Seattle, United States, January 2026: Starbucks shortages became a highly visible sign of mounting operational pressure inside large-scale retail systems, raising questions about how global brands balance efficiency, reliability, and customer expectations in an era of persistent supply volatility.

For Starbucks, the issue reflects a broader shift in retail dynamics, where consistency is no longer guaranteed by scale alone.

Retail Consistency and Consumer Expectations

Consistency is the foundation of modern retail loyalty. Customers form habits around predictable availability, particularly in food and beverage environments. Starbucks shortages disrupt those habits, inserting uncertainty into routines that once required no decision-making.

Unlike discretionary purchases, morning food and beverage choices are time-sensitive. When expected items are unavailable, customers often leave rather than substitute, amplifying the impact of supply disruptions.

Scale as Both Advantage and Vulnerability

Starbucks’ global footprint delivers efficiency but also magnifies vulnerability. Starbucks shortages illustrate how tightly interconnected systems can transmit disruption rapidly across regions.

A delay affecting one production facility can influence dozens of stores within hours, transforming localized issues into widespread operational challenges.

Inside the Supply Chain Supporting Daily Operations

Behind each store lies a complex network of regional bakeries, cold-chain logistics providers, and transportation partners. Starbucks shortages reveal how sensitive this system is to timing, labor availability, and coordination.

Food products require narrow delivery windows. Missed schedules often result in visible gaps rather than delayed fulfillment, leaving little room for correction.

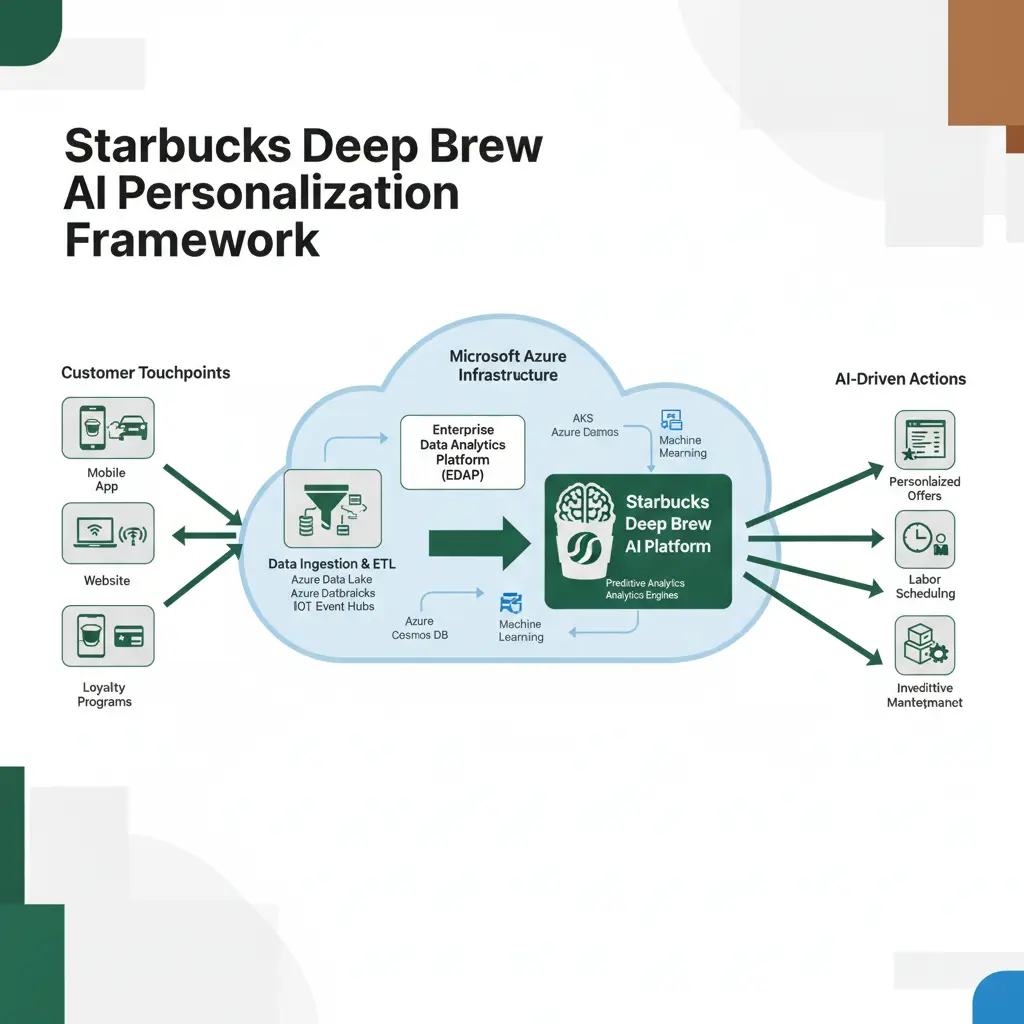

Automation and Predictive Inventory Management

Starbucks has invested heavily in automated forecasting tools designed to reduce waste and streamline ordering. However, Starbucks shortages expose the limits of predictive models when real-world conditions shift rapidly.

Automated systems perform best in stable environments. When disruptions exceed historical patterns, algorithms may underestimate demand instead of compensating for risk.

Labor Constraints Across the Supply Network

Workforce challenges extend beyond store counters. Production facilities, distribution centers, and transportation providers face staffing shortages that affect output and delivery reliability. Starbucks shortages are closely linked to these upstream pressures.

At store level, managers often intervene manually to adjust inventory, increasing administrative workload and operational stress.

Customer Behavior and Habit Formation

Consumer behavior in food service is deeply habitual. Morning routines allow little flexibility, and repeated disruption accelerates habit change. Starbucks shortages interrupt these routines, often pushing customers toward alternative providers.

Once habits shift, winning customers back becomes significantly more difficult.

Front-line Employees and Service Pressure

Baristas and store managers manage the immediate consequences of inventory gaps. Starbucks shortages place front-line staff in challenging positions, balancing brand standards with factors beyond their control.

One retail operations analyst said,

“When availability becomes unpredictable, employees spend more time managing disappointment than delivering consistent service.”

Urban Density Amplifies Visibility

High-volume urban locations experience faster inventory depletion and narrower recovery windows. Starbucks shortages appear most frequently in dense city centers, where customer flow remains constant throughout the day.

Visibility in these markets accelerates reputational impact and media attention.

Comparisons Across Large-Scale Platforms

Analysts increasingly compare Starbucks’ operational re-calibration to challenges faced by other large platforms adapting to scale, including X, owned by Elon Musk.

In both cases, rapid system changes exposed structural weaknesses requiring renewed oversight and flexibility.

Regional Variability Complicates Central Planning

Not all regions experience disruption equally. Some markets report intermittent gaps, while others face prolonged limitations. Starbucks shortages therefore resist uniform solutions.

This variability highlights the limits of centralized planning and the growing need for localized discretion.

Economic Pressures Tighten Operational Margins

Rising transportation costs, supplier consolidation, and wage inflation reduce buffer capacity across retail supply chains. Starbucks shortages reflect these broader economic pressures rather than isolated failures.

As margins tighten, tolerance for inefficiency diminishes, increasing systemic fragility.

Corporate Strategy Under Review

Starbucks leadership has acknowledged operational strain and initiated internal reviews aimed at restoring reliability. Addressing Starbucks shortages involves reassessing supplier redundancy, inventory buffers, and system responsiveness.

The company has emphasized re-calibration rather than retreat from automation.

Why the Issue Resonates Beyond One Brand

The visibility of Starbucks shortages makes them instructive across the retail sector. Consumers experience disruption directly, transforming logistical challenges into brand perception issues.

Other large food-service brands face similar pressures as automation expands industry-wide.

Balancing Efficiency With Resilience

Highly optimized systems reduce cost but sacrifice flexibility. Starbucks shortages highlight the growing importance of controlled redundancy, including backup suppliers and regional inventory reserves.

Resilience is increasingly valued alongside efficiency.

Long-Term Implications for Brand Trust

Starbucks retains strong brand equity, but consistency defines its promise. Starbucks shortages risk weakening trust if disruptions persist.

Customer loyalty depends more on reliability than innovation.

Adapting to a Volatile Retail Environment

Retail volatility is no longer episodic. Starbucks shortages reflect a structural shift driven by labor markets, logistics constraints, and demand unpredictability.

Adaptation now requires long-term operational and cultural change.

Data Systems Versus Human Judgment

Data remains essential, but it cannot replace situational awareness. Starbucks shortages underscore the importance of empowering human decision-making alongside automated systems.

Hybrid operational models are increasingly viewed as the future of large-scale retail management.

Industry Signals and Competitive Dynamics

Competitors observe Starbucks’ response closely. Starbucks shortages offer a real-time case study in how scale interacts with volatility.

Brands that adapt quickly may strengthen trust without expanding footprint.

Consumer Expectations in a Convenience Economy

Availability is no longer a bonus, it is assumed. Starbucks shortages clash with expectations shaped by instant-service culture.

Retailers unable to meet that expectation risk habit erosion.

Rebuilding Reliability as a Strategic Priority

Stability is becoming strategic. Starbucks shortages may ultimately prompt investments that redefine operational priorities.

Consistency increasingly signals strength more than speed.

Hidden Costs of Inconsistency

Beyond lost sales, inconsistency increases internal costs, employee strain, and recovery efforts. Starbucks shortages reveal expenses that extend well beyond inventory metrics.

Operational stress compounds quickly in high-volume environments.

A Transitional Moment for Retail Leadership

As 2026 unfolds, Starbucks shortages mark a critical transition for large-scale retail management. The challenges highlight shifting expectations around consistency, resilience, and operational control.

Leadership decisions made during this period will influence customer trust and long-term brand stability. These responses may also set new standards for how the wider retail industry navigates ongoing disruption.

Reliability Redefines What Scale Means in Modern Retail

In today’s retail landscape, scale is no longer defined by size alone but by the ability to deliver consistently. Brands with vast footprints must now prioritize stability over speed to maintain consumer trust. Repeated disruptions quickly erode loyalty, regardless of brand strength. As markets remain volatile, reliability has become the true measure of sustainable growth.