Washington, February 11, 2026, Parliament News, notes that in 2026, chipmaking equipment restrictions have emerged as one of the most consequential technology policy developments of the year. Federal officials confirmed a new wave of export controls targeting advanced semiconductor manufacturing tools, underscoring the strategic importance of microchip production in an increasingly competitive global landscape.

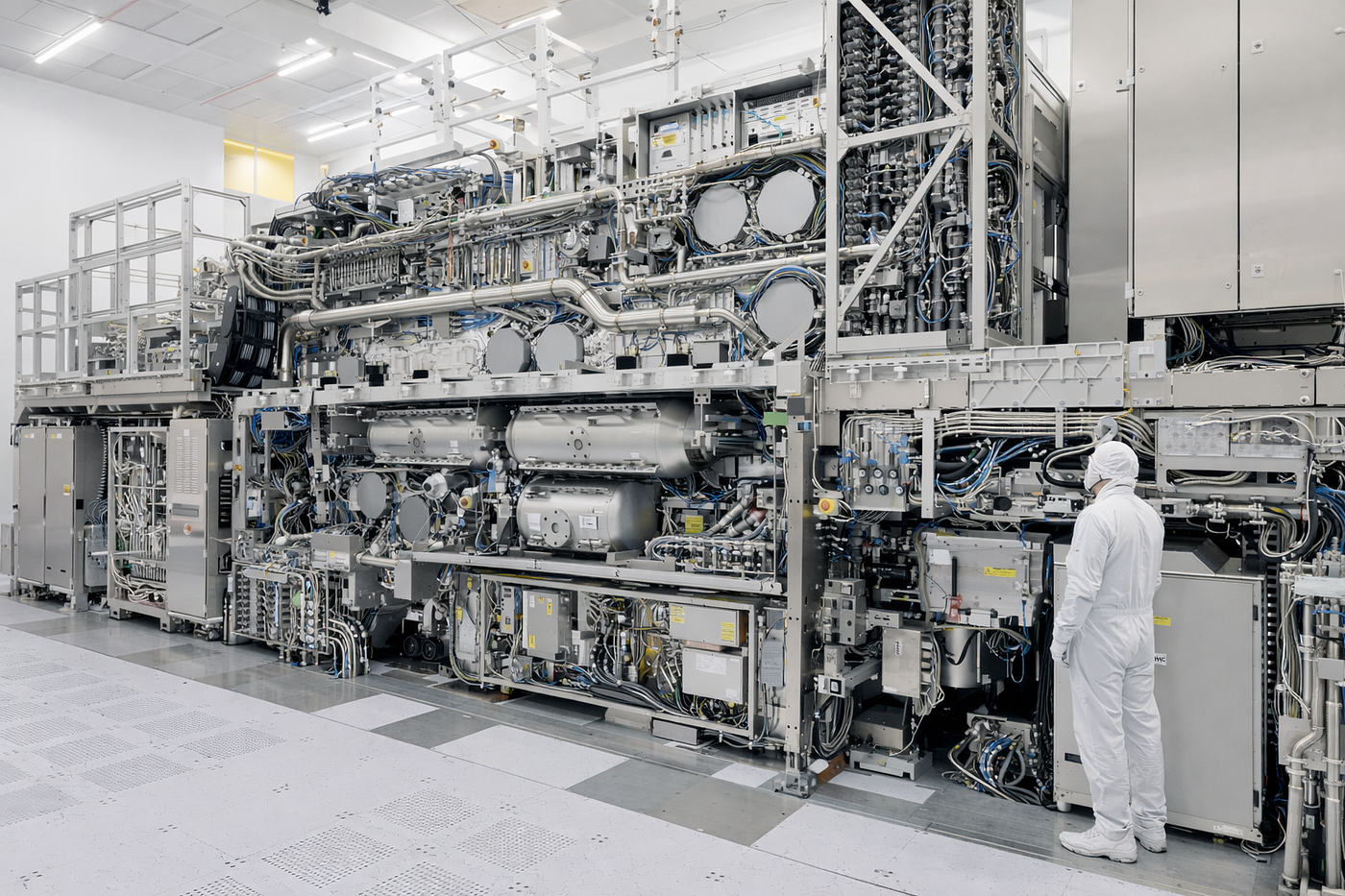

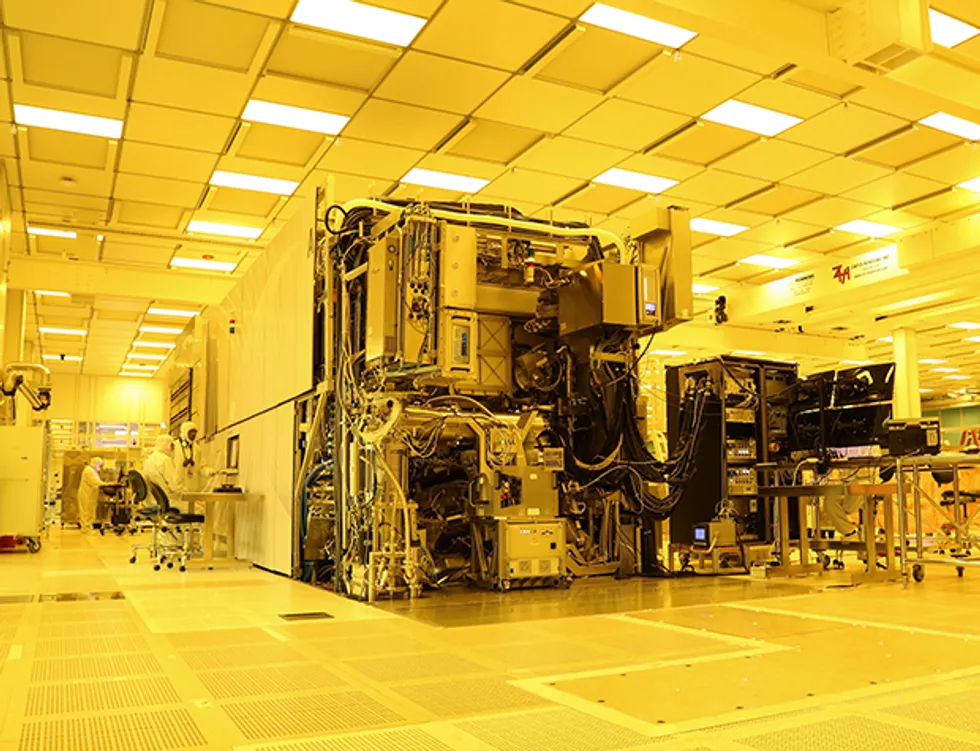

The measures focus on limiting overseas access to high end lithography systems, etching tools, deposition equipment, and other precision machinery required to manufacture cutting edge semiconductors. Lawmakers describe the policy shift as essential to protecting national security and maintaining long term technological leadership.

The Strategic Importance of Semiconductor Manufacturing

Semiconductors power modern economies. From smartphones and electric vehicles to data centers and military systems, advanced chips are embedded in nearly every critical sector. The ability to produce those chips at scale depends on complex manufacturing tools that require years of research and billions of dollars in development.

By tightening chipmaking equipment restrictions, policymakers aim to influence who can manufacture the most advanced processors. Control over fabrication tools is widely viewed as more strategic than control over individual chips because it determines long term production capacity.

Industry experts note that only a handful of companies worldwide can design and build the most advanced semiconductor equipment. This concentration of expertise makes export policy especially powerful.

Policy Drivers Behind the New Measures

The expansion of chipmaking equipment restrictions reflects growing bipartisan concern about technological rivalry. Officials argue that advanced microchips enhance artificial intelligence systems, cybersecurity infrastructure, aerospace development, and defense technologies.

Recent legislative discussions have focused on preventing sensitive manufacturing tools from contributing to military modernization abroad. Policymakers say that limiting access to these tools slows the development of next generation computing capabilities in competing markets.

Security agencies have briefed lawmakers on potential risks associated with unrestricted technology transfers. As a result, export control policy has become central to national defense strategy.

Economic Stakes for Manufacturers

While security considerations dominate headlines, the economic implications of chipmaking equipment restrictions are equally significant. American and allied equipment manufacturers generate substantial revenue from global customers.

Industry executives warn that strict controls may reduce overseas sales and encourage foreign governments to accelerate domestic equipment development programs. Semiconductor supply chains operate across multiple countries, and disruptions can ripple throughout the industry.

However, supporters argue that protecting advanced manufacturing know how outweighs short term commercial losses. They contend that long term technological leadership ensures stronger economic growth.

Legislative Framework and Enforcement

Congress has strengthened the legal foundation supporting chipmaking equipment restrictions through updated export control statutes. Agencies responsible for oversight have expanded licensing requirements and compliance audits to ensure adherence.

Officials emphasize cooperation with allied nations to prevent policy loopholes. Coordination reduces the risk that restricted equipment could be obtained indirectly through third party markets.

Regulatory authorities have also introduced stricter reporting obligations for companies exporting sensitive tools. Violations may carry significant penalties, reinforcing the seriousness of enforcement.

Global Market Reaction

Financial markets responded cautiously following the announcement of expanded chipmaking equipment restrictions. Semiconductor stocks experienced volatility as investors evaluated potential impacts on global trade flows.

International governments have expressed mixed reactions. Some allies support tighter controls as part of broader strategic alignment. Others worry about unintended consequences for global innovation and supply stability.

Market analysts suggest that clarity and predictability will determine long term investor confidence.

Supply Chain Complexity

Semiconductor manufacturing is one of the most intricate industrial processes ever developed. The production of a single advanced chip involves hundreds of steps and components sourced worldwide.

Implementing chipmaking equipment restrictions requires careful calibration to avoid unintended supply chain disruptions. Policymakers must distinguish between tools used for mature node production and those required for the most advanced fabrication processes.

Industry associations have requested transparent guidelines to maintain operational continuity while complying with new rules.

Artificial Intelligence and Strategic Computing

Artificial intelligence applications depend heavily on powerful processors capable of handling massive data sets. By enforcing chipmaking equipment restrictions, lawmakers seek to influence the pace of AI development in strategic regions.

Experts note that advanced lithography equipment enables the production of smaller, faster, and more energy efficient chips. Limiting access to these tools may shape the competitive balance in AI research and deployment.

However, technology specialists caution that innovation often adapts quickly to policy shifts, and global competition may intensify rather than diminish.

Diplomatic and Trade Dimensions

The expansion of chipmaking equipment restrictions adds complexity to diplomatic relations. Export controls are often intertwined with broader trade negotiations and security alliances.

Allied coordination remains central to policy effectiveness. Officials have engaged in consultations to ensure consistent standards across key manufacturing nations.

Trade experts highlight the delicate balance between safeguarding national interests and preserving open markets.

Industry Adaptation Strategies

Companies affected by chipmaking equipment restrictions are developing contingency plans. Some are diversifying customer bases, while others are investing in domestic production capacity to offset potential losses.

Research and development spending remains robust, as firms seek to maintain technological advantages in equipment design. Innovation continues despite regulatory tightening.

Executives emphasize the importance of clear communication from policymakers to support long term planning.

Workforce and Innovation Impact

Advanced semiconductor manufacturing relies on highly skilled engineers, technicians, and researchers. The implementation of chipmaking equipment restrictions may influence workforce allocation and talent development strategies.

Educational institutions are expanding programs in semiconductor engineering and materials science to meet growing domestic demand. Policymakers argue that strengthening local expertise complements export control measures.

Innovation ecosystems often thrive when supported by coordinated public and private investment.

Historic Comparison

Debates over strategic technology controls are not new. During previous industrial revolutions, governments imposed export restrictions on materials and machinery deemed critical to national power. The modern era of chipmaking equipment restrictions echoes those historical precedents.

In earlier decades, disputes arose over advanced aerospace components, nuclear technology, and encryption software. Each case reflected concerns about maintaining competitive advantage and protecting security interests.

History suggests that while export controls can shape technological development, global innovation tends to find new pathways. The challenge lies in balancing strategic safeguards with economic vitality.

Market Outlook for 2026 and Beyond

As 2026 progresses, analysts expect continued refinement of chipmaking equipment restrictions. Policymakers may adjust licensing thresholds or expand cooperation with additional allies.

Semiconductor demand remains strong across industries, including electric vehicles, renewable energy infrastructure, and telecommunications networks. The strategic value of fabrication tools ensures that policy debates will persist.

Investors are closely monitoring developments, recognizing that semiconductor policy now influences global economic trends.

Long Term Strategic Implications

The broader significance of chipmaking equipment restrictions extends beyond immediate trade flows. Control over advanced manufacturing capabilities shapes innovation trajectories, research investment, and geopolitical influence.

Policymakers argue that strategic patience is essential. Short term disruptions may give way to strengthened domestic ecosystems capable of sustaining long term leadership.

Technology experts caution that collaboration and competition often coexist in global markets. The outcome will depend on policy precision and international dialogue.

A New Chapter in Technology Governance

In Washington in 2026, chipmaking equipment restrictions represent a pivotal shift in how governments manage advanced industrial capabilities. Semiconductor tools are no longer viewed solely as commercial products but as strategic assets tied to national resilience.

One senior policymaker stated,

“Ensuring responsible access to advanced semiconductor manufacturing tools is fundamental to our security and economic future.”

This single remark reflects the seriousness with which leaders approach the evolving landscape.

As nations navigate the intersection of innovation and security, the semiconductor sector stands at the forefront of policy transformation. The decisions made today will shape technological competitiveness for decades.

The Silicon Sovereignty Era Begins

The tightening of chipmaking equipment restrictions signals the beginning of what many analysts describe as the Silicon Sovereignty Era. Governments are increasingly determined to safeguard the tools that define digital power.

While debates over trade and diplomacy continue, one reality remains clear: advanced semiconductor manufacturing sits at the heart of modern economic strength. The policies enacted in 2026 may ultimately redefine how nations cooperate and compete in the technology driven world.