San Francisco, February 4, 2026 — According to Parliament News, that The Uber profit outlook has become a focal point for global investors as the ride-hailing company enters a critical phase of financial maturity. While growth remains steady across its core mobility platform, the company is now navigating a more complex balance between affordability, regulatory compliance, and sustainable profitability. In 2026, Uber’s financial guidance reflects not a retreat from expansion, but a recalibration shaped by economic realities across global markets.

The outlook arrives at a time when technology-driven transport platforms are under heightened scrutiny from regulators, labor groups, and investors alike.

Revenue Growth Anchors Financial Stability

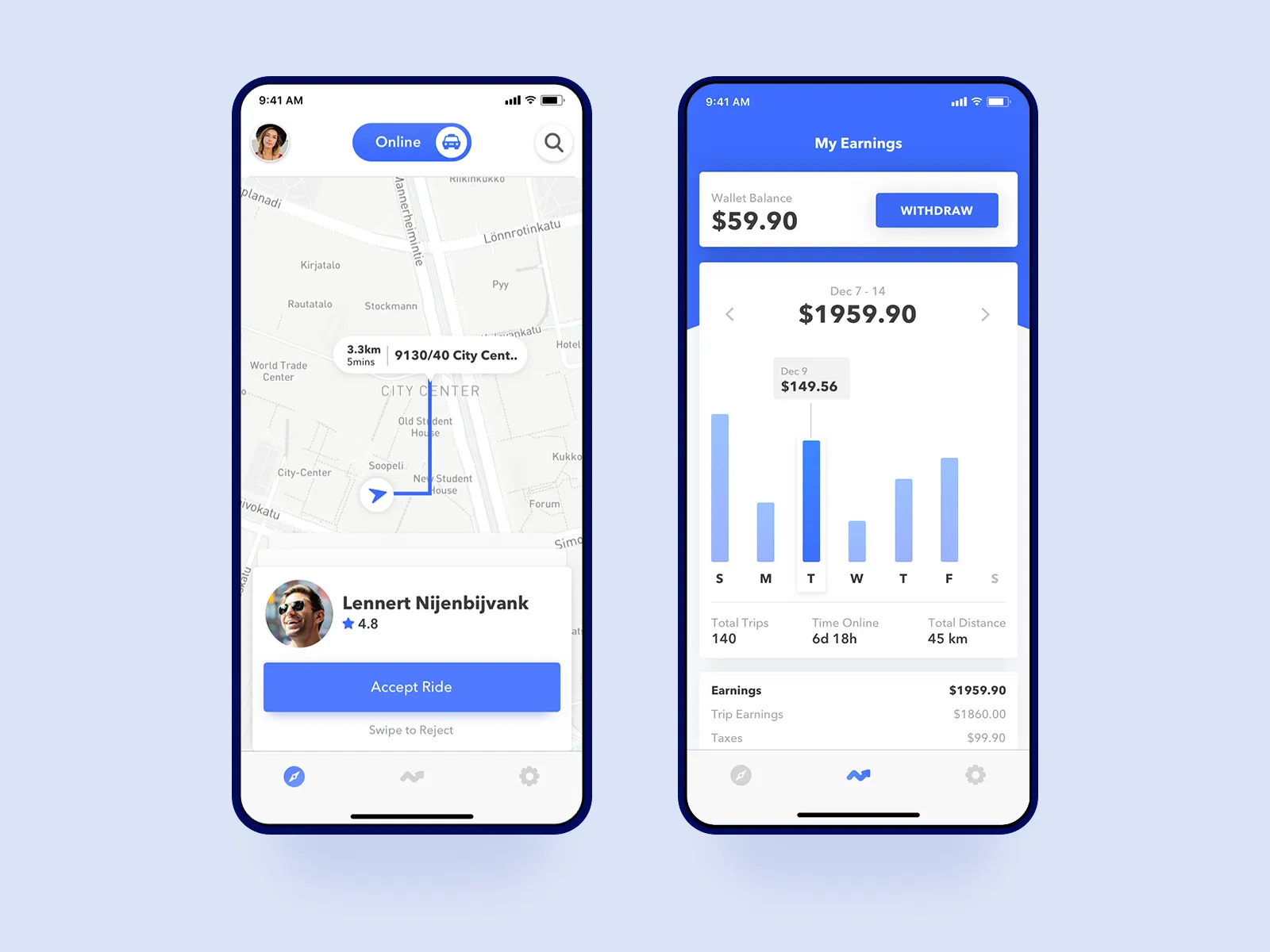

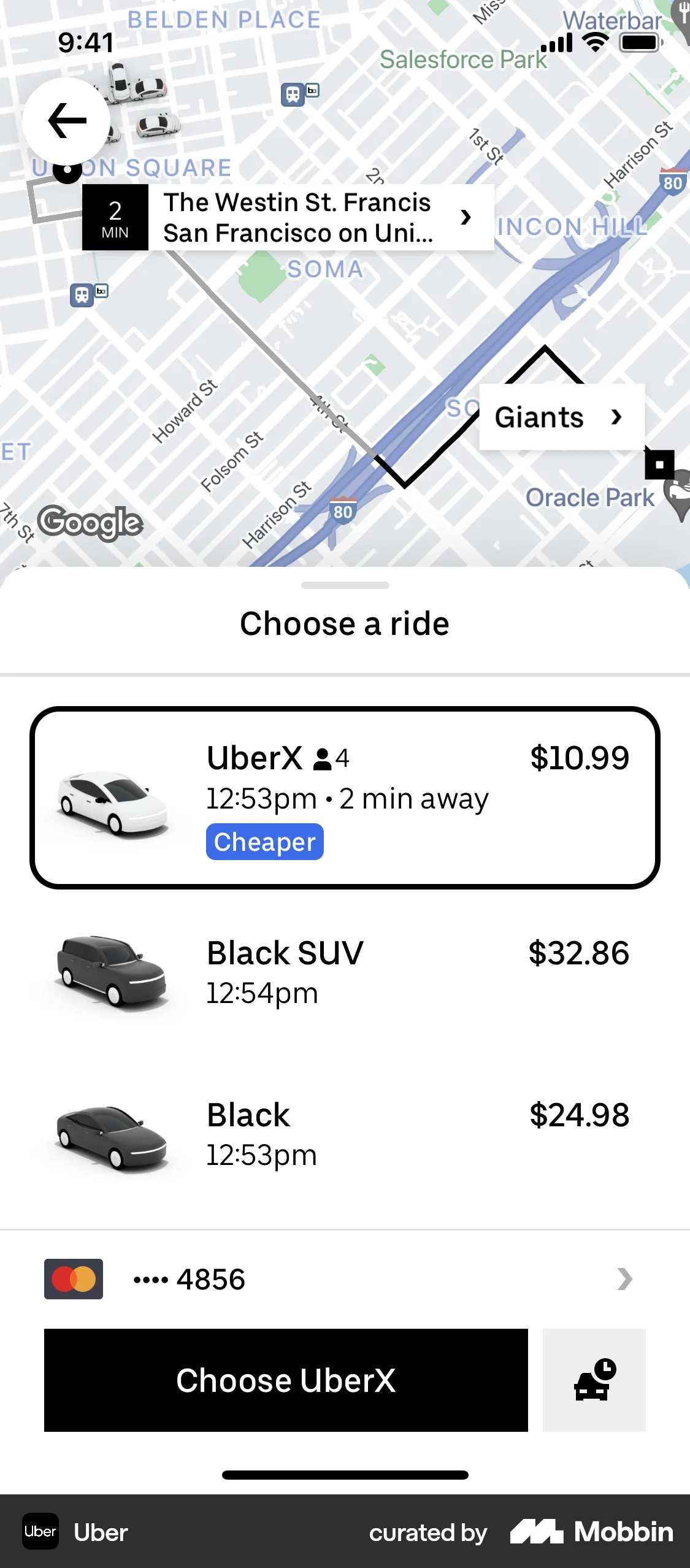

Uber continues to generate consistent revenue growth across its ride-hailing, delivery, and logistics segments. Demand for urban mobility, airport transfers, and app-based transportation remains strong, particularly in North America.

Management has emphasized that the Uber profit outlook is grounded in revenue resilience rather than contraction. Gross bookings continue to expand, supported by high user engagement and increased frequency of rides per active customer.

Pricing Strategy and Market Competition

Competitive pricing has emerged as a defining feature of Uber’s strategy in 2026. In many markets, the company has chosen to absorb margin pressure rather than risk losing riders to lower-cost alternatives.

This approach plays a central role in shaping the Uber profit outlook, as fare moderation directly affects short-term earnings. However, executives argue that maintaining market share is critical to long-term profitability once pricing environments stabilize.

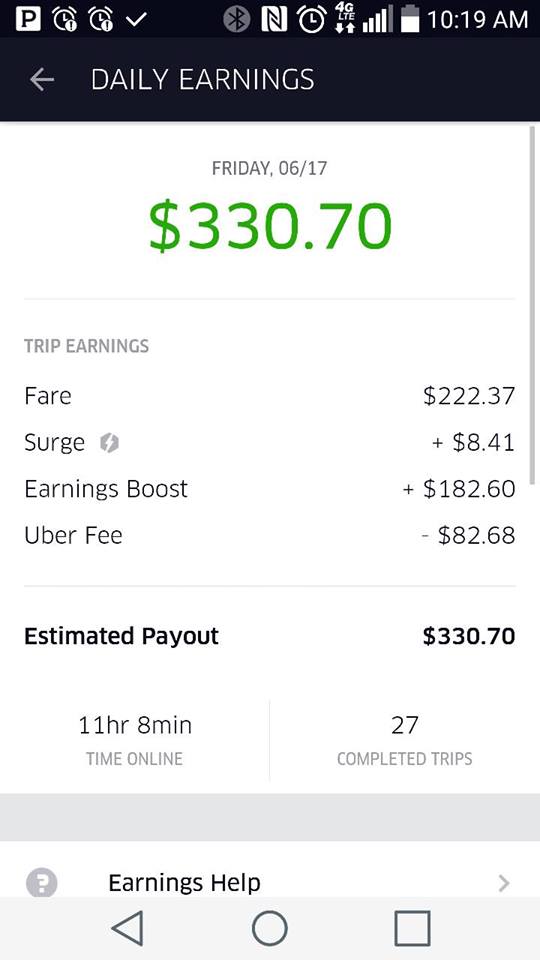

Rising Taxes and Regulatory Costs

Governments worldwide are imposing higher tax burdens on digital platforms. These include corporate levies, value-added taxes, and digital service taxes that increase operating costs.

Uber has acknowledged that taxation is one of the most significant external forces influencing the Uber profit outlook. In addition, compliance costs tied to labor classification and data protection regulations continue to rise, particularly in Europe.

Regional Performance Differences

The company’s financial performance varies widely by geography. North America remains the strongest contributor to profitability, while Europe and parts of Asia face tighter regulatory and tax constraints.

These regional dynamics are carefully reflected in the Uber profit outlook, with management adopting localized strategies rather than uniform global pricing or cost structures.

Business Diversification Reduces Risk

Beyond ride-hailing, Uber’s delivery and freight divisions continue to provide diversification. These segments help stabilize cash flows during periods of pricing pressure in the mobility business.

This diversification has strengthened confidence in the Uber profit outlook, offering insulation against volatility in any single business line.

Operational Efficiency Initiatives

Uber has accelerated efforts to streamline operations through automation, AI-driven routing, and reduced incentive spending. Internal efficiency programs are designed to offset margin pressure without undermining service quality.

Leadership believes these measures will play a meaningful role in improving the Uber profit outlook over the medium term.

Industry Perspective

One senior mobility market analyst said,

“Uber’s current guidance reflects a platform that has moved beyond hyper-growth and is now focused on disciplined profitability within a far more regulated global environment.”

Labor Economics and Driver Compensation

Driver pay and benefits remain a critical issue across multiple regions. Regulatory mandates for minimum earnings and benefits have increased labor-related costs.

These changes continue to influence the Uber profit outlook, particularly in markets where labor reforms are still evolving.

Technology Investment and Platform Trust

Uber’s continued investment in safety features, mapping accuracy, and fraud prevention supports long-term platform reliability. These investments strengthen user trust and reduce operational risks.

Although such spending affects near-term margins, it remains central to the long-term Uber profit outlook.

Capital Allocation and Financial Discipline

The company has adopted a more disciplined approach to capital allocation, prioritizing returns on investment and cash flow stability. Share buybacks and debt management have also improved balance-sheet strength.

This financial discipline underpins a more measured Uber profit outlook, appealing to long-term institutional investors.

Global Mobility Demand Trends

Urbanization, declining private car ownership, and growing preference for flexible transport continue to support ride-hailing demand. These structural trends provide a durable foundation for future growth.

They also reinforce confidence in the Uber profit outlook, even amid short-term earnings pressure.

Risk Factors Shaping Forecasts

Macroeconomic uncertainty, fuel price volatility, and currency fluctuations remain key risks. Uber incorporates these variables into its guidance to maintain conservative forecasting assumptions.

Such factors contribute to a cautious tone within the Uber profit outlook, reflecting realism rather than pessimism.

History of Uber’s Profit Evolution

Uber’s financial journey has evolved significantly since its founding in 2009. Early years focused almost exclusively on expansion, often at the expense of profitability. Through the 2010s, the company prioritized market dominance, investing heavily in incentives and global reach. By the early 2020s,

investor expectations shifted toward sustainable earnings, prompting Uber to restructure operations, exit unprofitable markets, and emphasize cost control. This evolution laid the foundation for today’s more balanced Uber profit outlook, which reflects maturity rather than experimentation.

Strategic Adjustments in a Maturing Market

Uber’s leadership describes the current period as one of strategic adjustment. Growth remains important, but not at any cost. The emphasis has shifted toward sustainable unit economics and regulatory alignment.

This strategic pivot is central to understanding the Uber profit outlook in 2026.

Competitive Landscape Intensifies

Local ride-hailing platforms and alternative mobility services continue to compete aggressively on price and service differentiation. This environment limits pricing power across the sector.

Such competition remains a persistent influence on the Uber profit outlook, particularly in highly regulated urban markets.

Investor Confidence and Market Expectations

While short-term expectations have moderated, long-term investor confidence remains intact. Many analysts view Uber as a bellwether for the broader gig economy.

The Uber profit outlook serves as a benchmark for how platform companies can adapt to regulatory maturity.

Long-Term Growth Versus Short-Term Pressure

Uber’s guidance reflects a deliberate acceptance of short-term margin pressure in exchange for long-term market positioning. Management believes this trade-off is necessary to preserve competitive advantage.

This philosophy shapes the underlying assumptions within the Uber profit outlook.

Financial Transparency and Governance

Improved financial reporting and governance practices have increased transparency for investors. Clearer guidance has reduced volatility around earnings announcements.

These improvements strengthen credibility around the Uber profit outlook.

Platform Economics at a Turning Point

The ride-hailing sector is no longer defined by unchecked expansion. Profitability, compliance, and resilience now dominate strategic priorities.

Uber’s experience illustrates how the Uber profit outlook reflects this broader industry transition.

A Measured Path Forward

Looking ahead, Uber expects gradual margin improvement as regulatory environments stabilize and efficiency gains accumulate. Technology investment and diversification remain central to this strategy.

The Uber profit outlook suggests cautious optimism rather than rapid acceleration.

When Scale Meets Sustainability

Uber’s current financial guidance marks a turning point where scale alone is no longer sufficient. Sustainable earnings must coexist with affordability and compliance.

In this environment, the Uber profit outlook has become a defining measure of how successfully the company can navigate the next phase of global mobility.