Austin, Texas, February 4, 2026 — According to Parliament News, that The Silicon Laboratories buyout has emerged as a pivotal development in the US semiconductor sector as industry consolidation accelerates in response to evolving technological demands and competitive pressures. Announced in 2026, the transaction underscores how established chipmakers are repositioning themselves to capture long-term growth in wireless connectivity, embedded systems, and low-power chip design.

The deal arrives at a moment when semiconductor companies are reassessing portfolio priorities following years of supply-chain disruptions, geopolitical uncertainty, and cyclical market volatility. Analysts view the acquisition as a signal that strategic depth and technological specialization now outweigh sheer scale in determining competitive advantage.

Strategic Rationale Behind the Transaction

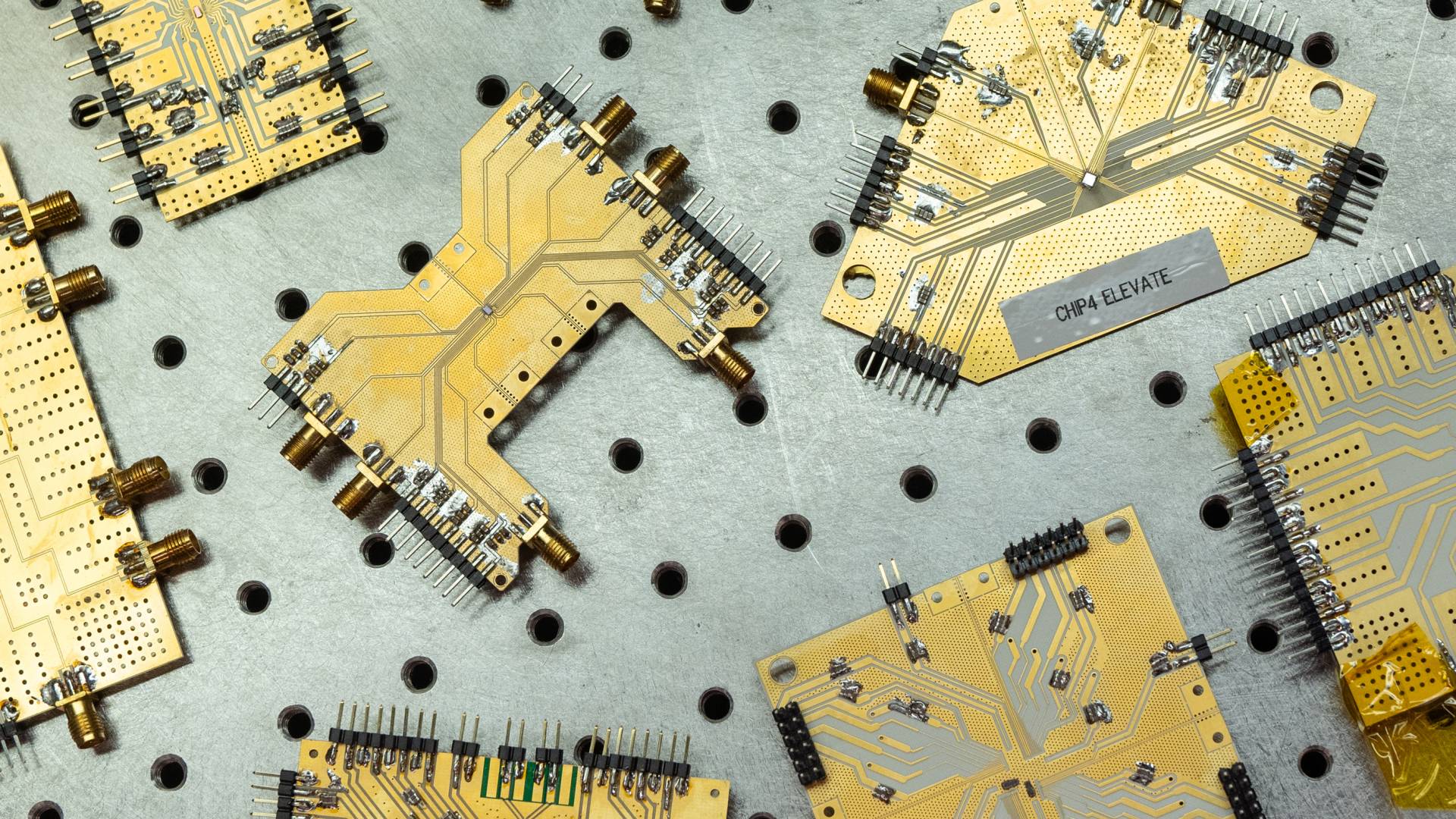

The acquisition reflects a deliberate shift toward strengthening capabilities in wireless communication and mixed-signal design. Silicon Laboratories has developed a strong presence in energy-efficient connectivity solutions that serve industrial automation, smart infrastructure, and connected consumer devices.

Through the Silicon Laboratories buyout, the acquiring company gains access to specialized intellectual property and engineering talent that would be difficult to replicate internally within a short timeframe. Executives have framed the transaction as a growth-oriented move designed to accelerate innovation rather than a restructuring exercise focused on cost reduction.

Market observers note that such targeted acquisitions are becoming more common as semiconductor firms seek precision rather than breadth in expansion strategies.

Wireless Connectivity as a Growth Engine

Wireless technology has become a foundational element of modern electronics. From factory automation and smart grids to healthcare devices and home automation, connectivity requirements continue to expand across industries.

The Silicon Laboratories buyout highlights how demand for low-power, secure, and reliable wireless solutions is reshaping investment priorities within the chip industry. Customers increasingly prefer integrated solutions that simplify system design while meeting stringent efficiency and security standards.

This shift has elevated the value of companies with deep expertise in embedded connectivity, particularly those serving long-lifecycle industrial markets.

Semiconductor Industry at a Crossroads

The global semiconductor industry is navigating structural change. Capital costs for advanced manufacturing continue to rise, while supply-chain resilience has become a strategic concern for both governments and corporations.

Against this backdrop, the Silicon Laboratories buyout represents a recalibration toward design leadership rather than manufacturing scale alone. While fabrication remains critical, the ability to deliver differentiated architectures and software-integrated solutions has become equally important.

Analysts suggest that companies able to balance manufacturing efficiency with design innovation will be better positioned to weather future cycles.

Regulatory Review and Approval Process

As with all major semiconductor transactions, the deal is subject to regulatory review across multiple jurisdictions. Regulators are increasingly attentive to competition dynamics and national security considerations within the chip sector.

Executives involved in the Silicon Laboratories buyout have emphasized the complementary nature of the businesses, suggesting limited overlap and reduced antitrust risk. The transaction is expected to proceed through standard review channels without significant delays.

Closing is anticipated later in 2026, contingent on customary regulatory approvals.

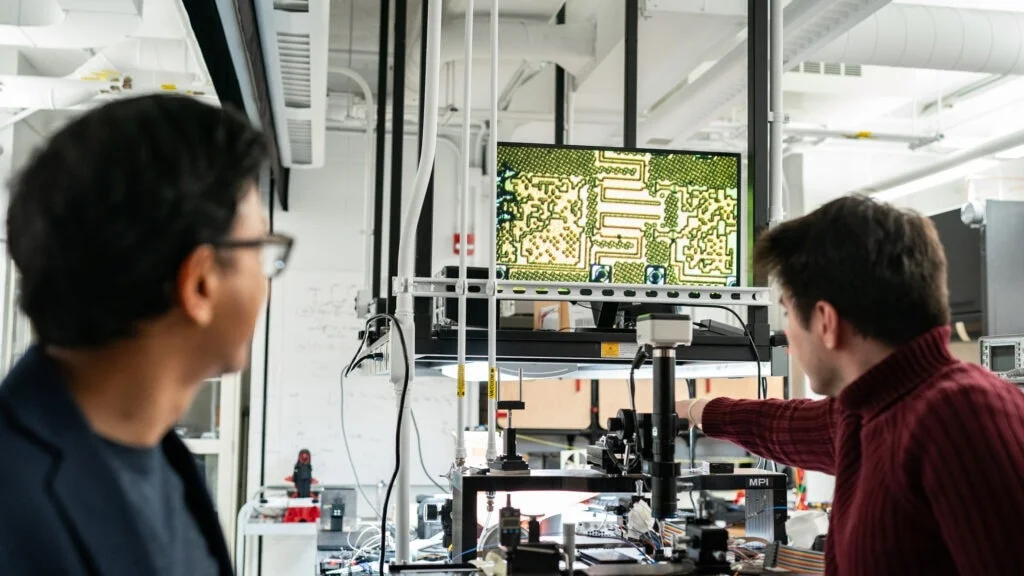

Engineering Talent and Innovation Continuity

Human capital remains one of the semiconductor industry’s most valuable resources. Retaining skilled engineers is often central to the success of acquisitions.

The Silicon Laboratories buyout places particular emphasis on preserving design teams and maintaining continuity in research and development. Austin is expected to remain a hub for wireless innovation, ensuring that institutional knowledge and customer relationships remain intact.

Industry analysts note that acquisitions which prioritize talent retention tend to achieve stronger long-term outcomes.

Customer Confidence and Product Roadmaps

For customers, acquisitions raise questions about product continuity, long-term support, and roadmap alignment. Semiconductor customers often design products years in advance, making stability a critical consideration.

Executives associated with the Silicon Laboratories buyout have stated that existing product lines will continue uninterrupted. Customers are being briefed on how combined capabilities may enhance future offerings without forcing abrupt transitions.

Maintaining customer trust during the integration phase will be essential to realizing the strategic benefits of the transaction.

One Market Perspective

One industry analyst said,

“This acquisition reflects a strategic bet on specialized wireless design rather than expansion for scale alone.”

The comment captures broader sentiment that focused expertise now carries greater value than size in many segments of the chip market.

Financial Context and Market Reaction

Investor response to the announcement has been measured. While acquisitions often introduce near-term uncertainty, markets appear receptive to the strategic logic underpinning the transaction.

The Silicon Laboratories buyout is not expected to significantly strain financial resources, according to analysts, given the emphasis on long-term growth rather than immediate cost synergies. Shareholder attention remains focused on execution and integration discipline.

Over time, the transaction’s success will be judged by its contribution to innovation pipelines and revenue stability.

Supply Chain and Operational Considerations

Semiconductor supply chains remain complex and globally distributed. Design-focused acquisitions can reduce exposure to fabrication bottlenecks by emphasizing intellectual property rather than manufacturing capacity.

Through the Silicon Laboratories buyout, the acquiring firm strengthens its ability to deliver complete system solutions while maintaining flexibility in sourcing and production.

This approach aligns with broader industry efforts to balance globalization with resilience.

Competitive Landscape and Industry Response

Competition within the wireless and embedded semiconductor markets remains intense. Multiple firms are investing heavily in low-power architectures, software integration, and security features.

The Silicon Laboratories buyout positions the combined entity to compete more effectively by offering broader and more integrated solutions. Analysts note that customers increasingly favor vendors capable of supporting entire system designs rather than individual components.

Such competitive dynamics are likely to drive further consolidation across specialized segments.

History of Silicon Laboratories in the Semiconductor Sector

Silicon Laboratories built its reputation through a focused approach to mixed-signal and wireless chip design, serving markets that value efficiency, reliability, and long product lifecycles. Over time, the company expanded its portfolio while maintaining a clear emphasis on low-power connectivity.

This strategic consistency enhanced the company’s attractiveness as an acquisition target. The Silicon Laboratories buyout reflects how sustained investment in specialized expertise can translate into long-term strategic value during periods of industry consolidation.

Implications for US Semiconductor Strategy

The transaction arrives amid broader efforts to strengthen domestic semiconductor capabilities. Policymakers have highlighted the importance of design leadership alongside manufacturing capacity.

Deals such as the Silicon Laboratories buyout reinforce the role of US-based innovation in shaping global technology trends. Analysts argue that leadership in chip design remains a critical pillar of competitiveness even as fabrication is geographically diversified.

The acquisition underscores confidence in the resilience of US semiconductor innovation.

Technology Integration and Future Development

Post-acquisition focus will shift toward aligning research priorities and development roadmaps. Wireless standards continue to evolve, requiring sustained collaboration and investment.

The Silicon Laboratories buyout is expected to support deeper integration of connectivity and analog processing, enabling more efficient and secure solutions across multiple applications.

Execution discipline during this phase will be critical to preserving momentum.

Long-Term Industry Outlook

The semiconductor industry is likely to remain cyclical, but long-term demand drivers such as automation, electrification, and digital connectivity continue to strengthen.

The Silicon Laboratories buyout reflects confidence that specialized chip technologies will play an expanding role across industries. Analysts expect further targeted acquisitions as companies refine portfolios to address specific growth opportunities.

Strategic clarity will remain a key differentiator.

Risk Factors and Integration Challenges

Despite strong strategic alignment, integration risks remain. Cultural differences, roadmap alignment, and customer communication all require careful management.

Executives associated with the Silicon Laboratories buyout have emphasized phased integration to minimize disruption. Industry experience suggests that acquisitions focused on complementary strengths tend to face fewer challenges than those driven by aggressive expansion.

Still, execution will determine ultimate success.

Broader Lessons for the Semiconductor Sector

The transaction illustrates how the semiconductor industry is evolving beyond traditional metrics of scale. Innovation depth, system-level integration, and customer trust have become increasingly important.

The Silicon Laboratories buyout serves as a case study in how focused technological leadership can shape acquisition strategy in a competitive global environment.

Other firms may follow similar paths as they reassess growth priorities.

The 2026 acquisition of Silicon Laboratories represents a significant milestone in the US semiconductor landscape. By emphasizing wireless connectivity and design expertise, the transaction highlights a broader shift toward strategic consolidation rooted in specialization.

As the industry continues to evolve, the Silicon Laboratories buyout stands as an example of how targeted acquisitions can redefine competitive positioning while preserving innovation momentum.