disciplined strategies.

The long-term trajectory of the US stock market continues to be supported by innovation, capital depth, and economic adaptability. These factors underpin confidence even amid short-term uncertainty.

Stability Defines the Current Phase

As trading continues in New York through March 2026, the US stock market appears defined by balance and renewed stability. Supported by earnings resilience, policy clarity, and diversified participation, equities have regained footing after recent turbulence. Investors navigating this phase are prioritizing informed decision-making, patience, and long-term focus as markets adjust to an evolving global landscape.